Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 06, 2024

Learn more about our Supply Chain Console

Eric Oak of the Supply Chain Insights team co-authored this report.

The Biden administration announced a new round of tariffs on imports of steel and aluminum from mainland China, including a more than three-fold increase in the Section 301 tariff rate for Chinese steel imports. Given the upcoming US elections in November, the timing suggests this is a political move rather than being purely economically driven.

The impact of tariffs on trade with China is likely to be minimal given the already significant range of tariffs applied to Chinese steel. China accounted for less than 1% of US steel imports in the first two months of 2024. It is also unlikely to be significant to the Chinese economy given that the US accounted for just 0.8% of Chinese steel exports.

By type, US imports of Chinese steel account for 0.4% of total non-alloy steel by weight. Stainless steel has the highest proportional share, with China accounting for 1.2% of US imports, yet is still below significant levels for US industry.

Mainland China made up 5.2% of US aluminum imports in the fourth quarter of 2024, lagging the more than 50% sourced from Canada. The tariffs may have more impact on aluminum markets recently affected by additional sanctions on Russian trade.

Specific products may see different impact

The Section 301 lists cover more than 1,300 products, and without details from the US Trade Representative, the tariff hikes could take multiple forms. If tariffs are not increased across the board, then products that have seen a higher import share from China might be targeted. The impact of specific products on microeconomies may be vastly different than the impact of the regime as a whole.

Some of the products with increased Chinese import share are consumer or near-consumer goods. Tariff increases could impact inflation if importers choose to share higher costs with consumers via price rises, as opposed to taking a hit to profits or negotiating lower pre-tariff prices with suppliers.

The current round of tariffs from the Biden administration was likely designed to avoid impacting consumer goods with high steel components, like home appliances. This would avoid a push on inflation, which the administration and the Federal Reserve are trying to actively manage.

Global challenges from steel growth

A larger issue for the growth in Chinese steel exports will be felt by the broader global market, which may not be as isolated from supply shocks in steel as the US. Total Chinese exports of iron and steel increased by 59.2% year over year in the fourth quarter of 2023 and by 34.5% year over year in January and February combined. In the fourth quarter, 30.2% of exports went to Association of Southeast Asian Nations (ASEAN) countries, notably Vietnam. Other destinations that received additional exports from China include India and Turkey.

Chinese steel exports are roughly 10% of the world's production, leading to a challenge for other markets to absorb its surging exports. This will likely lead to other countries imposing their own safeguards and protections in line with their own domestic industrial goals.

The Chinese steel industry is nearing a crisis with plummeting prices, excess inventory, and deep production cuts at construction-grade steel mills amid the current slowdown in China's property sectors. If exports are cut, the remainder will likely be absorbed by inventories, further hurting the market. Continued growth in infrastructure and domestic manufacturing, including shipbuilding and electric vehicles, will likely offset some losses from declining exports.

Approximately 30% of the production in the Chinese steel industry is associated with state-owned firms, limiting the government's ability to directly support the industry if a domestic demand crisis persists. If the domestic crisis persists, China may follow past practice and order producers to cut back to stabilize prices.

In the case of aluminum, China is also not a key source for imports, making up only 5.2% of imports by weight in the fourth quarter of 2023. The key provider of US aluminum imports is Canada, which provided 52.6% of aluminum in the same period.

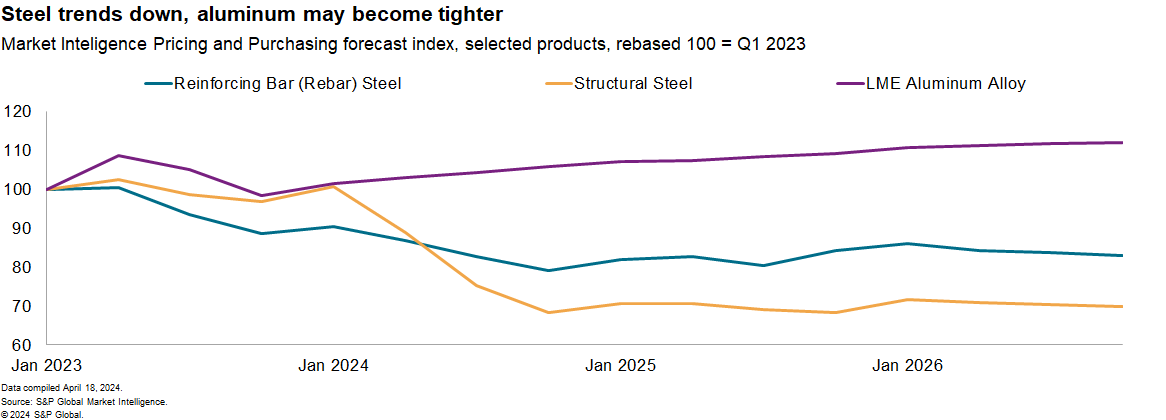

Unlike steel, Market Intelligence price forecasts indicate a tightening of the aluminum market as the prevailing trend, while steel prices are expected to remain below 2023 levels over the next three years. The aluminum sector also faces minor disruptions caused by new measures applied by the US and the UK against exports from Russia.

Risks for wider trade protectionism in metals

Protectionism and industrial policy will spread and be driven by political considerations through 2024 and beyond. Strategies to deal with tariffs include shifting suppliers and attempting to pass through higher tariffs to customers or burden-sharing with suppliers.

Markets that already have tariffs and quotas on Chinese exports will likely follow the US actions quickly if they feel that exports are shifting their way. The European Union's implementation of the Carbon Border Adjustment Mechanism (CBAM) next year may also distort markets. China may also respond in kind and magnitude, as was the case with the Section 301 duties in 2018 and 2019.

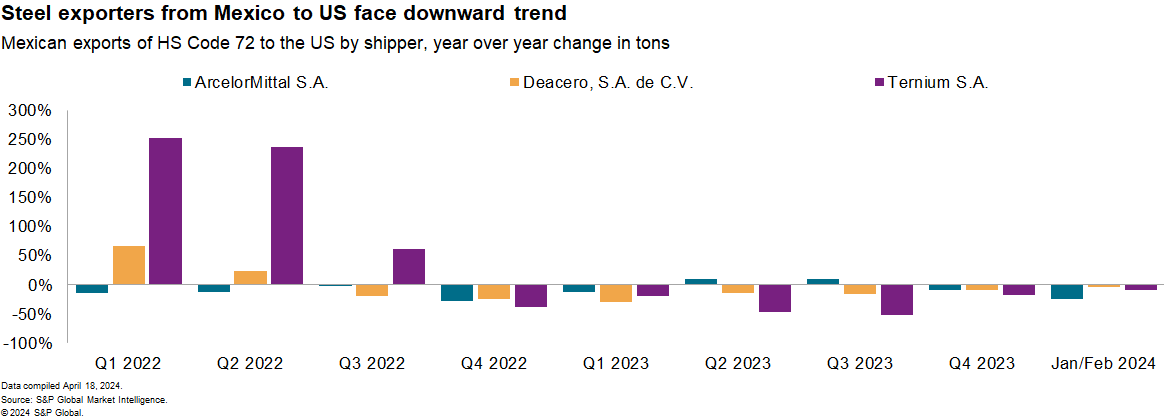

Companies should also expect additional scrutiny around circumvention, especially with the risk of indirect imports via USMCA countries and the automotive sectors.

Iron and steel imports to Mexico from China increased by 9.1% in the fourth quarter of 2023 before falling in January and February combined. Overall imports are still well above prior years, with imports from China in 2023 over 70% higher year over year against 2021. That growth is likely a driver behind the Biden administration's aim to work with Mexico to "jointly prevent … evasion of tariffs." Industrial policy vis-à-vis China will remain in focus during the 2024 election cycle, both in the US and Mexico

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.