Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 07, 2024

By Chris Rogers and Eric Oak

Learn more about our data and insights

The toy industry has one of the most seasonal supply chains, raising the stakes for ensuring delivery of the right products in a narrow timeframe. In 2024 threats have included strikes at US east coast ports and elevated storm conditions in both the Pacific and Atlantic basins as well as reduced shipping capacity due to the Red Sea conflict issues.

Yet, the US retail sector "feels very good about their position relative to having the inventory, the merchandise they needed where they needed it," according to the National Retail Federation, thanks to earlier shipping strategies.

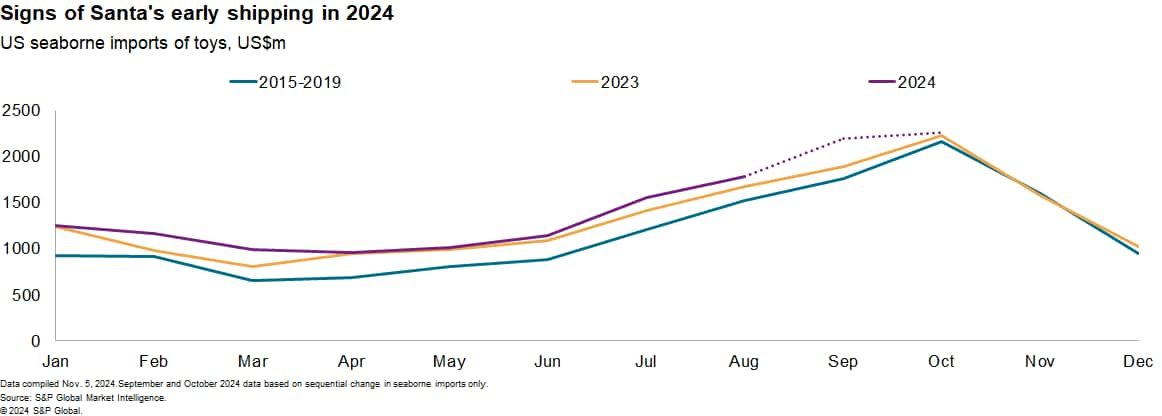

US imports of toys typically start their season run-up in July before peaking in October, our data shows. In 2023, shipments followed a similar pattern to the pre-pandemic era (2015-2019) even with the period of rapid inventory destocking during the year.

So far in 2024, there are signs of earlier shipments than normal. Imports in July rose by 35.7% year over year versus an average in 2015 to 2019 of 14.7%. For seaborne imports alone, shipments in October only rose by 2.6% versus September, while historically the increase has been 28.8%. That may reflect a surge in shipments in September to beat the US east coast port strike.

Toyetic movies: Fastest growing toy brands

As important as having goods on time is having the right goods. One of the big four toymakers noted that the "majority of toy shoppers are looking for evergreen well-known brands" though it has also noted that one of the "positive drivers for the industry overall in that more theatrical or toyetic theatrical movies are coming online."

Toyetic characteristics, or the suitability of a media franchise to spawn a range of toys, is a key attribute for successful toy brands with franchises swapping from toy-to-film monetization and back again, as shown by last year's Barbie movie.

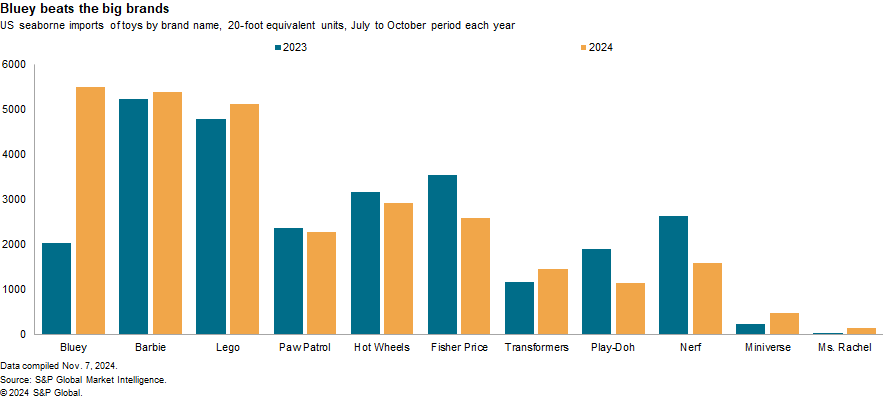

Using US import data as a proxy for a brands' performance, "Transformers" had the largest amount of imports by sea to the US among the franchises with major films released in 2024, reaching 1,453 20-foot equivalent units (TEUs) of container freight, up by 25.3% year over year in the July 1 to Oct. 31 period. The fastest growth among kid-focused movies was shown by Inside Out (648% higher year over year) followed by Despicable Me (273%).

It's not just kids films driving toy tie-ins, with collectibles linked to Deadpool & Wolverine rising by 273%, while Beetlejuice surged 1,963%. Both also saw rapid growth during the Halloween shopping season.

Want more? Listen to Chris Rogers talk about holiday supply chains

Social media properties are also proving toyetic, with imports linked to Youtuber Ms. Rachel reaching 137 TEUs despite only launching a few months earlier. Another rapidly emerging trend has been for new brands of miniature toys, with the Miniverse range rising by 108% year over year.

The biggest gaining brand import in 2024 in absolute terms is also a media tie-in, with imports of the beloved Bluey brand surging 169.8% year over year to reach 5,508 TEUs of shipments. Fan-favorite Lego also increased by 6.8% year over year while Barbie rose by a more modest 3.1% — partly due to sustained popularity after 2023's film.

At the other end of the scale, many of the perennial brands have experienced a downturn in 2024, with imports of products associated with the Nerf, Play-Doh and Fisher Price brands falling by as much as 40.0% year over year in 2024, while Hot Wheels and Paw Patrol fell at a slower rate.

Less cost, more joy: Managing toy supply chains

Looking into 2025, the slowdown in some of the more established brands is leading the large toymakers to cut costs within their supply chains, with one firm noting around 60% of its cost-cutting program is coming from efficiencies in sourcing (fewer suppliers) and more efficient logistics networks as well as cutting inventory levels to multi-year lows.

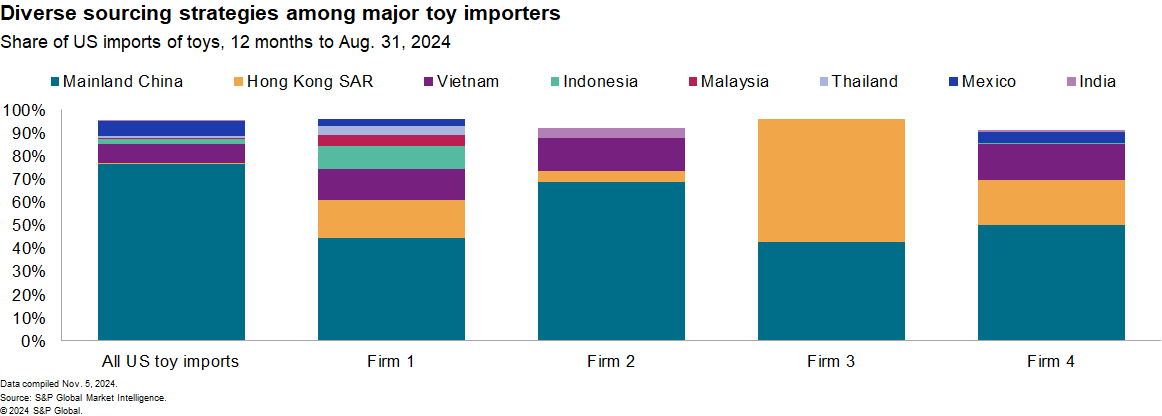

Even with the long-term inventory cut, firms have brought product in early, citing the risk of further US port strikes in January 2025. The desire to cut costs and mitigate risk — including against tariffs — has led to a reshoring of toy supply chains over the past five years, though mainland China still represented 76% of US toy imports in the 12 months to Aug. 31, 2024.

There's a significant spread in strategies between the toy firms though, with one firm drawing just 45% of its imports from mainland China augmented with a wide range of imports from across Asia. At the other end of the scale, another imports 96% of its requirements from mainland China and Hong Kong SAR combined.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.