Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 02, 2018

Week Ahead Economic Preview

- Worldwide releases of IHS Markit Services PMI data will provide further insights into global economic growth and price trends at the start of 2018

- Central banks in Australia, New Zealand, Russia, India, the Philippines, Thailand and Brazil are all deciding on monetary policy…

- … but main market focus is on BoE

Worldwide releases of IHS Markit Services PMI surveys will provide further insights into global economic growth and price trends at the start of 2018. A number of central banks are deciding on monetary policy, but markets will likely focus on the Bank of England. Other key data highlights include China’s trade figures.

Bank of England

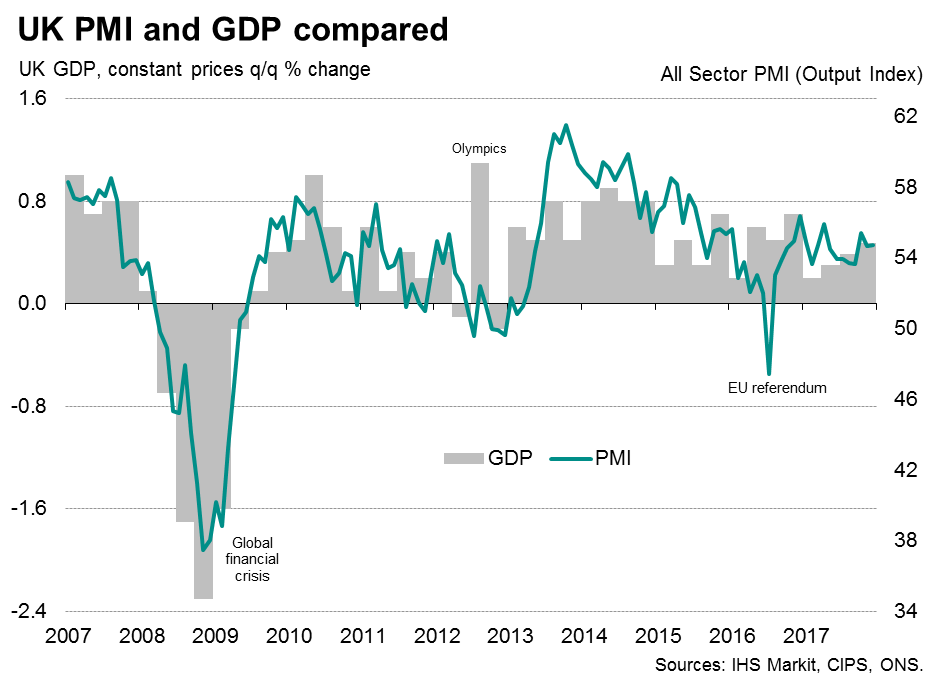

In the UK, a highlight of the coming week will be the monetary policy decision of the Bank of England. The UK economy enjoyed further resilient growth in the closing quarter of 2017, but risks to the outlook remained, not least the extent to which higher prices and falling real pay will continue to erode consumer spending power, and the degree to which Brexit uncertainty is holding back business investments. As a result, the focus will be on the central bank’s assessment of the economy and its latest Inflation Report, with markets not expecting any policy changes. Meanwhile, in the wake of similar releases for manufacturing and construction, the publication of services PMI data for January will provide greater clarity as to how the economy fared at the start of 2018. Preliminary official data showed that the UK economy expanded at a faster rate of 0.5% during the fourth quarter.

US services in the spotlight

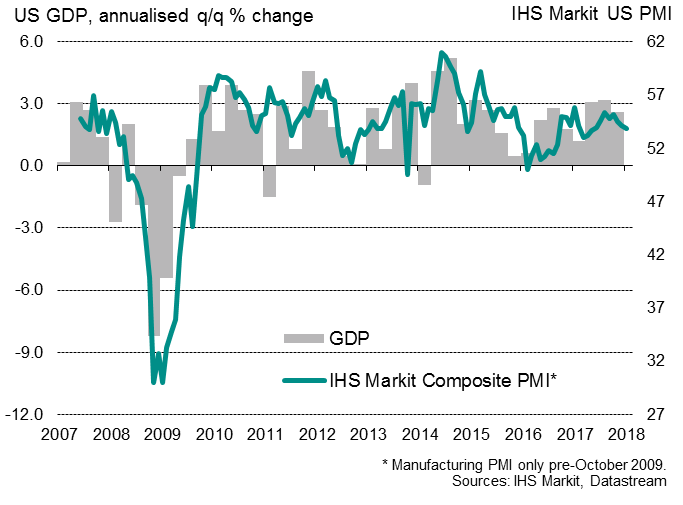

Analysts will eagerly await updates to the US services PMI surveys for further clues of future Fed policy. The acceleration of manufacturing growth and upward price trends have been grist to the mill for Fed hawks, adding to the likelihood of interest rates rising in March. Markets widely anticipate a March rate move, with the CME FedWatch measure implying an 80% chance, up from about 70% before the latest FOMC meeting.

No changes to RBA policy expected

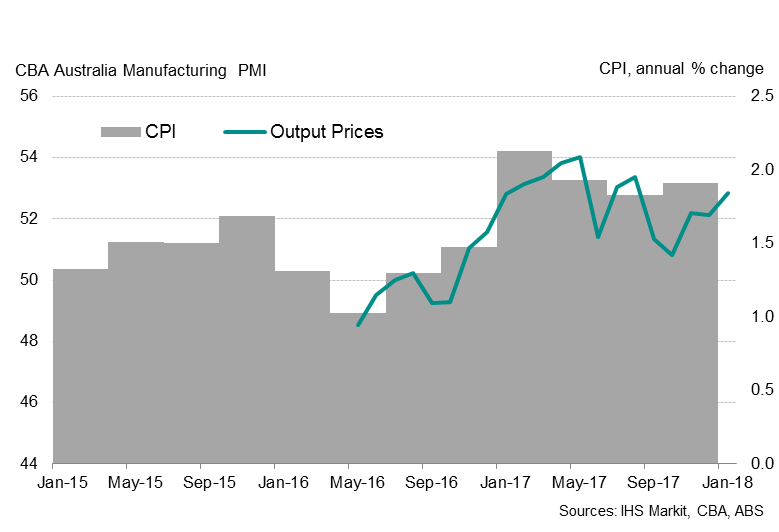

In Australia, the headline inflation rate at the end of 2017 remained below the central bank’s target range of 2–3%, but markets are expecting the Reserve Bank to leave monetary policy unchanged at its next meeting. The latest CBA Manufacturing PMI showed that recent pressures on input costs and strong demand are pushing manufacturers to lift output prices, which could filter through to consumer prices in coming months. The release of the CBA Services PMI will also offer more clues of domestic demand and price pressures.

Monday 5 February

- Worldwide releases of IHS Markit Services and Whole Economy PMI surveys (Jan)

- Indonesia GDP (Q4 and 2017)

- Euro area retail sales (Dec)

- Russia GDP (Q4)

Tuesday 6 February

- IHS Markit Retail PMI surveys for the eurozone, France, Germany and Italy (Jan)

- Australia trade and retail sales (Dec)

- RBA monetary policy meeting

- The Philippines and Taiwan inflation (Jan)

- Germany factory orders (Dec) and Construction PMI (Jan)

- Canada trade (Dec)

- US trade and JOLTs job openings (Dec)

Wednesday 7 February

- IHS Markit Sector PMI data for Asia, Europe, the US and global (Jan)

- UK Halifax House Price Index (Jan)

- Malaysia (Dec) and Taiwan trade (Jan)

- Brazil, India and New Zealand monetary policy decisions

- Germany industrial production (Dec)

- France trade balance (Dec)

- Russia and Brazil inflation (Jan)

- Italy retail sales (Dec)

Thursday 8 February

- IHS Markit/REC UK Report on Jobs (Jan)

- China trade (Jan)

- Mexico and the Philippines monetary policy decisions

- Germany trade (Dec)

- BoE monetary policy decision and Inflation Report

- Brazil inflation (Jan)

Friday 9 February

- Japan machine tool orders (Jan)

- China inflation (Jan)

- Malaysia, the Philippines and France industrial production (Dec)

- UK trade balance and industrial production (Dec)

- Brazil retail sales (Dec)

- Russia monetary policy decision and trade balance (Dec)

- Canada inflation (Jan)

- US wholesale inventories (Dec)

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}