Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 18, 2024

By Ken Wattret

Learn more about our data and insights

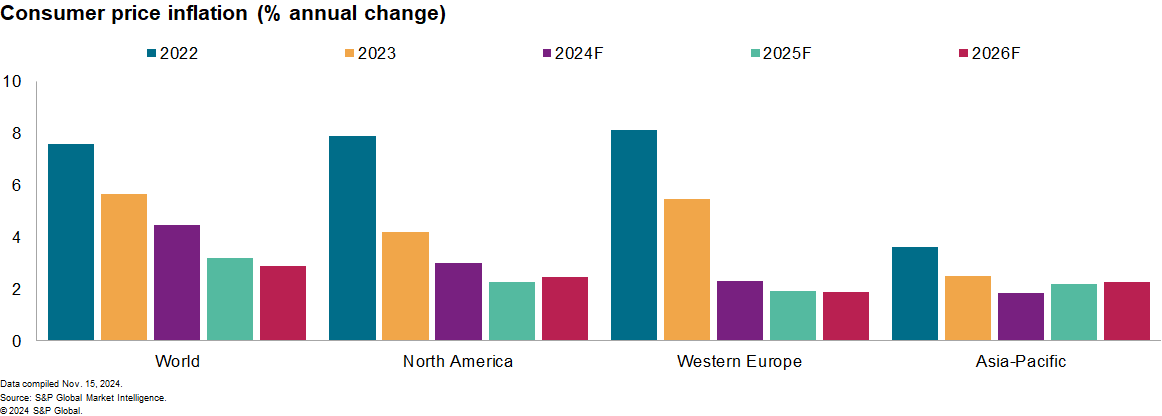

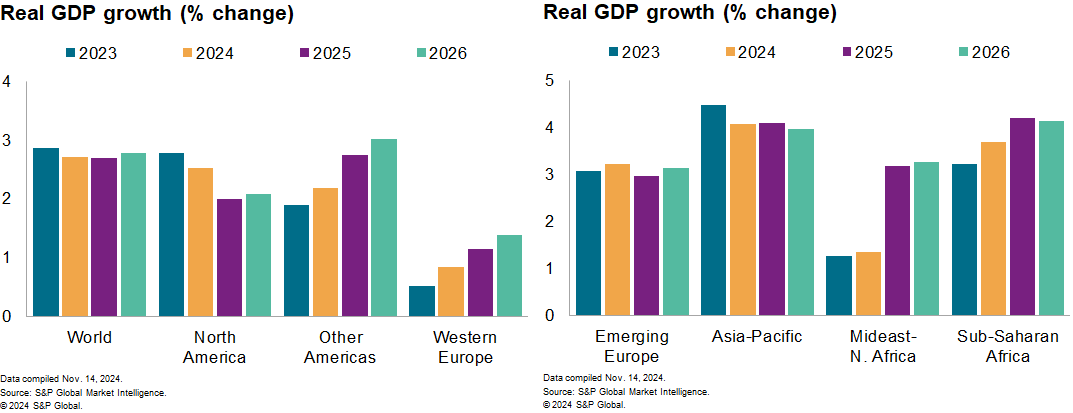

S&P Global Market Intelligence's forecasts have not changed materially in November's update, but uncertainty over the outlook has risen markedly. Following recent elections, the likelihood of major US policy shifts has risen, with potentially widespread economic and financial implications. This could radically alter our current base case for the global economy of gradually moderating inflation, falling interest rates and steady if unspectacular growth.

Probable policy shifts imply higher inflation and interest rates and weaker growth. Uncertainty over when, and to what extent, shifts in US trade, taxation and immigration policies will be implemented makes quantifying their economic implications challenging. Still, using various assumptions, we have run an alternative scenario via our Global Link Model (GLM) to try to gauge some of the key economic effects.

In an alternative scenario, US real GDP losses versus baseline are estimated at around one-third of a percentage point by 2026. The tariffs proposed by president-elect Donald Trump prior to the election would significantly raise consumer price inflation, which would likely stall the US Federal Reserve's easing cycle in 2025. This would raise interest rates more broadly, keeping the US dollar elevated, with the overall tightening of financial conditions leaning down on US growth. Its exports would also be hit by retaliatory measures. The negative effects on US output are limited by more stimulative fiscal policy, including lower corporate taxes.

Global real GDP growth would be reduced by 0.4 percentage point by 2026 relative to baseline. Of the US key trading partners, mainland China's economy is impacted most owing to higher tariffs, with real GDP reduced by around 1 percentage point versus baseline by 2026. Consistent with this, Asia-Pacific is the region with the largest estimated real GDP loss versus baseline, at around 0.7 percentage point by 2026. While the estimated impact on Europe is only around half that magnitude, the likelihood of recessionary outcomes in some of the larger, most trade-sensitive economies including Germany would rise given already challenging economic conditions.

Financial market pricing already partly incorporates some of the post-election impacts. At the time of writing, futures markets currently discount only one additional 25 basis-point rate cut by the Fed by January 2025 and a gradual pace of easing thereafter. Ten-year Treasury yields have backed up by over 80 basis points versus mid- September's low, meanwhile, with the US dollar staging a broad-based rebound. We will continue to monitor market developments and modify our forecasts accordingly.

The crude oil price assumptions feeding into our November forecasts have been lowered. The average Dated Brent price for 2025 has been reduced from $75/b to $71/b, and the expected period of somewhat lower prices has been extended. Global crude oil supply is projected to exceed demand in 2025 unless OPEC+ backtracks on its plan to increase production. Other things equal, this points to lower consumer inflation rates, although the outlook is complicated by the factors highlighted above.

Underlying inflation trends have remained favorable. The core goods inflation rate in the G5 group of economies, which we both calculate and track, was sub-zero in September for the sixth month in a row (down 0.2%). The signals from various indicators, including our Purchasing Managers Index™ (PMI®) data, suggest that price pressures will remain muted in the near term. Services inflation in the G5 economies has also continued its gradual descent, although it remains comparatively elevated (4.2%).

Hear our economists discuss global macroeconomic themes region by region

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.