Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Sep, 2023

Unsurprisingly, the Broadband Equity, Access and Deployment (BEAD) federal program was the star of the Fiber Connect 2023 conference held in Orlando, Fla. on Aug. 20–23. The buzz for the $42.45 billion program highlighted the upcoming opportunities and challenges that internet service providers (ISPs) will have to effectively navigate as soon as dollars flow down to broadband operators. Much of the advice centered on ensuring high adoption levels and not just passing a home with fiber.

Fiber Connect 2023 had its biggest attendance yet in Orlando, Fla. on Aug. 20–23. Many speakers focused on federal funding, with the topic even occupying the full day's agenda on the event's last day. While the incoming dollars will stimulate the already known "fiber frenzy," the industry faces challenges with labor, supply chain, consumer adoption and maintenance of the fiber yet to be built with BEAD.

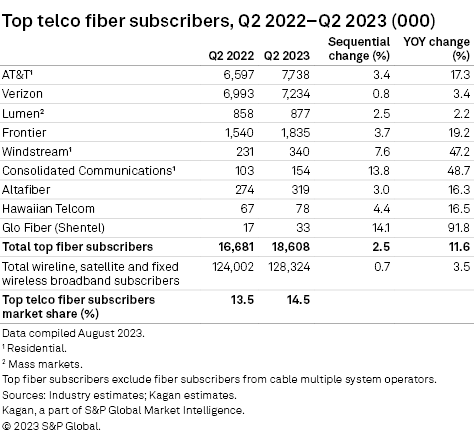

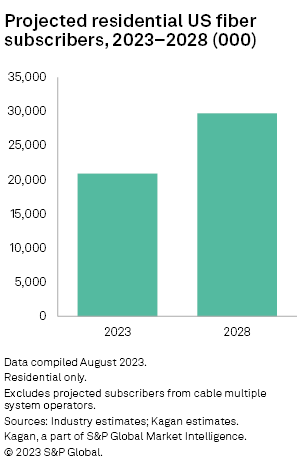

Fiber has become the lifeline of telcos as they navigate the transition away from DSL. As of the three months ended June 30, 2022, the top telcos counted 18.6 million fiber subs, or 14.5% of the wireline, fixed wireless and satellite universe, according to Kagan, a part of S&P Global Market Intelligence. There is still massive room for fiber adoption, especially among copper users.

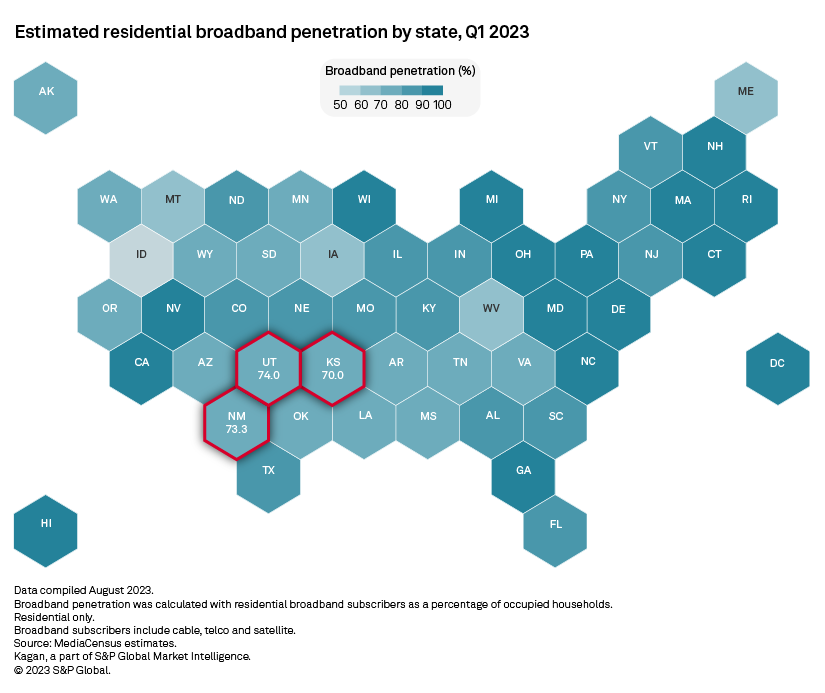

There were sessions at the conference to remind fiber internet service providers of how to approach BEAD. In a panel with the state broadband office representatives of Kansas, Utah and New Mexico, one piece of advice to ISPs was to thoroughly plan how to enable all homes with fiber, especially in high-cost areas that face difficult terrain and low density. Identifying the source and type of technology used will also be crucial.

Each local government unit dedicated to distributing BEAD dollars had its own set of tips. For Kansas, ISPs with a reliable financial track record and financial backing will be prioritized. The Utah state broadband office highlighted cybersecurity in the notice of funding opportunity and compliance with US-made products. Meanwhile, small ISPs in New Mexico with a solid business model and workforce plan will have a leg up. It was suggested in the panel that sharing one's broadband maps to the state broadband offices, presumably under an NDA, will be helpful in maximizing the dollars effectively.

Using MediaCensus data, we can estimate the total number of broadband subs in Kansas, New Mexico and Utah. Of the 50 states and the District of Columbia in our MediaCensus analysis, Utah and New Mexico rank 43rd and 44th by broadband penetration, respectively, while Kansas trailed closely behind at 46th place.

The expectation of a mostly onshore supply chain that will be funded by BEAD, with vendors like Nokia and Adtran already gearing up to be "Buy America" certified, underscored the emphasis on the "Build America, Buy America" initiative (BABA). BABA was passed under the Infrastructure Investment and Jobs Act to urge people to purchase technology that has more than 55% of its parts made in America. However, government agencies realized that not all components are manufactured domestically.

The National Telecommunications and Information Administration (NTIA) recently published a document that waives all electronics in BEAD projects from BABA, save for four components: optical line terminals and remote optical line terminals; OLT line cards; optic pluggables; and optical network terminals and optical network units. The waiver is available for comment until Sept. 21, 2023.

The labor shortage was also a pressing topic for BEAD. Discussions of how to appeal to younger generations highlighted how crucial a purpose-driven recruitment style was for younger demographics who could potentially see a career in fiber build-out. The glaring shortage was also a concern for operators and government officials who noted that work does not stop after construction. Network maintenance and broadband education will still require a robust workforce for years to come.

But with construction using BEAD funding afoot, many speakers urged to look beyond the "homes passed" metric. Fiber passings do not necessarily mean many are already connected to fiber. The triple broadband check, as discussed in the "Fiber Triple Broadband Check" panel discussion, lists three important factors to consider: homes passed; homes connected; and home adoption. Homes passed have fiber readily accessible to them on the ground. Homes connected ensures that Americans have access to devices, even basic ones such as mobile phones, laptops and personal desktops. The speakers agreed that the improvement of one's quality of life begins with homes connected, not homes passed. The adoption and education of these connected devices in the home will spur economic activity, encourage SMBs and set forth a new age in the connected economy.

Perhaps BEAD might be the shiny, new tool in the toolbox now. However, the conference closed out with a reminder that there are other federal grants on the table that ISPs could look to for new opportunities to connect more homes to fast, reliable high-speed internet.

Multichannel Trends is a regular feature from Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Research