Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 06, 2018

Weekly Pricing Pulse: Commodity prices shrug off currency and tariff woes to push higher

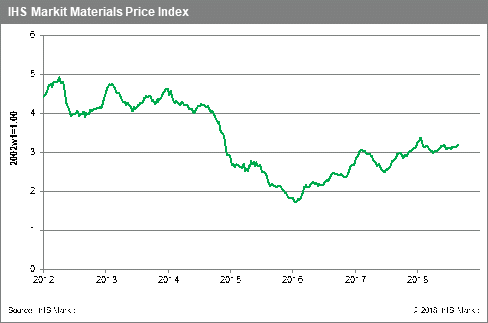

Although the week started off with the good news that a NAFTA refresh may soon be concluded, the US-China trade war threatened to intensify on reports that the Trump Administration was planning tariffs on another US$200bn of Chinese imports. Currency markets were also volatile with both the Argentine peso and Turkish lira seeing new weakness. Despite these bearish signals, the Material Price Index (MPI) rose 1.2% w/w, as oil supply-side issues lifted crude prices.

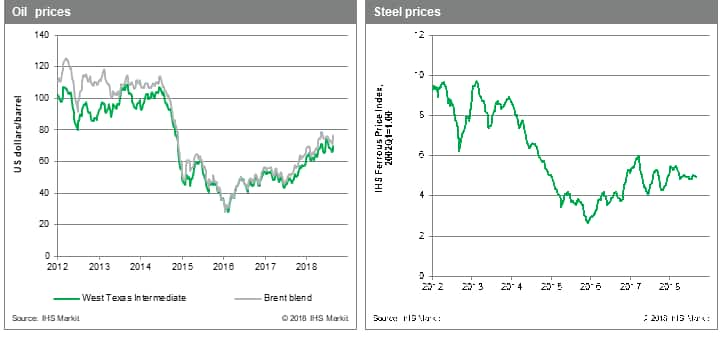

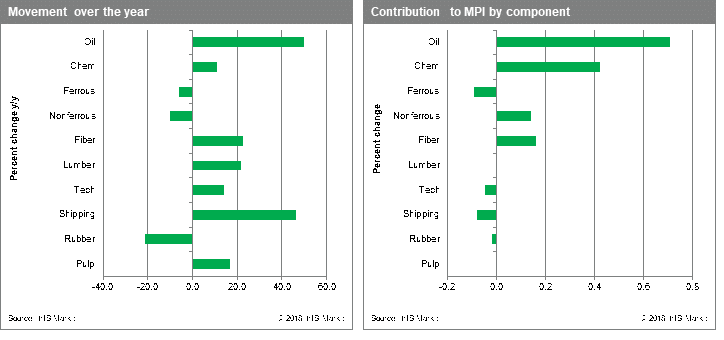

Only four of the ten MPI's components increased last week. Oil was the big story, rising 3.9% w/w. Ship tracking data showed that daily crude exports from Iran had fallen 39% in August from July, which helped to push Brent prices up $4 to $78 /bbl. Chemical prices also continued their recent upward march on the back of oil strength with a 1.7% w/w gain. The non-ferrous index, having faced a battering in recent weeks, rallied 2.3% as investors reduced short positions. Fiber prices added to August gains rising 2.5% w/w. The fiber index within the MPI is up 12% since the end of July, the result of firm demand in Asia and cost pressures.

Recent currency volatility that

has roiled commodity markets can be tied to several factors: higher

inflation, along with large current account deficits and large

foreign-currency debts in some emerging markets. However, it is a

slow normalization in global financial markets, led by the US

Federal Reserve that is exposing these vulnerabilities. With this

tightening slated to continue, uncertainty and volatility are

likely to characterize markets in the months ahead, and will be a

challenge to any sustained rise in commodity prices.

Recent currency volatility that

has roiled commodity markets can be tied to several factors: higher

inflation, along with large current account deficits and large

foreign-currency debts in some emerging markets. However, it is a

slow normalization in global financial markets, led by the US

Federal Reserve that is exposing these vulnerabilities. With this

tightening slated to continue, uncertainty and volatility are

likely to characterize markets in the months ahead, and will be a

challenge to any sustained rise in commodity prices.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-shrug-off-currency.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-shrug-off-currency.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+shrug+off+currency+and+tariff+woes+to+push+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-shrug-off-currency.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices shrug off currency and tariff woes to push higher | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-shrug-off-currency.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+shrug+off+currency+and+tariff+woes+to+push+higher+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-shrug-off-currency.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}