Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 07, 2020

Weekly Pricing Pulse: Creaking commodity prices finally give way

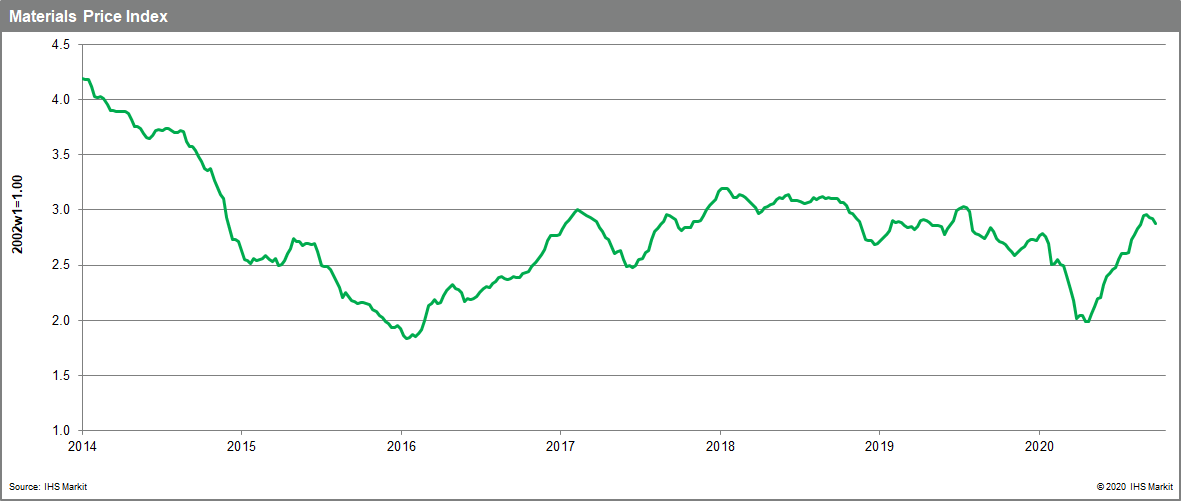

The recent decline in our Materials Price Index (MPI) accelerated last week with a 1.5% drop. While markets have become more unsettled in September, China's absence from commodity markets because of its Golden Week holiday may have contributed to the softening in prices.

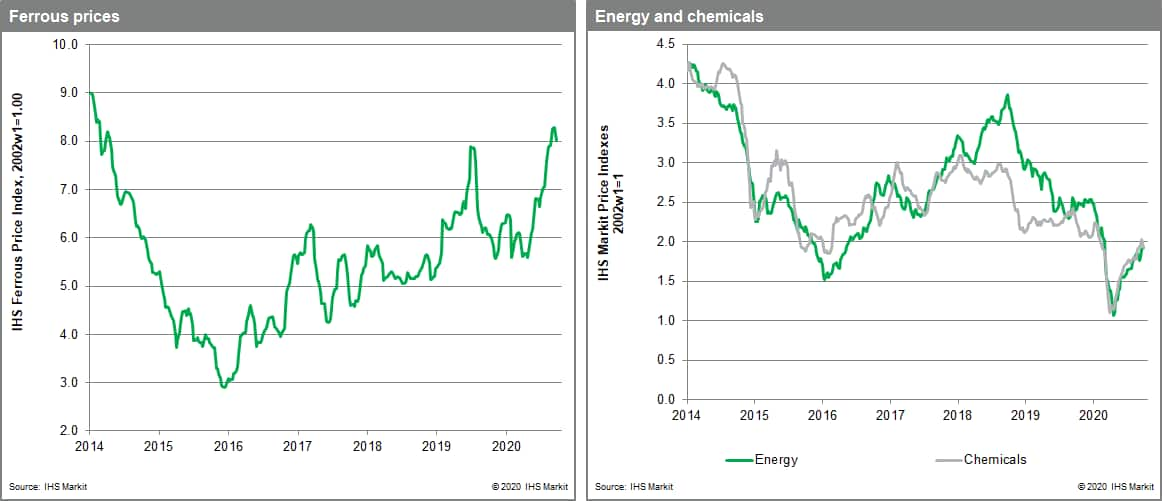

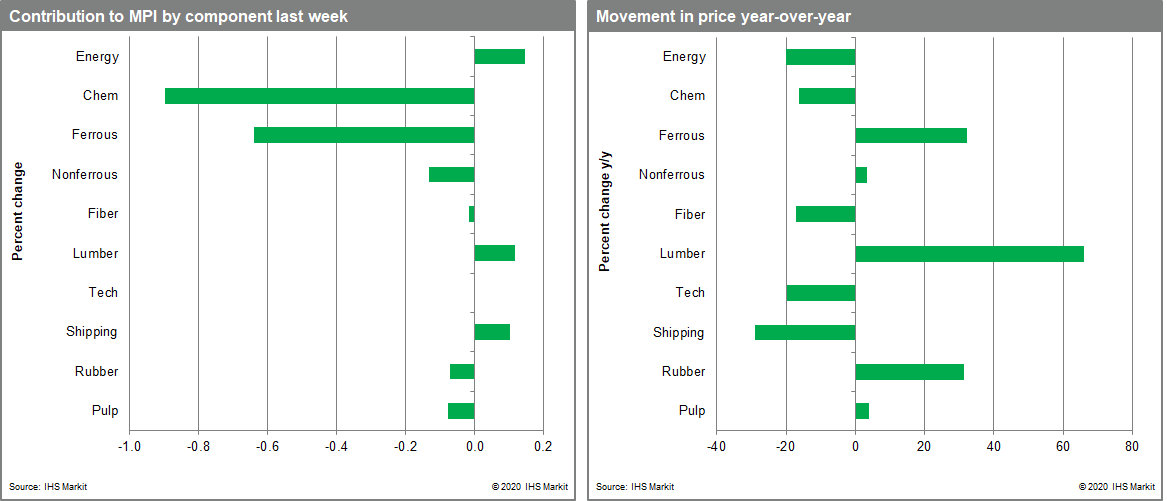

Chemicals prices led the MPI lower last week falling 5.1%, driven by declines in all three components: propylene (-1.7%), benzene (-3.0%) and ethylene (-8.4%). Ethylene's weakness came from a 38.4% plunge in European prices. US prices across all three products fell as capacity, temporarily shuttered by a series of hurricanes, came back online. Pulp fell 2.0%, a fourth consecutive weekly decline, though prices are still up 3.5% year-to-date. Paper manufacturers are noting, however, that global activity has increased recently, with supply tightening due to maintenance stoppages. Non-ferrous prices fell sharply mid-week on demand concerns but then rallied on Friday, ending the week down 1.5%. Better news on a possible second round of fiscal in the US and renewed interest in Democratic candidate Biden's infrastructure plan seems to have buoyed markets after metals sold-off midweek. Steel raw materials prices fell 1.5% as Chinese buying slowed for the Golden Week holiday and Turkish scrap prices eased lower. Energy, lumber and freight prices were the only subcomponents to rise last week. Energy rose 1.4% due to a small rise in thermal coal prices of 0.6% and a large rise in LNG prices of 9.2%. Oil prices fell 2.0% on the same demand concerns that pulled most prices down last week.

Rising COVID-19 case counts in the Northern Hemisphere and worries of a second wave of infections plus and a tumultuous US Presidential debate seems to have unsettled markets last week. The good news for the week, however, came from the latest Purchasing Manger Index report, which showed the global manufacturing continuing its recovery. Most encouraging, new orders in September grew at the steepest rate since January, while backlogs of work showed the largest rise since 2018. This said, the overall pace of output growth edged lower while business sentiment about the outlook slipped for a second month. The question for the fourth quarter is whether reduced government support, a possibly contentious US Presidential election, and the potential re-imposition of COVID-19 containment measures will begin to impair the global recovery.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-creaking-commodity-prices-finally-give-way.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-creaking-commodity-prices-finally-give-way.html&text=Weekly+Pricing+Pulse%3a+Creaking+commodity+prices+finally+give+way+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-creaking-commodity-prices-finally-give-way.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Creaking commodity prices finally give way | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-creaking-commodity-prices-finally-give-way.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Creaking+commodity+prices+finally+give+way+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-creaking-commodity-prices-finally-give-way.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}