Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 02, 2018

China's economy enjoys solid start to 2018 as PMI hits seven-year high

- Caixin Composite PMI Output Index at 53.7 in January, highest since start of 2011

- Jobs growth seen for second straight month

- Overall inflationary pressures ease, but service providers report a marked rise in input costs

- Business confidence about the year ahead edges up but remains subdued

Latest survey data showed that China’s economy enjoyed a strong start to 2018, with the fastest growth of business activity for seven years accompanied by an improving labour market.

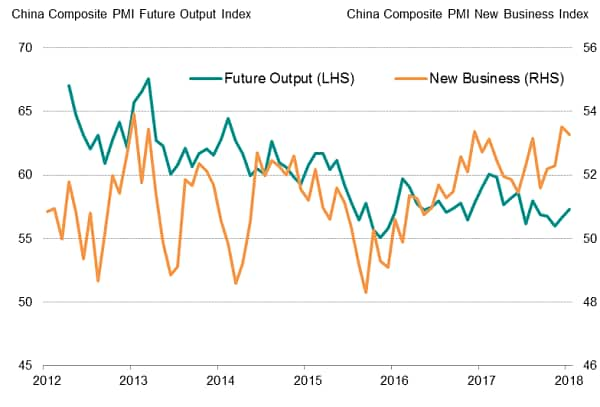

Forward-looking indicators suggest that economic growth momentum could strengthen in coming months, which will be welcome news to the government as they tackle financial risks and reduce corporate debt.

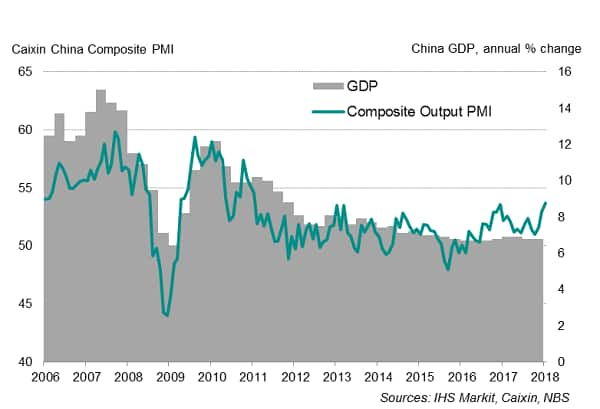

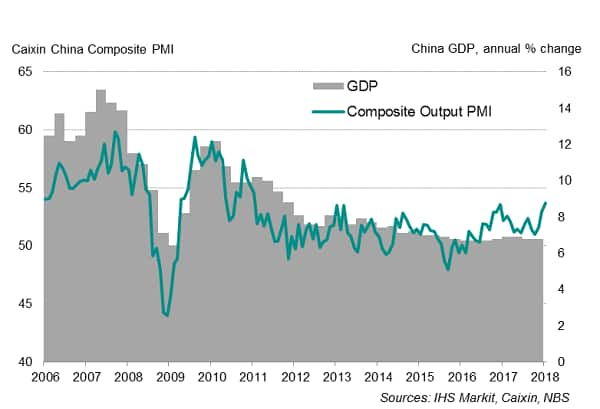

China PMI and economic growth

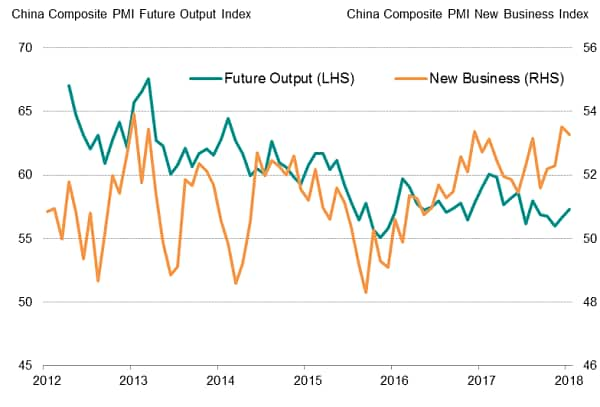

China PMI forward-looking indicators

Solid start to 2018

The Caixin Composite PMI™ Output Index rose to 53.7 in January, up from 53.0 in December, reaching its highest since January 2011. New business intakes also increased at one of the fastest rates in the past seven years, which continued to stretch operating capacity. Backlogs of work climbed further in January, boding well for further growth of output and hiring in coming months.

The stronger-than-expected 2017 economic growth prompted many to upgrade their forecasts, including IHS Markit, who now project the Chinese economy to grow 6.6% this year, up from 6.5% previously. However, even after the upward revisions, the strong start to the year, as indicated by the PMI surveys, poses upside risk to 2018 GDP estimates.

In early 2017, China’s first-quarter GDP growth took many analysts by surprise, coming in above expectations, but the faster growth pace had been signalled well in advance by Caixin PMI surveys, which also hinted at a stronger manufacturing upturn.

Broad-based upturn

The upturn is also encouragingly broad-based by sector. Growth accelerated in both manufacturing and services in January, though the latter enjoyed the stronger pace of expansion. Manufacturing output growth edged up, posting the strongest rise in just over a year, while service sector business activity expanded at a rate not seen since May 2012, matched by the best monthly growth in new business for over two-and-a-half years.

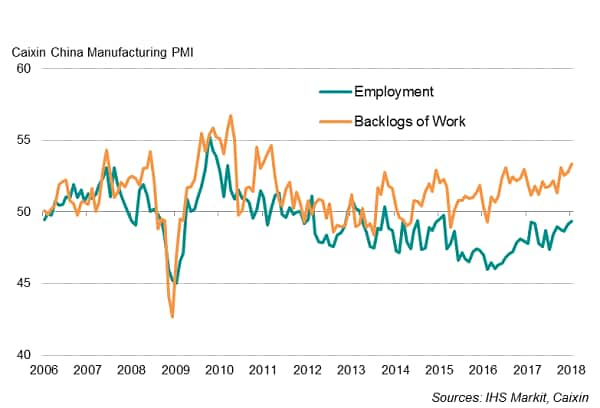

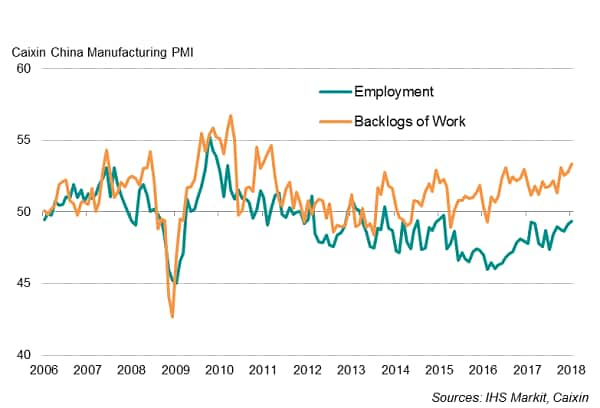

Overall employment grew at the start of the year, albeit only marginally. Job creation in the service sector was able to offset the ongoing decline in factory jobs. But perhaps more encouraging was that the latest fall in manufacturing employment was the weakest in nearly three years and only slight. With production backlogs rising at the fastest rate since early 2011, the ongoing pressure on operating capacity will likely encourage Chinese goods producers to step up hiring.

China Manufacturing PMI employment and backlogs

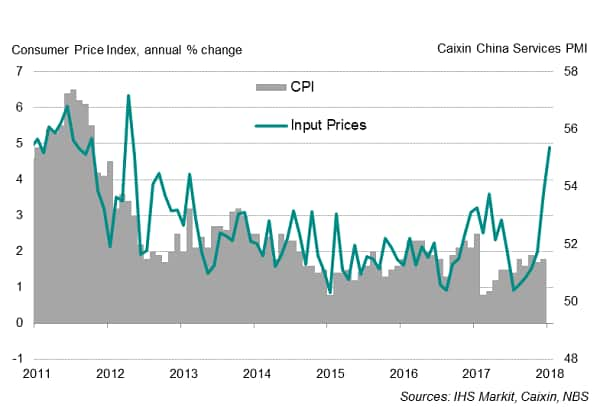

Rising costs

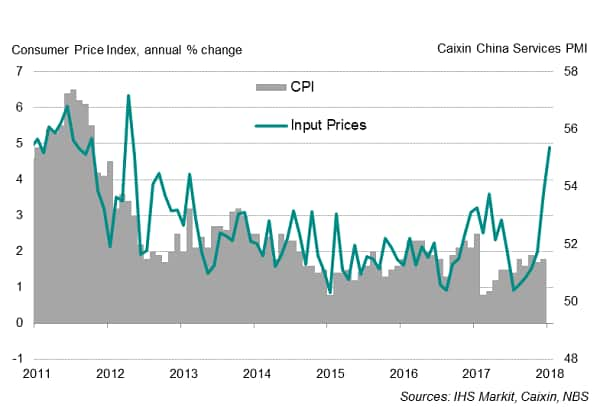

Rates of input price inflation faced by manufacturers and service providers are meanwhile converging. While goods producers reported another sharp rise in cost burdens, the rate of increase slowed markedly to a five-month low. In contrast, the service sector saw the largest monthly rise in input costs for over five-and-a-half years. The Caixin services PMI's gauge of input prices exhibits a correlation of 76% with official consumer price inflation data, suggesting that headline inflation may turn higher at the start of 2018. Anecdotal evidence showed that salary increments were part of the reason for higher costs in the service sector.

China Services PMI and consumer inflation

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

Latest survey data showed that China’s economy enjoyed a strong start to 2018, with the fastest growth of business activity for seven years accompanied by an improving labour market.

Forward-looking indicators suggest that economic growth momentum could strengthen in coming months, which will be welcome news to the government as they tackle financial risks and reduce corporate debt.

China PMI and economic growth

China PMI forward-looking indicators

Solid start to 2018

The Caixin Composite PMI™ Output Index rose to 53.7 in January, up from 53.0 in December, reaching its highest since January 2011. New business intakes also increased at one of the fastest rates in the past seven years, which continued to stretch operating capacity. Backlogs of work climbed further in January, boding well for further growth of output and hiring in coming months.

The stronger-than-expected 2017 economic growth prompted many to upgrade their forecasts, including IHS Markit, who now project the Chinese economy to grow 6.6% this year, up from 6.5% previously. However, even after the upward revisions, the strong start to the year, as indicated by the PMI surveys, poses upside risk to 2018 GDP estimates.

In early 2017, China’s first-quarter GDP growth took many analysts by surprise, coming in above expectations, but the faster growth pace had been signalled well in advance by Caixin PMI surveys, which also hinted at a stronger manufacturing upturn.

Broad-based upturn

The upturn is also encouragingly broad-based by sector. Growth accelerated in both manufacturing and services in January, though the latter enjoyed the stronger pace of expansion. Manufacturing output growth edged up, posting the strongest rise in just over a year, while service sector business activity expanded at a rate not seen since May 2012, matched by the best monthly growth in new business for over two-and-a-half years.

Overall employment grew at the start of the year, albeit only marginally. Job creation in the service sector was able to offset the ongoing decline in factory jobs. But perhaps more encouraging was that the latest fall in manufacturing employment was the weakest in nearly three years and only slight. With production backlogs rising at the fastest rate since early 2011, the ongoing pressure on operating capacity will likely encourage Chinese goods producers to step up hiring.

China Manufacturing PMI employment and backlogs

Rising costs

Rates of input price inflation faced by manufacturers and service providers are meanwhile converging. While goods producers reported another sharp rise in cost burdens, the rate of increase slowed markedly to a five-month low. In contrast, the service sector saw the largest monthly rise in input costs for over five-and-a-half years. The Caixin services PMI's gauge of input prices exhibits a correlation of 76% with official consumer price inflation data, suggesting that headline inflation may turn higher at the start of 2018. Anecdotal evidence showed that salary increments were part of the reason for higher costs in the service sector.

China Services PMI and consumer inflation

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-economy-enjoys-solid-start-to-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-economy-enjoys-solid-start-to-2018.html&text=China%e2%80%99s+economy+enjoys+solid+start+to+2018+as+PMI+hits+seven-year+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-economy-enjoys-solid-start-to-2018.html","enabled":true},{"name":"email","url":"?subject=China’s economy enjoys solid start to 2018 as PMI hits seven-year high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-economy-enjoys-solid-start-to-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%e2%80%99s+economy+enjoys+solid+start+to+2018+as+PMI+hits+seven-year+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-economy-enjoys-solid-start-to-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}