Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 26, 2020

Weekly Pricing Pulse: Continuing signs of recovery lifts commodities

Can the momentum in the manufacturing sector be sustained, with prices rising further over the near-term? To be sure, the rise in prices highlighted by the four-month rally in our Materials Price Index does indicate the worst of the recession globally is over. But the continuing increase in COVID-19 case counts globally, and the re-imposition of containment measures even in regions that had seemingly beat-back the pandemic, underscores what is likely to be the start-stop pattern to growth.

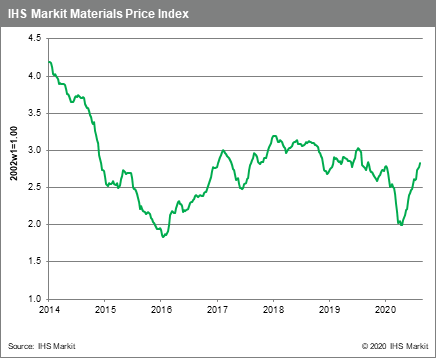

Commodity prices have staged an impressive rebound between April and mid-August. As measured by our Materials Price Index (MPI), prices have erased their first quarter plunge during the last four months and are now up 3.4% for the year.

Why the quick recovery? A combination of factors seems to be at play: the strong performance of the Chinese economy, production cuts (oil) or supply disruptions (copper), a weaker US dollar, huge government stimulus and even hope for a vaccine late this year. Pent-up demand, changes in consumer spending patterns and business inventory management are also contributing to the rebound in manufacturing activity, supporting prices.

For consumers, suppressed spending on many activities (travel, restaurants, entertainment) is channeling purchasing towards goods (and saving), with much of the pent-up demand from earlier this year being released now. Businesses have helped boost the apparent consumption of commodities by replenishing stocks run down during the first half of the year. Firms also seem to want higher inventory in their supply chains because of disruptions, a decision made easier by low financing costs.

In terms of physical consumption, our caution is that the rise in commodity prices does not foretell a full recovery in 2020 or even 2021, as the damage to labor markets worldwide has been too great. Goods markets have benefited - temporarily -- from the change in behavior. The question is, will consumers embark on a fresh round of goods purchases with labor markets still weak and government transfers being dialed back? We think it unlikely. Likewise, the boost to apparent consumption from inventory restocking will be difficult to sustain unless firms feel comfortable with even higher inventory sales ratios, which in some industries already look elevated, even granting a desire to hold higher buffer stocks.

In short, we think the rebound in manufacturing is more likely a bounce (albeit welcomed) that will be difficult to maintain. Likewise, the run-up in material prices since April has been impressive. However, do not expect the momentum to carry across the rest of 2020

Let's take a closer

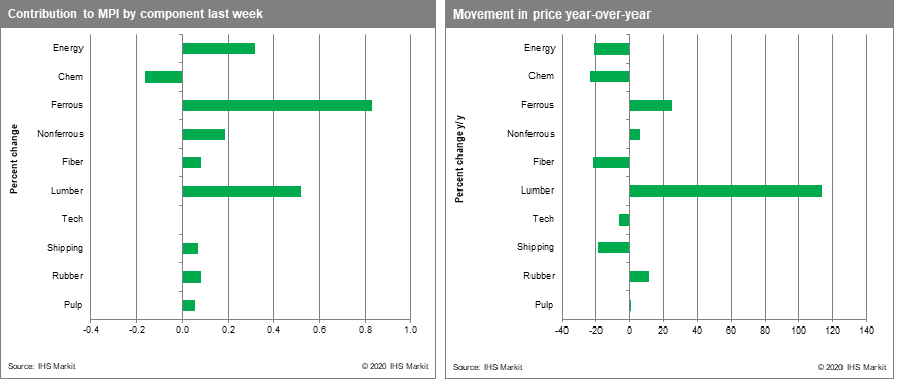

The rally in commodity prices per our MPI, continued last week with the index rising 2.0%, its fifteenth increase in the last sixteen weeks. The slow-down in COVID-19 case count growth in badly affected countries and hope for targeted stimulus in China helped lift nine of the MPI's ten components last week in another broad-based gain.

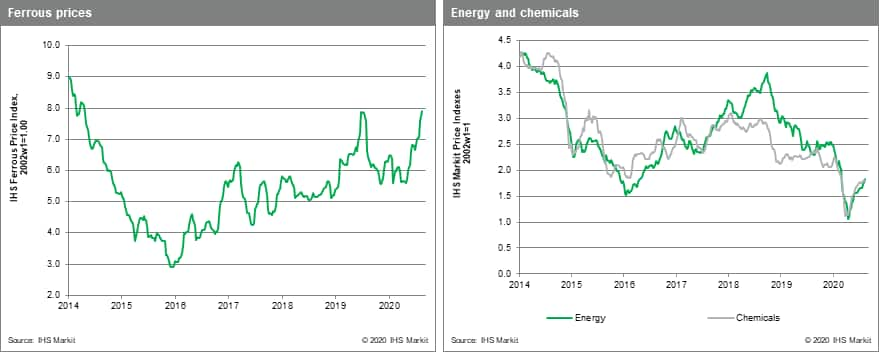

Energy led the MPI higher last week, rising 3.1%. LNG was again responsible for most of the increase, jumping 19.1%. Asian LNG prices rose 24%, European prices 21% and US prices 11%. Strong demand, tied to hot weather in Japan and North America boosting electricity generation, and low gas storage levels in Europe, were behind the price increases. Steel raw materials prices rose 1.9% as iron ore moved yet another leg higher on China stimulus news. Iron ore prices have also been supported by a building queue of bulk vessels at Chinese ports. Lumber shows no sign of slowing down, with another double-digit rise of 11.5%. Strong single home sales and housing starts in the US, fuelled by low interest rates, continue to keep the lumber market off-balance. Non-ferrous prices rose 2.0%, with copper and nickel rising 2.9% and 3.2%, respectively. Copper moved higher on falling exchange inventory and a court ruling in India that will keep that country' largest smelter closed indefinitely.

Commodity markets chose to brush aside disappointing August flash Purchasing Manager Index reports and slower growth in Chinese retail sales last week. Instead markets focused on the slow relaxation of COVID-19 containment measures worldwide and the Peoples Bank of China's new 700-billion-yuan credit facility. Markets are viewing the credit facility as fuel for the spending authorities have promised for targeted infrastructure investments and hence bullish for commodities exposed to China, reinforcing the positive sentiment regarding mainland China already priced in.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-continuing-signs-recovery-lifts-commoditi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-continuing-signs-recovery-lifts-commoditi.html&text=Weekly+Pricing+Pulse%3a+Continuing+signs+of+recovery+lifts+commodities+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-continuing-signs-recovery-lifts-commoditi.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Continuing signs of recovery lifts commodities | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-continuing-signs-recovery-lifts-commoditi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Continuing+signs+of+recovery+lifts+commodities+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-continuing-signs-recovery-lifts-commoditi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}