Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 01, 2018

Thailand PMI survey shows manufacturing growth accelerating into 2018

- Manufacturing PMI edges up to 50.6 in January from 50.4 in December, highest since February 2017

- Employment remains weak

- Optimism at highest in over a year

The positive growth momentum in Thailand’s manufacturing economy seen at the end of last year extended into 2018 as business conditions improved further in January, according to the Nikkei Thailand Manufacturing PMI. However, jobs growth remained disappointingly elusive.

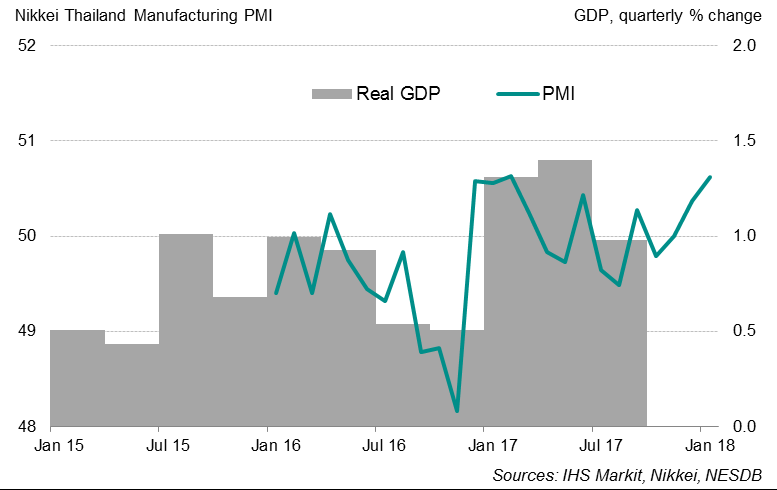

Thailand PMI and economic growth

Positive start to 2018

The Nikkei Thailand Manufacturing PMI™ edged up to 50.6 in January from 50.4 in December, marking the best monthly improvement in nearly a year.

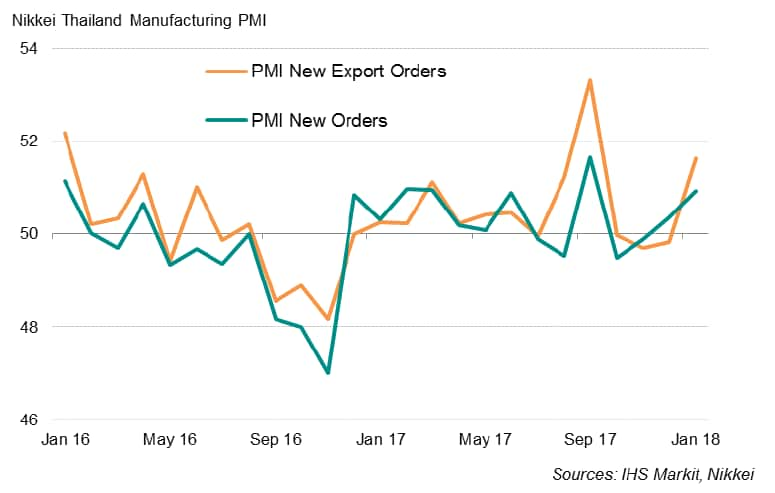

Most encouraging were the survey indications of a firming of demand for Thai manufactured products at the start of the year. Export sales returned to growth for the first time in four months.

Although down from December, the rate of output expansion remained above the survey average since data collection started in December 2015.

The upturn also engendered a rise in pre-production stocks for the first time since February 2017, which boosted the headline PMI. Inventory building reflected indications that Thai businesses were feeling more confident about output in the year ahead. The Future Output Index rose to the highest in just over a year.

Broadening demand for Thai goods

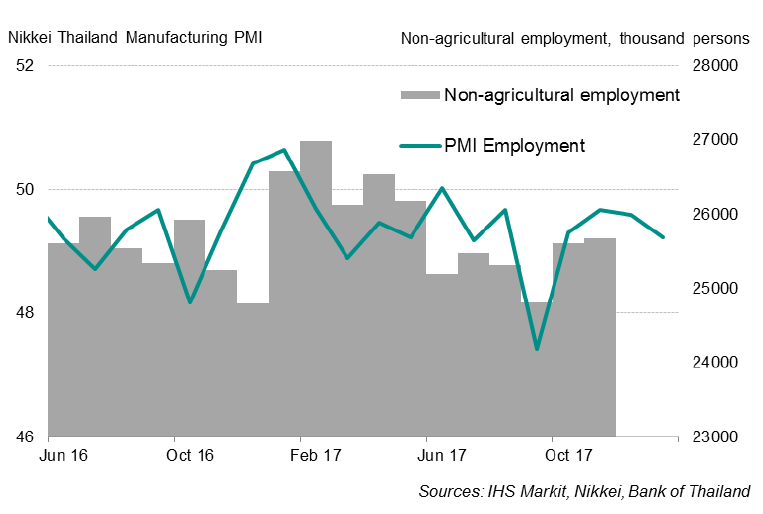

Employment remains weak

The only fly in the ointment was a lack of jobs growth. The PMI survey data showed that net manufacturing employment has not increased for a year, with January seeing another fall in factory payroll numbers. Anecdotal evidence suggested cost-cutting measures and industrial automation replacing human labour were the principal reasons for shrinking manufacturing jobs.

Furthermore, a lack of capacity pressure in the sector, as indicated by a persistent fall in backlogs of work, also dampened hiring, as firms preferred to tap existing resources to meet demand than take on additional workers.

Thailand PMI and employment

Subdued price pressures

Meanwhile, inflationary pressures remained modest, generally linked to higher global commodity prices than being pulled higher by greater domestic demand. Anecdotal evidence suggested that rising raw material costs, especially for oil and plastics, were key drivers of increased factory costs.

Past surveys showed that input price inflation in Thailand has been well below most of its regional peers, in part likely because of a stronger exchange rate that has helped to contain import costs. As a result, mild cost increases allowed Thai manufacturers to raise their selling prices only modestly in January.

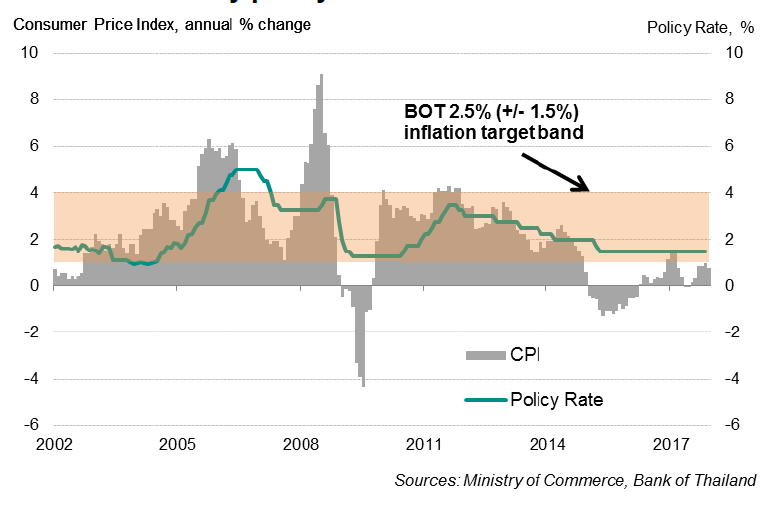

Thailand’s consumer inflation came in below the Bank of Thailand’s target range in 2017. January survey data suggested that inflation is far less likely to accelerate quickly at the start of 2018 despite external price pressures.

Monetary policy

The latest PMI survey generally paints a positive economic picture, in turn suggesting that additional monetary stimulus is not needed for the moment. Furthermore, BOT governor Veerathai Santiprabhob said recently that a significant policy cut could undermine financial stability and have a negative impact on household savings.

However, subdued rates of growth in manufacturing activity and low inflation support the view that current loose monetary conditions remain necessary to foster stronger economic growth and help revive inflationary pressures, especially when the recent appreciation of baht could have an adverse impact on export sales.

The central bank has kept the policy rate on hold near a record low 1.5% since April 2015. The next monetary policy meeting is on 14 February.

Thailand monetary policy and inflation

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

bernard.aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-pmi-survey-shows-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-pmi-survey-shows-manufacturing.html&text=Thailand+PMI+survey+shows+manufacturing+growth+accelerating+into+2018","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-pmi-survey-shows-manufacturing.html","enabled":true},{"name":"email","url":"?subject=Thailand PMI survey shows manufacturing growth accelerating into 2018&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-pmi-survey-shows-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Thailand+PMI+survey+shows+manufacturing+growth+accelerating+into+2018 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-pmi-survey-shows-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}