Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 4 Sep, 2023

By Xiuxi Zhu and Fed Mendoza

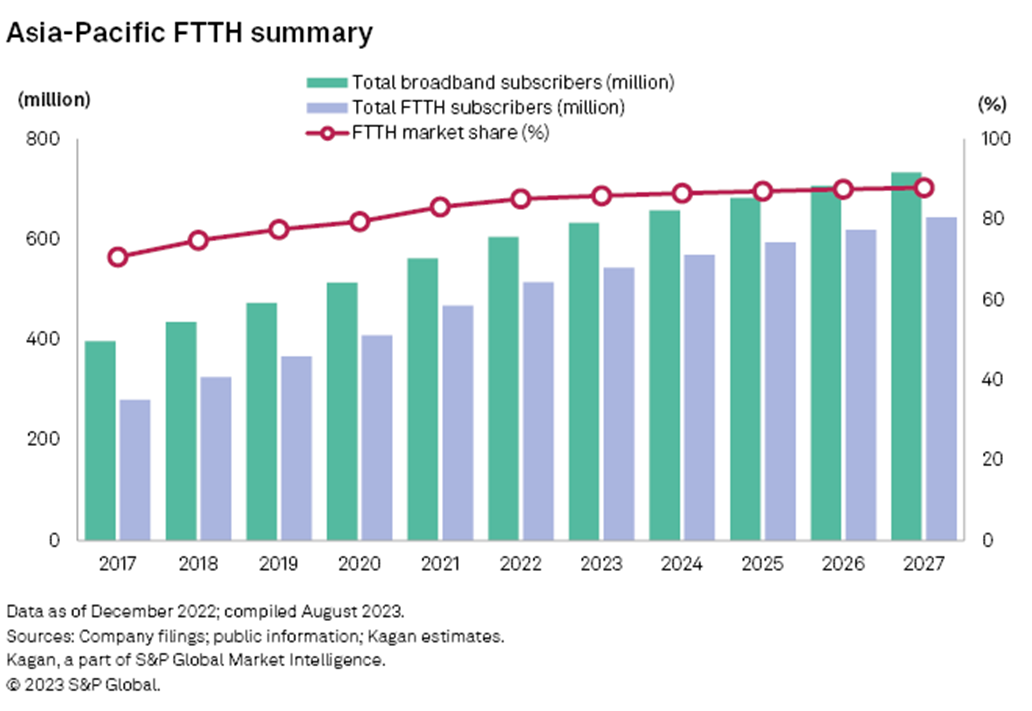

Government-led broadband projects across markets in the Asia-Pacific region have reaped the fruits of success in recent years as optical fiber networks reach most households. As of year-end 2022, the region's total fiber broadband subscriptions had exceeded the 500-million mark, an 85.1% share of the entire residential fixed-line broadband subscriber base, according to Kagan data.

➤ APAC continues to expand fiber coverage in emerging markets, while the take-up rate of fiber broadband services still sees room to grow.

➤ Markets with a high share of fiber-to-the-home (FTTH) service subscriptions, such as Japan, South Korea, Singapore and Vietnam, have been expanding fiber coverage to remote areas and upgrading fiber transmission speed.

➤ Indonesia, Thailand, Malaysia and the Philippines intend to increase fiber broadband service take-up by selling prepaid fiber-to-home packages and 5G building packages.

➤ China and India led the fiber optic cable deployment mileage among developing markets in recent years.

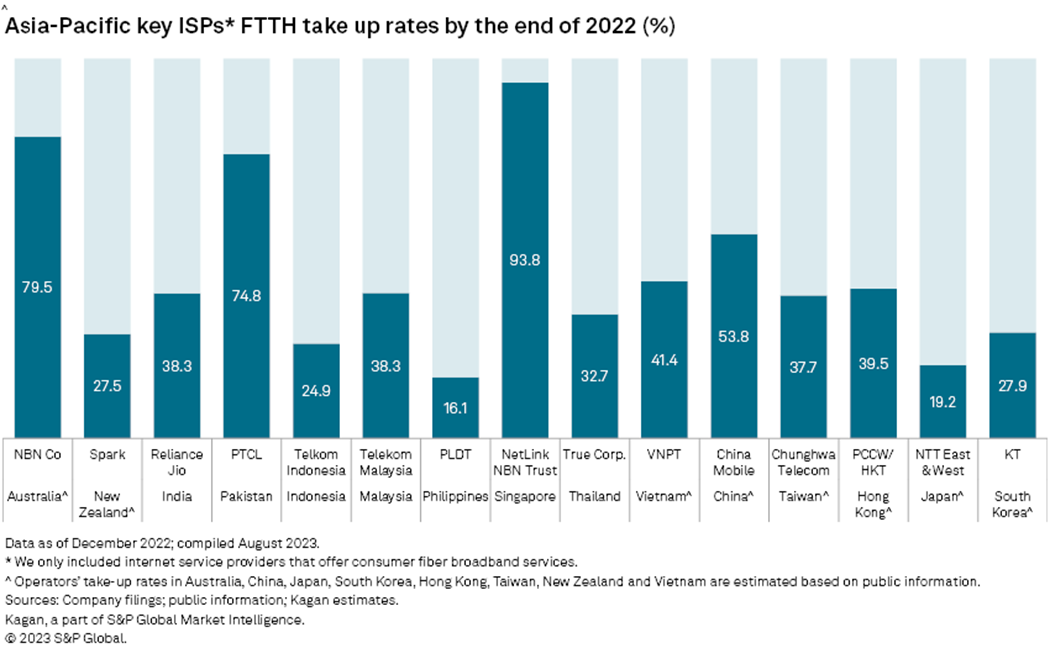

Despite fiber networks' reach of more than 50% of households in most markets in our analysis, fiber broadband service take-up rates remained below 50% in most of the markets by the end of 2022, which suggests that the utilization of the fiber infrastructure was still far from saturation in this region.

Mainland China led in the total length of fiber optic cable deployment among developing markets at 59.6 million kilometers of fiber lines installed. Kagan estimates that fiber broadband subscribers will account for at least 90% of total broadband subscribers in mainland China by the end of 2027. China Mobile Ltd. led the fiber initiative with an estimated 19.4 million kilometers of fiber cables deployed.

In India, Reliance Jio Infocomm Ltd. surpassed all other FTTH providers within two years of its launch. By year-end 2022, the business had more than 7.6 million FTTH-connected residences, cementing its position as the market leader. Bharti Airtel Ltd. is the second-largest fixed broadband operator in India. According to Airtel, the company expanded its FTTH footprints across more than 500 new towns in India in 2022.

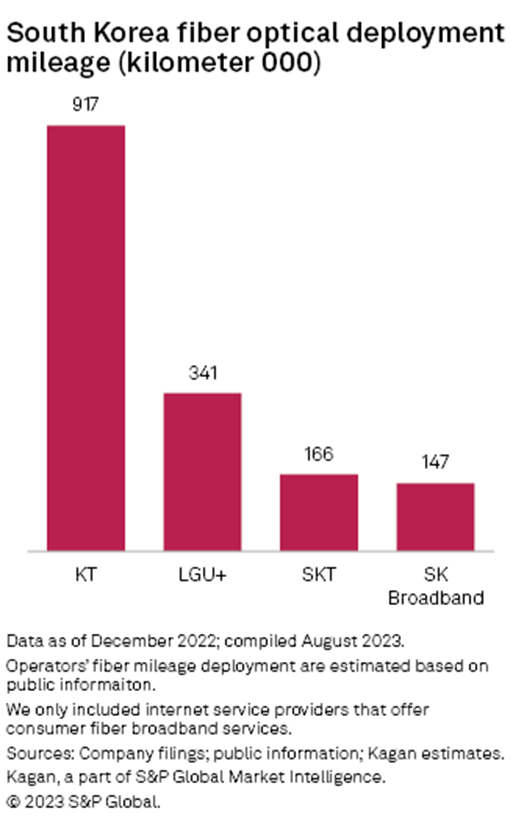

Japan and South Korea were early movers in fiber network adoption, and both enabled nationwide fiber broadband services in the aughts. Both markets have been focusing on speed improvement and power saving of long-distance signal transmission with upgraded network infrastructure.

Despite mature technologies held by major telcos, Japan faces obstacles in deploying fiber infrastructure in remote rural areas due to geographic restrictions and natural disasters. The high capital expenses involved in deploying optical lines in mountain areas has remained unattractive to telcos and constructors. NTT and KDDI have sought collaborations with the US space company SpaceX to develop wireless space broadband for regions where fixed fiber lines are harder to reach.

Chunghwa Telecom is the dominant fiber internet provider in Taiwan, while PCCW Ltd.'s Hong Kong Telecommunications (HKT) Ltd. dominates Hong Kong's fiber deployment. Both markets have established marketwide fiber backbones, totaling less than 20,000 kilometers of fiber optical lines deployed as of end-2022, combined, according to Kagan's estimate. The two markets are also key global fixed-line communication nodes, which led to multiple submarine cable projects across Hong Kong and Taiwan.

Southeast Asia

Meanwhile in Southeast Asia, major broadband operators have intensified "fiberization" to keep up with the growing demands of high-speed and more reliable broadband in the market.

Indonesian telcos have begun to boost fiber broadband technology adoption while simultaneously enhancing the 5G network. As of year-end 2022, Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk had upgraded its copper-based connections in 459 cities and districts to fiber, achieving its 2020 objective of passing 37 million residences.

The Philippines' largest telco, PLDT Inc., had 17.2 million homes passed as of the first quarter of 2023. The telco has been actively rolling out fiber lines and deploying fiber ports since 2015, aiming to make the Philippines a fiber-powered market. Incumbent fixed broadband player Converge Information and Communications Technology Solutions Inc. had 15.1 million homes passed, reaching major localities in the first quarter of 2023.

Broadband penetration in Indonesia and the Philippines remains low as rural locations and small islands are not serviceable by fixed networks. As a solution, fixed wireless and satellite are deployed to provide internet access in outlying areas. To deliver satellite internet access in Indonesia's remote places, Kacific Broadband Satellites Ltd. collaborated with regional service providers PT Bis Data Indonesia (BIGNET) and Pt Primacom Interbuana (PRIMACOM) to construct 2,500 sites as of June 2022.

Malaysian ISPs are supported by the local government's digital infrastructure project, the Jalinan Digital Negara (JENDELA). By year-end 2022, the project reached 7.7 million premises. NetLink NBN Trust, the sole fiber network builder and the backbone of Singapore's Nationwide Broadband Network reported 1,584,124 homes passed as of June 2023, pushing more fiber network infrastructure to enhance the end-user experience. NetLink's customers and Singapore's major ISPs Singapore Telecommunications Ltd., StarHub Ltd. and M1 Ltd. currently offer fiber broadband plans with download speeds of up to 2.5 Gbps and upload speeds of up to 1.25 Gbps.

Thai ISPs True Corp. and Advanced Info Service PCL have passed more than 23 million households in 2022 through intensive fiber rollouts and adherence to Digital Thailand National Policy. Vietnam's three major ISPs, Vnpt Ltd., Vietnam Military Telecoms Co. and FPT Telecom Joint Stock Company, have reached more than 18 million fiber customers in total by year-end 2022. The market's fiber optic system uses Synchronous Digital Hierarchy (SDH) and Dense Wavelength Division Multiplexing (DWDM) to transmit a high volume of data across Vietnam.

Global Multichannel is a regular feature from Kagan, a part of S&P Global Market Intelligence.

Research

Blog