Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 06, 2024

By Chris Rogers and Eric Oak

Learn more about our data and insights

The return to office of President-elect Donald Trump brings the prospect of a renewed round of import tariffs to the US, particularly from mainland China but also more broadly, as well as responses in kind from other countries.

Companies therefore need to brush off their playbooks for dealing with tariffs, and there are plenty of routes for doing so.

Boost airtime: Fight tariffs at the source

The first stage for dealing with tariffs can be to lobby the government for exemptions, or the removal of the duties completely. This can take many forms, from exemption requests, waivers or direct influence, and can vary widely in effectiveness and risk.

Lobbying the government directly can be effective before tariffs are issued, looking to prevent the duties in the first place. Efforts after the fact can be more fraught, as political messaging can often come into play.

Exemptions are often allowed for many types of duties, waiving the duties for specific products if approved by the government. These can be temporary and are not always granted or renewed. Waivers and exemptions can often give a company a specific advantage, but can also come with political visibility.

In the case of the Section 301 duties exemption process from 2019, one firm achieved a 62.5% success rate in gaining approvals for their exemptions versus an industry average 3.5%, partly due to close relations of the firm's CEO with President Trump and partly due to commitments to US manufacturing.

Modulate the key: Financial strategies

In the short term, strategies for dealing with tariffs tend to focus on their immediate financial impact. These approaches are often faster and easier to implement — with a tradeoff of not being available for every company or situation.

Companies can increase the prices of their goods to reflect the increased costs of input materials. This is not always viable for firms in competitive industries and can lead to an erosion in market share for impacted firms. Companies may also face political pressures if price increases are associated with wider inflation.

Firms can also negotiate with their suppliers to offset the cost of the tariffs with lower input pricing. This is the best financial scenario for firms, but the renegotiation of contracts and competitive sourcing processes can take time.

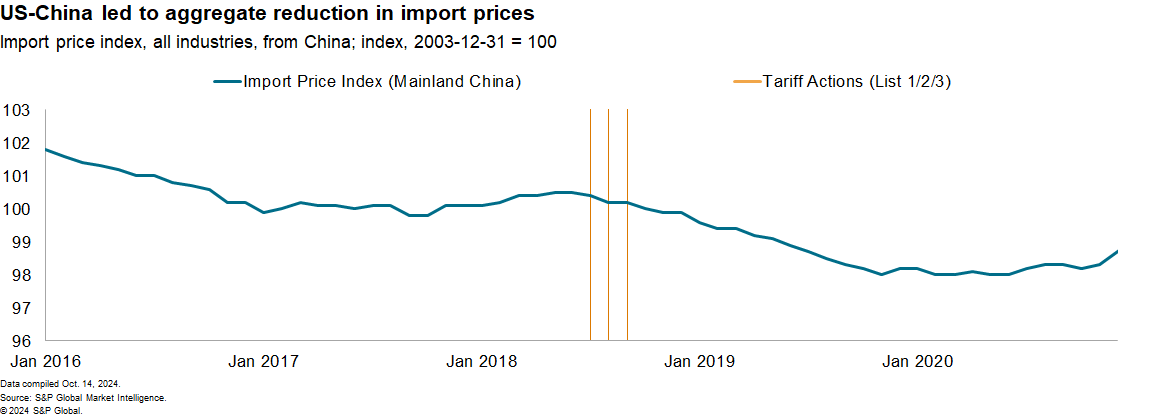

The escalation of the US-mainland China trade war in 2018 and its aftermath show a good example of import prices decreasing in response to tariffs. The application of duties on US$250 billion-worth of mainland Chinese imports in the third quarter of 2018 came before a 1.9% year-over-year decline in import prices by November 2019.

A less desirable prospect can be absorbing the additional costs by lowering margins. High-margin businesses can often use this as a fast stopgap before implementing other measures, while lower-margin businesses will have to make tougher decisions. The ownership of firms also matters — public companies may find the erosion of margins less palatable than private concerns.

Change the track: Adjust sourcing strategies

Over the longer term, companies can also react to tariffs by adapting their sourcing strategies in three main ways.

First, companies can pull forward their sourcing from the target country to establish a stockpile of goods that are unaffected by tariffs. The rapid expansion in US seaborne imports in fall 2024 was partly a response to beating strikes on the US east coast as well as duties which were expanded by the Biden administration.

A further wave of imports can be expected in winter 2024/25 as firms look to beat the next round of strikes and potential tariffs. However, the elevated inventories may be difficult to justify or sustain given higher interest rates during the prior period of tariff increases.

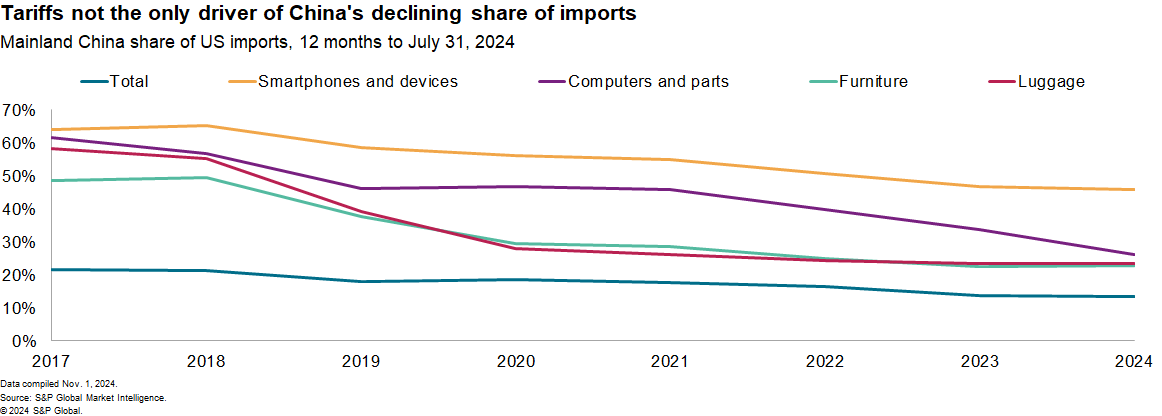

Second, firms can shift sourcing to countries not impacted by tariffs, either due to the type of tariff or superseding trade agreements. Not all tariffs can be avoided this way, and the alternative sources may have additional costs or considerations that make the total cost of sourcing from that location less economical. The exodus from mainland China in the wake of the prior round of tariffs led imports from mainland China of products covered by tariffs to drop from 21.6% of imports in 2017 to 13.5% in the 12 months to August 31, 2024.

A final strategy is to import components for final assembly rather than finished goods to reduce or eliminate the tariff load, which can be characterized as partial reshoring. If, for example, there is a tariff on kitchen utensils but not the component metal, importing the metal and casting the utensils in-country could reduce the tariff load. This carries much of the same caveats as full reshoring, however, and not all companies are able to shift and adjust their manufacturing locations like this.

As more details of tariffs in the US become clear in 2025, firms will increasingly need to pick one or more of these strategies. None of these fixes for tariffs are without cost, leaving firms in the unenviable position of needing to return to the financial responses of raising prices, cutting costs elsewhere or accepting lower profitability.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.