Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 26 Mar, 2025

HIGHLIGHTS

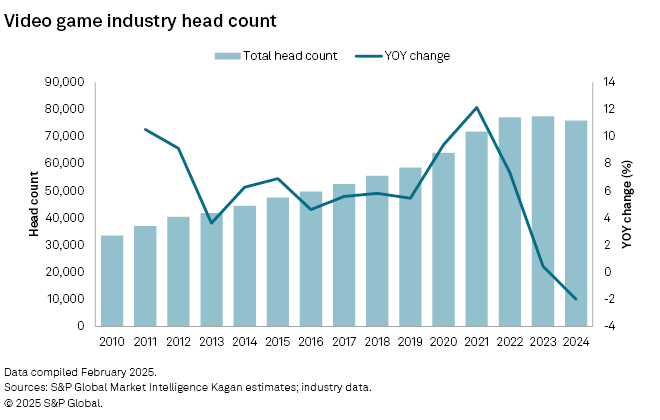

— The gaming companies in our analysis cut a combined 1,554 positions in 2024, or 2% of their total workforce.

— Publishers are running lean in search of stable margins in a challenging revenue environment after staffing up during the pandemic.

Hiring surged in the games industry in 2020 and 2021 as publishers and developers used an advantageous lending environment and growing revenues to invest in development.

The market's revenue opportunity started to sour in mid-2022, but the staffing momentum continued into 2023, when workforce levels peaked. Widespread layoffs and project cancellations started to surface in late 2023 and carried on into 2024.

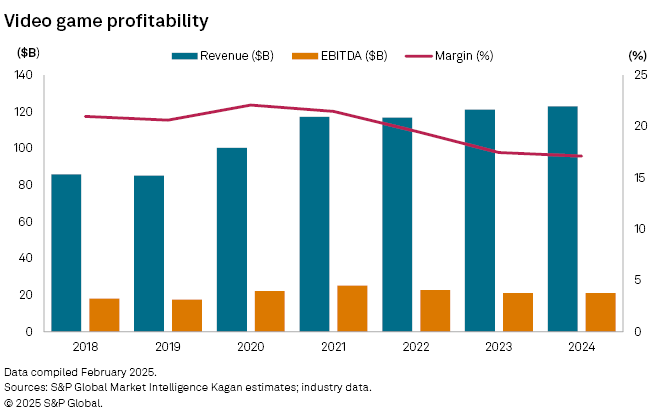

Publishers and platform holders are running lean in search of stable margins in a challenging revenue environment. Our recent margin analysis suggests cutting to profitability has yielded mixed results. The average EBITDA margin for 75 of the largest companies in gaming fell by a third of a percentage point for the full year.

Most of the margin strength came from console vendors Sony and Microsoft, both of which improved profitability in part by resisting price cuts for its marquee hardware. This resulted in fewer console shipments and shifted the sales mix to higher-margin software.

Software pure plays did not have that lever to pull, and many of the top publishers in our analysis were flat or down in terms of EBITDA margin year over year.

Despite the recent staffing downturn, head count is still well above pre-pandemic levels, which may suggest the industry could withstand further downward pressure on staffing.

But bear in mind that we are now solidly in the PlayStation 5/Xbox Series era, when 1440p and even 4K resolutions are quickly becoming commonplace. The additional workload required to produce assets with more detail to match those higher resolutions will make it difficult to return to the staffing levels of the PlayStation 4 era.

There are opportunities for AI tools to automate certain workloads in the creative process and allow fewer artists to create more assets, but it may be too early to gauge the long-term impact of such tools.

Already a client?

Already a client?