Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Feb, 2023

|

Some traders reaped record profits in 2022 as supply disruptions from Russia's invasion of Ukraine pushed commodity prices to new, but volatile, highs. |

The conflict between Russia and Ukraine disrupted markets, but the chaos proved a boon for some traders adept at moving commodities across borders.

|

Sanctions, self-imposed restrictions from Russia and other supply chain disruptions upended certain corners of the commodity sector in early 2022. However, companies specializing in buying, selling and moving the commodities recorded a banner year, deploying those skills as the world scrambled to secure supplies of key products such as nickel, steel and other valuable raw materials that previously came from Russia.

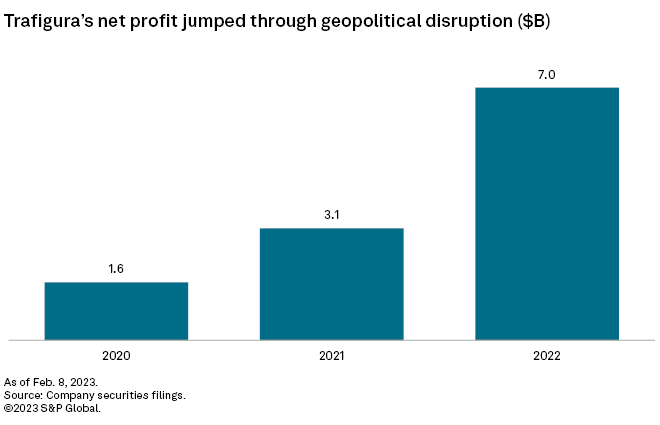

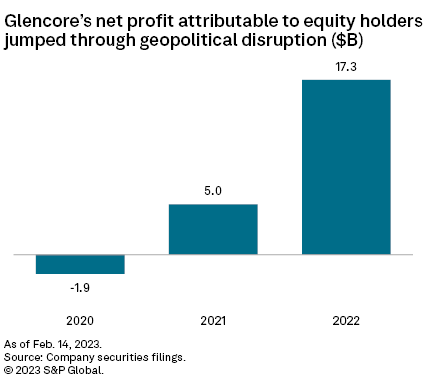

Trafigura Group Pte. Ltd. is one of the largest traders in the world, and the Singapore-headquartered company more than doubled its net profits to $7.0 billion in 2022, from $3.1 billion in the previous year. Switzerland-based trader Glencore PLC, another massive trader in the metals and mining sector, cranked up net profit attributable to equity holders to $17.32 billion in 2022, 3.5 times its profit of $4.97 billion in 2021.

"I think that if this volatility continues, the trading business is going to continue to be an extremely good business," Rick Rule, veteran mining sector investor and former president and CEO of Sprott U.S. Holdings Inc., told S&P Global Commodity Insights. "Whether investors themselves should participate in it really depends on the psychological makeup of that investor because it's a real rodeo."

Rule added that trading businesses can see a wide fluctuation in earnings year-to-year and that energy and mining markets are likely to remain "volatile for a long time."

In 2022, Trafigura reported $318.5 billion in revenues, up 37.8% from $231.3 billion in 2020. That was largely driven more by price than increased volumes as the amount of oil and petroleum products traded decreased slightly in the period. In contrast, the volume of nonferrous concentrates and refined metals increased by only 2.2%, while bulk mineral volumes traded by Trafigura rose 10.4%.

Commodities markets were disrupted by the Russian invasion of Ukraine, particularly as it came on the heels of a recovery in demand following the COVID-19 pandemic. Elevated commodity prices drove record revenues for Trafigura, the company wrote in its annual report, noting that a strong balance sheet, a global logistics footprint and ready access to substantial financial liquidity allowed the trader to continue supplying customers despite geopolitical strains.

"Europe's energy crisis and the war in Ukraine underscored the fragility of global supply chains and why security of supply is vital in a world of increasing geopolitical uncertainty," Jeremy Weir, executive chairman and CEO of Trafigura, wrote in the company's annual report. "This has shown that what we do — connecting vital resources to help power and build the world — has not only become more complex but also more critical and in demand than ever before."

Saad Rahim, chief economist at Trafigura, wrote that a post-pandemic recovery in demand and a lack of investment in new supply exacerbated the invasion's impacts. The confluence of factors led to "unprecedented price volatility."

"The war has upended historic commodity trade flows, led to record low inventories in many commodities and created uncertainty about supply," Rahim wrote. "Sanctions added multiple layers of complexity and disruption. Throughout the tumult, commodity prices have consistently struggled to reflect underlying supply and demand."

Trafigura predicts that further volatility is likely in the coming year as inflation remains high and the war continues.

The company declined a request for an interview about its trading over the past year.

Good for Glencore

The dislocation in markets was also a boon to diversified miner Glencore PLC, which collects substantial revenue from its trading business.

Glencore did not respond to a request for comment. However, a spokesperson pointed to the company's annual results released Feb. 14.

A sharp rise in global coal pricing, in particular, was beneficial to the company: Thermal coal prices hit record levels in 2022, while average prices for higher energy and lower energy content coals climbed 163% and 112%, respectively, partly due to the low availability of coal to replace Russian supplies in Europe, the company reported.

"The global pandemic, recovery from it and years of underinvestment, followed by conflict in Europe, exposed preexisting vulnerabilities in energy security and supply chains, underpinning the generally high and volatile 2022 commodity price environment, which enabled [Glencore] to generate record profitability for the year," Glencore CEO Gary Nagle said in the report.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

Panjiva is the supply chain research unit of S&P Global Market Intelligence, a division of S&P Global Inc.

Evaluate the impact of the Russia-Ukraine conflict on the metals market with our essential mining intelligence. Learn more >