S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

27 Mar 2025

Blog — 23 Sep, 2021

By Deana Myers

Netflix’s Sept. 19 win for “The Crown” in the Emmys’ top drama series category demonstrates that the streaming service’s originals strategy is paying off. Following a rough year for productions and swelling competition in the streaming space has necessitated an increased program budget for Netflix Inc. in this and the coming years. For 2021, we forecast the company could amortize about $13.60 billion in total costs, including $5.21 billion positioned for originals.

The launch of new subscription video-on-demand players, such as The Walt Disney Co.'s Disney+, AT&T Inc.'s HBO Max, Comcast Corp.'s Peacock and ViacomCBS Inc.'s Paramount+, resulted in swaths of content being held back as each looks to populate their own services. We expect that distributors will continue to reserve rights for their own SVOD services, more so from territories where they are soon to launch. However, some rights deals have lengthy contracts and would either require buying out the contract or waiting for it to expire.

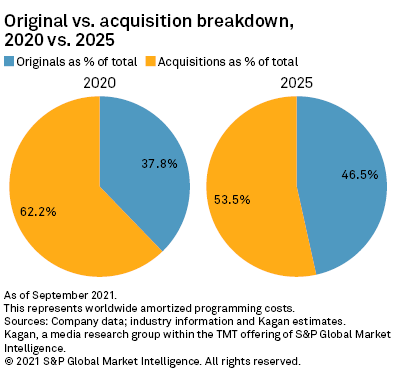

Netflix has prepared for this trend since entering the originals market in 2012 as it expected studios would eventually hold back programming. By 2014, about 6.8% of spend came from new orders and increased to about 37.8% of the budget in 2020. As the service focuses more on new content, we expect that to grow closer to 50% by 2025.