Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — April 22, 2025

Ellie Brown

After cleaning up their service portfolios at the end of 2024, the hyperscalers spent the first few months of 2025 on growth. Several cloud regions were launched across new geographies, new AI services continued their relentless rollout, and new pricing structures were announced. The influx of additions led to a notable expansion of stock-keeping units in the hyperscalers' service portfolios in January. On the pricing front, cloud pricing benchmarks dipped slightly as a handful of large benchmark decreases more than balanced out the more numerous, but smaller, benchmark increases.

As with many industries these days, public cloud is working hard to strike the right balance between relentless growth and thoughtful maintenance of existing offerings — hedging bets while still hoping to project cutting-edge expansion and improvement. Nowhere is this more evident than in the hyperscalers' service portfolios, which experience all the ups and downs of shifting priorities, restructurings, additions and deprecations from month to month. While the hyperscalers continue to push out their AI agendas, they are also trying to restructure pricing to help align with an ongoing FinOps movement. As they work to refresh and maintain their existing cloud regions, the hyperscalers are also looking toward continued expansion to new geographies. As the cloud computing market matures, so too must cloud providers' strategies — it is no longer about growth at all cost, but thoughtful growth achieved in the right directions.

Benchmark price changes

On a quarterly basis, S&P Global Market Intelligence 451 Research's Cloud Price Index collects pricing on cloud services from Amazon Web Services Inc., Microsoft Corp. (Azure), Google LLC, International Business Machines Corp. and Alibaba Cloud. By weighting the data in the 10 regions covered by the index using market-share data from our Market Monitor & Forecast service, we can benchmark how much customers in those sectors are paying for public cloud infrastructure over time.

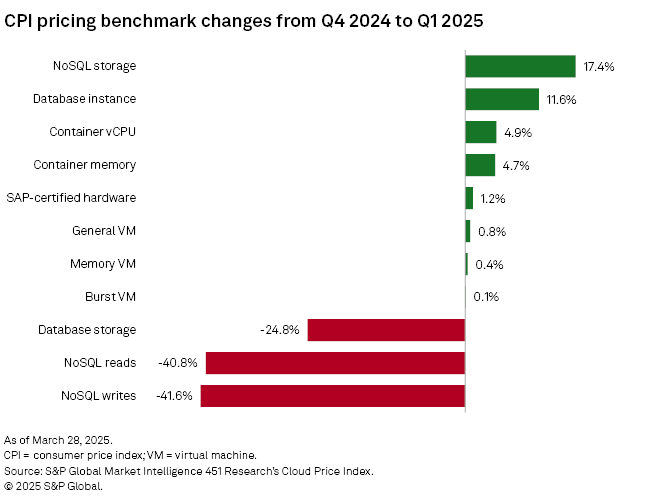

From the fourth quarter of 2024 to the first quarter of 2025, the standard on-demand pricing benchmarks created and tracked by the Cloud Price Index exhibited a general deflationary trend. While several benchmarks registered small increases in price, a handful of large pricing benchmark decreases more than balanced them out. Of the 21 cloud service categories benchmarked by the CPI, eight increased in price across the quarter while three decreased. The largest increases took place in the NoSQL storage benchmark (17.4% increase quarter over quarter) and database instance benchmark (11.6%), with smaller increases registered for the container vCPU, container memory, SAP SE-certified hardware, general virtual machine, memory VM and burst VM benchmarks. On the flip side, the benchmarks that saw a decrease in price across the quarter included database storage (-24.8% change quarter over quarter), NoSQL reads (-40.8%) and NoSQL writes (-41.6%).

Various factors can influence changes to cloud price benchmarks, including macroeconomic pressure, regional service price changes, the rollout of newer service iterations and large-scale shifts as providers update their pricing strategies. More insight into our CPI benchmarks is available in the Cloud Price Index Data Visualization.

Pricing, spending, AI and FinOps

While the Cloud Price Index pricing benchmarks generally saw some notable dips to start the year, cloud users still anticipate an increase in their overall cloud spending over the course of 2025. In our Cloud, Hosting & Managed Services, Budgets & Outlook 2025 survey, nearly 70% of survey respondents said they are anticipating an increase in their organization's public cloud spending in 2025 compared with 2024. In addition, 7.8% of survey respondents anticipate a significant increase (more than 25%) in their annual public cloud spending.

In general, however, increased spending on public cloud isn't due to price increases initiated from vendors: Cloud users identified that the primary factors behind their planned spending increases this year include advanced services to support AI and machine-learning initiatives (55.0% of respondents), expanded resources needed to support new business initiatives/IT projects (49.7%), and additional resources needed to support workloads migrated from other IT environments (47.0%). Only 33.8% of respondents pegged anticipated increases in cloud provider prices as the primary factor driving their increased spending for the year.

Notably, the global AI push appears to be bumping up against the ongoing development of cloud FinOps practices: Even as organizations are trying to get a handle on their cloud spending with optimization and efficiency measures, the expanding resource needs of AI initiatives continue to drive increased spending. In addition, planning for this increased cost remains difficult — 64% of survey respondents believe that their organization is either "somewhat" or "very" likely to exceed its cloud budget in 2025, nearly even with the response rate from last year (64.4% of 2024 respondents).

New year, new SKUs and new regions

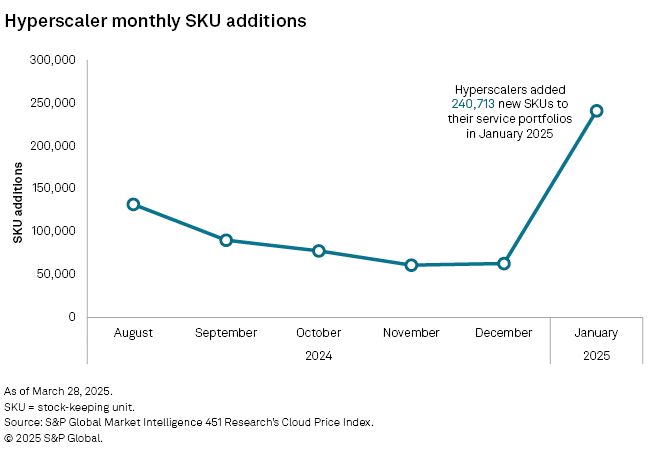

The majority of changes the hyperscalers make to their cloud service portfolios each month are not due to price changes or service removals but result from the addition of new SKUs tied to newly released services or regions. For the Big Three hyperscalers (AWS, Microsoft Azure and Google Cloud), the Cloud Price Index usually tracks about 80,000 new SKU additions each month. Variations on the average are usually caused by the rollout of new services across multiple provider regions (new VMs, in particular, tend to produce a large number of associated SKUs, each tracking to unique usage tiers) or brand-new regions being opened by a hyperscaler for the first time.

The start of 2025 saw a massive surge in new SKU additions to hyperscaler service portfolios, with the new calendar year serving as a convenient time to launch multiple cloud regions. Across the month of January, the hyperscalers added a total of more than 240,000 new SKUs to their service portfolios.

The above-average number of SKU additions in January was driven almost entirely by the rollout of two new AWS cloud regions: the Asia-Pacific (Thailand) region, which was announced as generally available on Jan. 7; and the Mexico (Central) region, which opened Jan. 14. About two-thirds of January's total cloud service changes took place in just Thailand and Mexico as AWS rolled out more than 173,000 new SKUs to fill those regions. Other recent regional launches include Google's opening of a new region in Mexico in December 2024, as well as the March opening of its 42nd cloud region, located in Sweden. Microsoft Azure also opened a new sustainable cloud region in New Zealand in December 2024.

Cloud providers are also expanding and improving their global presence in additional ways — for example, AWS partnered with multi-service operator Orange SA to release a new AWS Wavelength Zone in Casablanca, Morocco, in January. AWS Wavelength lets users run applications using AWS infrastructure and services in partner telco datacenters for an AWS region-like experience. In late March, AWS announced it would be providing more detailed geographic information for all its regions and availability zones, to help customers better align with regulatory, compliance and operational requirements.

More generally, the AI push and associated strategic realignments have led to a slowdown in regional expansion by hyperscalers. While the physical rollout of new hyperscaler regions has slowed, the flow has not dried up completely. In early 2025, Microsoft announced it would be opening a new region in Malaysia in the second quarter of 2025, while Google announced plans to open its own Malaysia region along with a new cloud region in Bangkok, Thailand.

Notable hyperscaler price changes and service additions

Over the past several months, the hyperscalers have also made a variety of price changes and service additions to their portfolios, some of which are highlighted below:

Pricing and management changes

➤ Microsoft announced in December 2024 that Azure Automation would be revising its service and subscription limits, beginning Jan. 7, 2025. The revised limits impact the maximum number of active Automation accounts in a subscription, as well as the maximum number of concurrent running jobs at the time per Automation account.

➤ Microsoft also announced that starting April 1, 2025, it would standardize the monthly billing price for all new and renewing annual term subscriptions, with a price increase of 5% for all licenses on CSP, MCA-E and Buy Online. Pay-monthly options that are not impacted by the update include Azure Reserved Instances, Azure Savings Plans, Azure Marketplace and GitHub.

➤ Starting Feb. 11, 2025, all newly created Azure Virtual Network Manager instances will be charged based on the number of virtual networks where an active Azure Virtual Network Manager configuration is deployed, replacing the previously used subscription-based pricing model. The pricing change will not be applied to existing Azure Virtual Network Manager instances until February 2028, giving users time to switch away from subscription-based pricing for their existing instances.

➤ Microsoft also announced that, as of March 1, 2025, it would be reducing the price of Azure confidential ledger to about $3 per day, per instance for the computation and ledger use.

➤ Amazon Web Services has announced plans to phase out third-party resale of commitment discounts with two changes taking effect in the coming months: The first change will prevent the aggregation of discounts through reseller accounts, while the second will require vendors on the AWS Marketplace to submit architectural documents to ensure their products are entirely deployed on AWS. For more details, please see our dedicated report on the topic.

➤ As of Nov. 1, 2024, AWS reduced the price for sections of its Amazon DynamoDB service, a NoSQL database for building high-performance, low-latency applications at any scale. On-demand throughput pricing for DynamoDB has been reduced by 50%, while global tables pricing has been reduced by up to 67% (provisioned capacity tables saw a 33% write pricing reduction, while on-demand tables have had their replicated write pricing lowered by 67%). The new, lower pricing applies to all regions globally.

Service additions

➤ In late January, AWS announced the general availability of DeepSeek-R1, a large language model featuring chain-of-thought capabilities and reinforcement learning. DeepSeek-R1 is available for deployment via Amazon Bedrock and Amazon SageMaker AI, and as of March 10, 2025, is also available as a fully managed model in Amazon Bedrock.

➤ On the instances front, in December AWS unveiled second-generation FPGA-powered Amazon EC2 instances (F3) that offer up to three times as many processor cores as the earlier F1 instances.

➤ Google Cloud launched a highly performant VM offering in December, available in preview: A3 Ultra VMs powered by NVIDIA Corp.'s H200 Tensor Core GPUs and Hypercompute Clusters, which offer enhanced performance over earlier generations for a better cloud experience for AI workloads..

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is a technology research group within S&P Global Market Intelligence. For more about the group, please refer to the 451 Research overview and contact page.

Location

Products & Offerings

Segment