Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 3 Nov, 2022

By Xiuxi Zhu

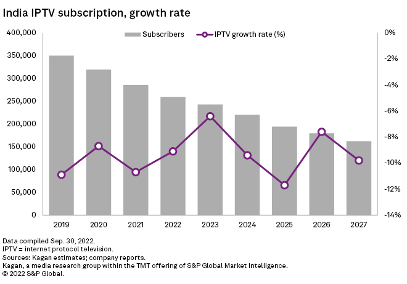

IPTV operators in India ended 2021 with about 285,000 subscribers overall, down 10.7% year over year, as competing services in the market — such as cable and direct-to-home — offered more affordable and diverse over-the-top options.

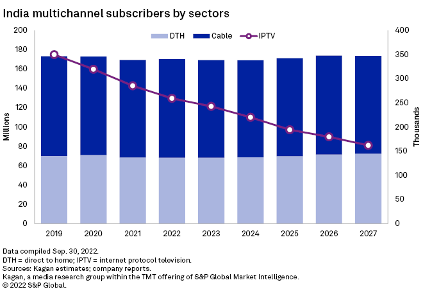

Kagan estimates India IPTV subscriptions will further drop to less than 162,000 by the end of 2027, representing a compound annual growth rate of negative 9% from 2022 to 2027, while multichannel subscriptions will grow at a projected 0.4% CAGR. We also expect DTH subscriptions to grow at a 1.2% CAGR and cable subscriptions to decline at a negative 0.1% CAGR in the same period, and for both sectors to maintain their market shares.

A different trend can be seen in other Asia-Pacific markets. Based on our projections, IPTV subscriptions in China will grow at a 2.4% CAGR from 2022 to 2027, gradually taking market share from cable, while multichannel subscriptions will grow at a 0.3% CAGR. In South Korea, we expect IPTV subscriptions to grow at a 2.2% CAGR, eventually taking market share from the DTH and cable sectors. Similarly, we see emerging markets such as Thailandand thePhilippines growing their multichannel and IPTV subscriptions in the same period.

IPTV in India faces market competition from DTH and cable services, which are cheaper and can accommodate features such as OTT add-ons.

OTT features

OTT subscriptions are significantly up in India because of the diverse content offered to the multicultural viewership of the market. OTT subscriptions grew 53.7% year over year in 2021.

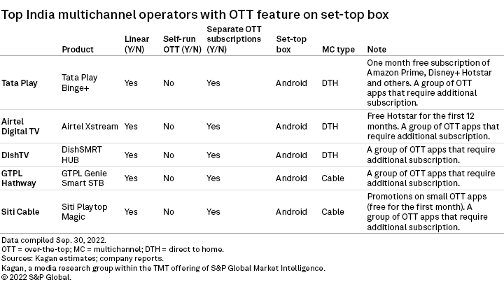

Due to the popularity of OTT, top multichannel operators in the country have started to use set-top boxes that allow users to download OTT apps in addition to their subscription to multichannel services.

Bharti Airtel Ltd.-owned Airtel Digital TV, the second-largest DTH operator in India, has further developed its online services. In February, Airtel Digital debuted Xstream Premium, a platform offering both DTH linear channels and aggregated OTT channels across a set-top box, an app and a web browser. The operator plans to add more OTT choices to this virtual multichannel, or VMC, streaming platform and to remove the need to subscribe to a DTH service to view linear content on the Xstream portal.

The telco company sells broadband and Airtel Digital TV packages bundled with OTT services as well. For example, it offers Walt Disney Co.'s Disney+ Hotstar service under its selected broadband plan. It also offers Amazon.com Inc.'s Amazon Prime Video and Netflix Inc. basic plans with other packages.

We expect Airtel Digital to attract more customers with the VMC service and bundled sales.

IPTV operators in India have fewer partnerships with OTT services and seldom offer their own streaming options. The leading IPTV service provider, AP State FiberNet Ltd., or APSFL, focuses on the "triple-play" strategy that bundles fixed broadband, IPTV and telephone services. APSFL has been seeking partnerships with OTT services since 2018, but there are no promotions available for users to date.

Affordability

Another factor that prevents Indian TV viewers from migrating to IPTV is affordability.

According to Kagan estimates, Indian IPTV subscribers spent approximately 0.6% of their gross monthly income on the service, while DTH and OTT users spent 0.5% and 0.2% of theirs, respectively, on those subscriptions. This means users of both DTH and OTT could spend 0.7% of their income to pay for two types of service, just slightly higher than the 0.6% share they would spend on a single IPTV service.

Global Multichannel is a service of Kagan, a group within S&P Global Market Intelligence's TMT offering.

Already a client? Click here to read the full report, including detailed overviews of infrastructure’s impact on Indian IPTV development, and comparisons between Indian, Chinese and South Korean multichannel markets.

Blog

Blog