S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Feb, 2023

By Camellia Moors

| The Azovstal steel plant in Mariupol, Ukraine, in March 2020. Russian forces seized the plant in May 2022 following a nearly three-month siege of Mariupol. The plant was largely destroyed during the siege. Source: Getty Images Europe/Getty Images News via Getty Images |

Ukraine's iron ore and steel industries are set to face more difficulties as attacks on the country's electricity infrastructure intensify.

|

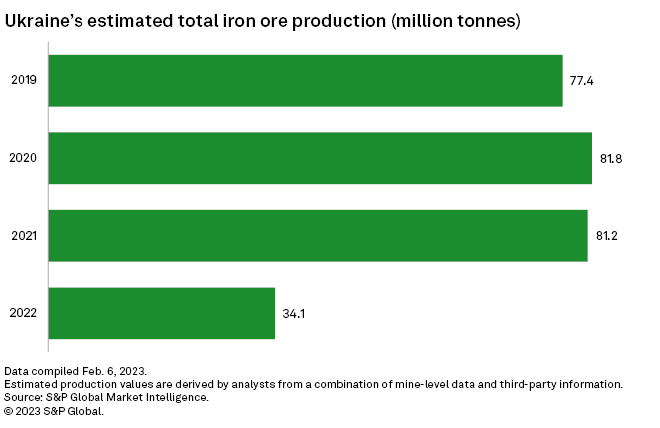

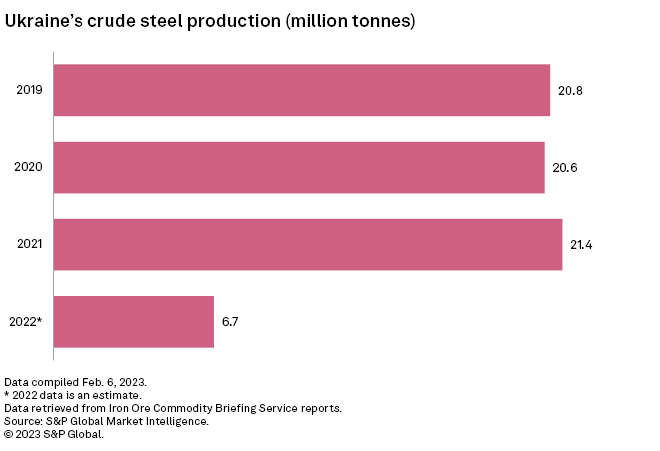

The country produced 3.3% of the world's iron ore in 2021, but estimated iron ore production in 2022 dropped 47.1 million tonnes year over year, or about 58%, to 34.1 Mt. Crude steel production fell 68.5% in the same period to reach 6.7 Mt from 21.4 Mt, according to S&P Global Market Intelligence data.

Market Intelligence analysts said Ukrainian iron ore exports are likely to drop further in 2023. Between January and November 2022, Ukraine exported about $2.8 billion in iron ore and $4.3 billion of steel, according to data from Panjiva, the supply chain research unit of Market Intelligence.

In 2021, Ukraine's iron ore and steel exports were valued at a combined $20.78 billion, or 31.6% of the country's $65.87 billion in total exports. Between January and November 2022, iron ore and steel's combined share in the export mix value dropped to 17.2%, or just $7.04 billion of the $40.96 billion in goods exported during the period, according to Panjiva data.

Ukrainian steel producers were unable to operate about 40% of the time in December 2022 due to invasion-related power outages, said Simeon Djankov, policy director of the Financial Markets Group at the London School of Economics and senior fellow at the Peterson Institute for International Economics. Energy-intensive steel production businesses, which require high-temperature furnaces, lost more productive time with each outage than other business types, as their operations cannot immediately be brought back online, Djankov told S&P Global Commodity Insights.

"[Blackouts have] gone from basically, in September and October, not being that substantial — [affecting] 1% to 2% of nationwide economic production — to [impacting] essentially 15% of the whole economy," Djankov said. "Large parts of the country actually have no issues, particularly the western parts of the country, [but] for some areas it's actually quite substantially beyond this 15%.

"I expect incidentally that in January, it will be something like a quarter of overall national production will have been lost due to [the conflict]," Djankov said.

Industrial areas targeted

Russia's recent attacks, including the launch of dozens of cruise missiles on Feb. 10, have targeted Ukrainian energy infrastructure and power production facilities, forcing emergency blackouts across the country.

Djankov and Oleksiy Blinov, head of research at Alfa Bank, tracked ATM outage and credit card use data, which largely correlates with regional power outage periods, to conclude that Ukrainian businesses lost 15% of their productive time on average due to power outages in December 2022.

The waves of missile attacks included strikes on the southeastern Ukrainian city of Zaporizhzhia, approximately 47 miles from Zaporizhzhya Iron Ore Plant's namesake Zaporizhzhya operation and about 81 miles from ArcelorMittal SA's Kryvyi Rih iron ore mine and JSC System Capital Management's Kryvyi Rih State Combine property.

"The focus of our people [in Ukraine] has been to maintain our assets, maintain [Kryvyi Rih's] integrity," said Aditya Mittal, CEO and director of ArcelorMittal, on a Feb. 9 earnings call. "The critical implication of that is that we're maintaining our opportunity to produce steel in the future. Today, the operating levels [in Ukraine] are roughly 15% to 20% for steel and 20% to 25% for iron ore mines."

A spokesperson for System Capital Management's Metinvest Holding LLC, which produces raw iron ore materials and steel products through subsidiaries, said most of the company's Ukrainian operations "continue to operate at varying levels of utilization, given security, logistical and economic factors."

Metinvest holds a majority share of PJSC Azovstal Iron and Steel Works, whose Azovstal steel plant in Mariupol became a Ukrainian holdout during Russia's siege of the city.

Operating levels could be cut further as steel production capacity is hampered by a lack of adequate port infrastructure to transport steel and materials needed to produce it, as well as parts needed for electrical repairs.

"Unlike in November and December, the January [attacks] had two characteristics: First, [the Russians] focused a lot more on port cities," Djankov said. "The other pattern that we see is the Russians seem to have good intelligence … of where repairs are happening on the electricity grid and where, more worryingly, the spare parts are coming from, and they're starting to hit these warehouses very efficiently."

A struggling commodities sector

Even for companies with undamaged plants and electricity access, broader economic headwinds have made it unprofitable for Ukrainian iron and steel producers to operate at full capacity.

A Metinvest spokesperson told Commodity Insights high energy and raw materials prices, weak steel demand and low global steel prices have all contributed to the company operating all of its Ukrainian plants at less than 50% capacity.

Metinvest's pig iron production in the first nine months of 2022 decreased by 65% year over year to 2.5 Mt, while steel production dropped by 62% to 2.7 Mt, the spokesperson said.

Iron ore prices reached a seven-month peak in late January before optimism around China's expected 2023 iron ore imports and steel production waned, causing the price to drop in February. China was among the top importers of Ukrainian iron ore in 2022, while European nations, the U.S. and Japan make up the top destinations for Ukrainian steel and other industrial products like aluminum, according to Panjiva data.

Energy price increases since the invasion have also driven up multiple metal products' cost of production, including steel. Companies like Metinvest have also upended their traditional operations to support Ukrainian efforts rather than supplying traditional markets.

"Several factors have impacted [Metinvest's] Ukrainian operations during the war. ... Russia's blockade of Ukrainian seaports led to changes in the country's logistics routes and supply chains, as well as an increase in the cost of delivering products to end consumers," a Metinvest spokesperson said.

Panjiva is the supply chain research unit of S&P Global Market Intelligence, a division of S&P Global Inc.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.