Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 20 Jan, 2022

By Jessica Fuk

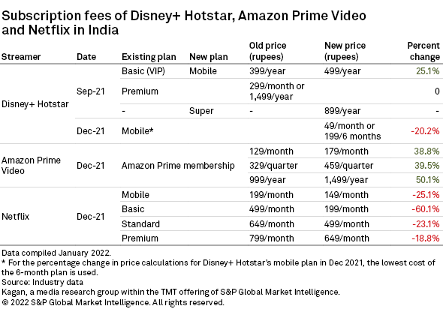

Streaming competitions in India intensified as Netflix Inc. reduced its subscription fees in the market for the first time on Dec. 14, 2021, the same day that Amazon.com Inc. raised its Prime membership rates by about 40% to 50%. The pricing of all Netflix plans was cut. The biggest markdown was for the basic plan that dropped from 499 rupees to 199 rupees per month, translating to a 60.1% decrease. Walt Disney Co.'s Disney+ Hotstar, which had just increased the charge of its basic (mobile) plan on Sept. 1, soon followed to offer two discounted rates of 49 rupees and 199 rupees for subscription periods of one month and six months, respectively, for its mobile plan.

Kagan estimates the booming Indian subscription video-on-demand market reached 97.81 million paid subscriptions as of year-end 2021 and generated an annual subscription revenue of $723.02 million in the year. Having secured the top two places in terms of subscriber share in the market, both Disney+ Hotstar and Amazon Prime Video, which had initially set their prices at more affordable levels close to those of the local services, intended to raise their ARPU through price hikes.

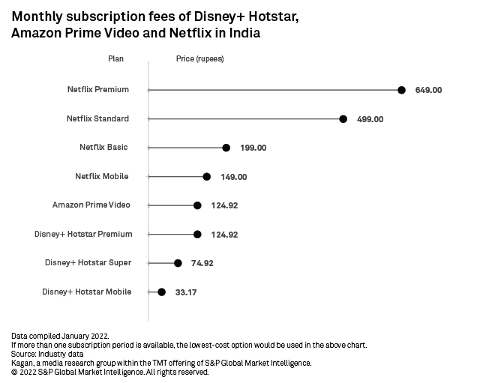

Lagging behind the top three in the ranking of subscription share, Netflix is eager to boost its subscriber base. The price cut was basically reducing the price of each tier down to the original price of the next lower tier. The monthly subscription fee of the entry mobile pack contracted by 25.1%. The mobile plan remains the market's highest-cost entry pack, compared to Amazon Prime Video, which offers an annual subscription at a rate of 1,499 rupees.

Prior to the price reductions, there was a big gap between the prices of Netflix's basic and mobile tiers. The basic pack was relatively expensive and charged at an affordability level of 1.23% based on India's per capita gross national income at purchasing power parity of $6,574 in 2020. With the market's ARPU projected at below $1 per month in 2021, the majority of subscription video services in India are calculated at an affordability level of below 0.10%.

Apart from making its mobile pack more attractive in the market, Netflix attempts to upsell some of its mobile subscribers to the basic pack and engage them to stream on the big screen with the potential to migrate them to the two other premium plans with better resolution and other perks.

In about a week after Netflix's price reductions, Disney+ Hotstar rolled out two promotional plans for its mobile tier including a six-month plan charged at 199 rupees and a monthly plan priced at 49 rupees in order to drive an uptick in new subscriber additions. The streamer's regular mobile plan is priced at 499 rupees per year and the pricing of the premium tiers remains unchanged. Disney+ Hotstar's highest-cost premium subscription that comes with UHD content and up to four logins is charged at 1,499 rupees per year, the same rate as Amazon Prime Video's annual subscription and is by far more affordable than Netflix's premium tiers.

Other global streaming services have adopted different monetization models including ad-based video on demand to drive growth in India, but Netflix seems to be keen on maintaining the existing subscription model. Netflix had accepted that its premium pricing would weaken its competitiveness in the price-sensitive market, and there is still room to further reduce its prices to be in line with that of other streamers.