Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Jun 05, 2023

By Matt Chessum

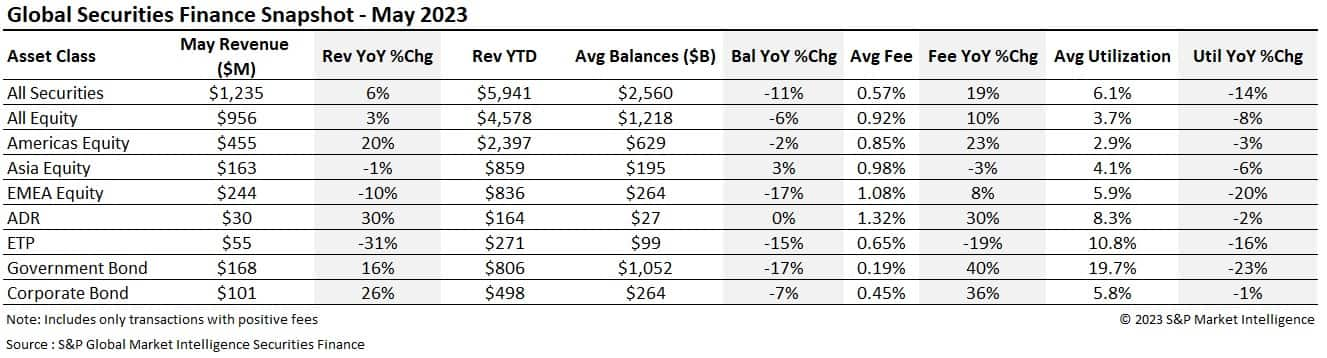

Securities finance revenues for the month of May reached $1.234B. This represents a 6.3% increase YoY (23% increase on May 2021 and 52% increase on May 2020) and a 4% decrease MoM. Americas equities and fixed income assets continued to produce strong returns.

Utilization decreased across all asset classes (YoY) as balances also declined (YoY). Average fees were higher across all asset classes apart from ETPs and Asia equity. Average fees increased 40% YoY across government bonds and 36% YoY across corporate bonds leading to fees of 19bps and 45bps respectively. Specials activity across the Americas continued to push average fees higher (+23% YoY) to an impressive 85bps (down from 95bps during April).

The month of May was another busy month regarding economic news. The market volatility experienced throughout April continued for a good period of the month as the uncertainty regarding the demise of First Republic Bank sent further shock waves through financial markets. First Republic Bank subsequently became the fourth regional US lender to collapse since early March and the second-biggest bank failure in US history.

Around the globe inflation figures started to moderate and Artificial Intelligence came to the fore of market events. Technology stocks rallied and the Nasdaq finished the month 31% higher when compared to January. This led to a high degree of short covering across the market. The possibility of the US government defaulting on its national debt, as difficult discussions in relation to the debt ceiling continued, also made financial markets very choppy throughout the last few weeks of the month.

During the month market news in the Americas was focused on the technology sector. The big seven stocks (AMD, Google parent Alphabet, Amazon, Apple, Meta, Microsoft, Netflix, Nvidia and Tesla) continued to push equity markets higher with stronger than expected earnings. As uncertainty surrounding the economy and the ensuing June interest rate decision started to grow, investors were also on a renewed effort to seeking a degree of comfort by pursuing growth stock strategies which helped push mega tech stocks even higher. The impact of Artificial Intelligence, which continues to be a hot topic, on the future earnings of these companies is also driving stock prices higher.

Despite revenues across Americas equities increasing 19.6% YoY, May was the lowest revenue generating month of 2023 for the region. Revenues declined 13% MoM as April revenues of $524.3M, remain the strongest of the year so far. Average fees declined from 95bps during April to 85bps during May and balances declined by over $45.1B over the month which suggests that a large degree of short covering took place. Utilization also declined MoM in line with balances (2.88% May, 3.06% April). Utilization hit its lowest level of the year so far. The last time it stood at a similar level (2.85%) was during April 2022.

Across Canada, revenues increased 4% YoY to $32.8M. This is a decline MoM ($39.4M April) making May the second lowest revenue generating month of the year for the country. Revenues were driven lower by a fall in balances over the month (-$12B) as average fees remained close to those of April (66bps May and 67bps in April).

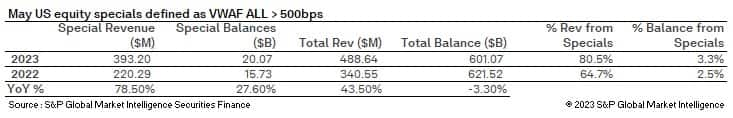

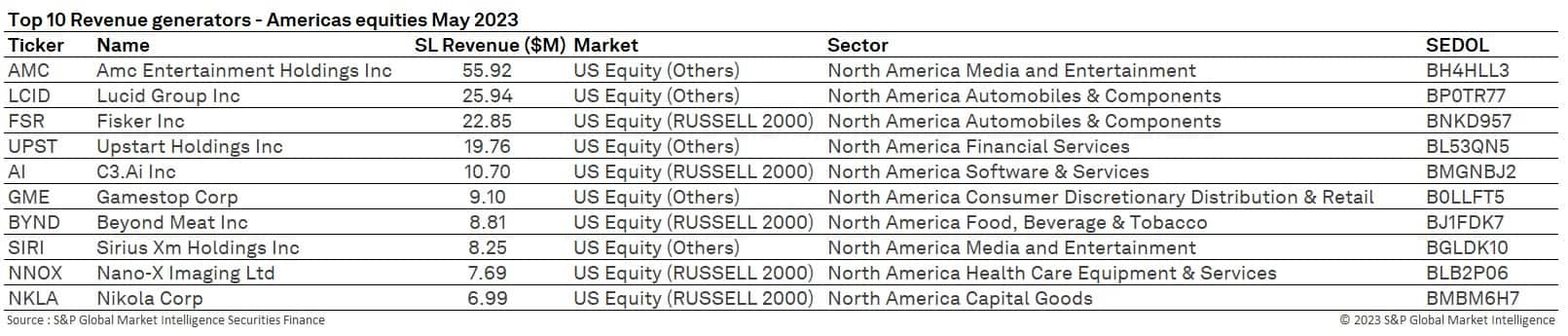

Specials activity across the Americas declined over the month mainly due to the decline in revenues seen in AMC. $333M in specials revenues were derived from US equities which represents a 41% increase YoY. YTD specials revenues in the US are equal to $1.74B.

Across Canada, revenues from specials decreased 15% YoY to $9.2M ($10.8M May 2022) and specials balances were approximately 1.7% of all on loan positions. YTD specials activity in Canada has generated $50.5M which is a 31% increase YoY.

Over the month revenues in AMC declined significantly. Revenues peaked at $132.3M for the stock during April. AMC has generated incredible returns for lenders throughout 2023. During 2022 the top performing stock was Lucid Group Inc (LCID) which generated $263M in revenues, YTD AMC has generated over $418M compared to Lucid Group which has generated $111M. May was the second highest revenue generating month for the stock this year (Jan $31.4M).

C3.Ai Inc (AI) was a new addition to the table throughout the month. This stock released earnings guidance for the year during May that fell short of analysts' estimates. The stock has suffered from incredible volatility since the start of the year, ending 2022 trading at $11 a share whilst reaching $44 at the end of the May. The company's share price recently soared on news that its software may be sold to Amazon before sliding 13% on the recent news of its earnings.

Nano-X Imaging Ltd made a renewed appearance in the table during the month following previous attacks by hedge funds that claimed that that company had engaged in fraud. The company is also reportedly struggling as investors continue to believe that the medical imaging company will have a long wait before it generates a profit based on its current set of financials.

California start-ups Lucid Group (LCID) and Fisker (FSR) downgraded their production forecasts during the month and the financial press reported that Lucid burned through $1B while delivering just 1,406 vehicles in the first quarter of 2023. This made demand for these two stocks strengthen throughout May.

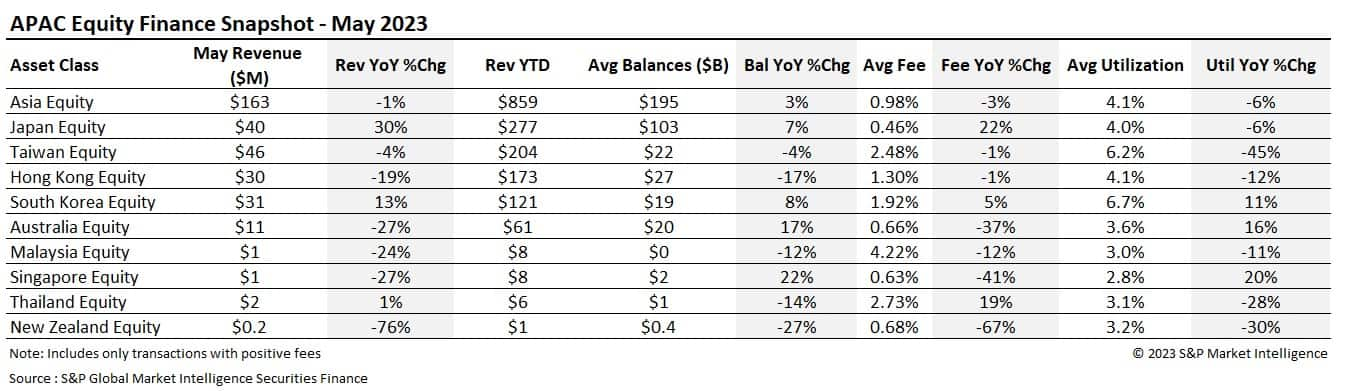

Securities finance revenues across the APAC region declined 1% YoY to $163M. Revenues also declined when compared MoM (-11%). Despite average fees also declining YoY, they did hit a year high of 98bps during the month. Like the Americas region, balances declined across the region by $35.7B over the month. Utilization also hit its lowest level of 2023 (4.15%) so far, also reaching its lowest level since July 2021 (3.83%).

Taiwan produced its best revenues of 2023 so far despite a decrease of 4% YoY. MoM revenues increased 7% and balances grew by $2B. Utilization also increased over the month to 6.24%. Lendable assets increased by $7.7B over the month and hit the highest level seen for many years.

Japan continued to produce strong revenues across the APAC region despite the local stock market hitting a 33 year high. Recent changes to corporate governance regulations and a reported desire of investors looking to reallocate away from China have benefited the country's stock market over the year. Revenues in the country reached $39.7M which is the lowest for 2023 so far but an increase of 30% YoY. Average fees increased 22% YoY and remained higher than those seen throughout both January and February this year.

Revenues across South Korea rebounded during the month to reach their highest monthly level since March 2022 ($34.1M). Revenues grew steadily over the month and reached a daily high on the May 31st. Average fees also hit their highest point (1.92%) since April 2022 as utilization continued to grind higher over the month reaching 6.95% on the last day of the month, close to one its highest points on record.

Across Asia, specials revenues declined YoY by 1.6% ($81.4M). YTD specials activity across the region has generated $382.2M which is a decline of 2% YoY. Revenue from specials activity during the month was derived from 6.4% of all on loan balances.

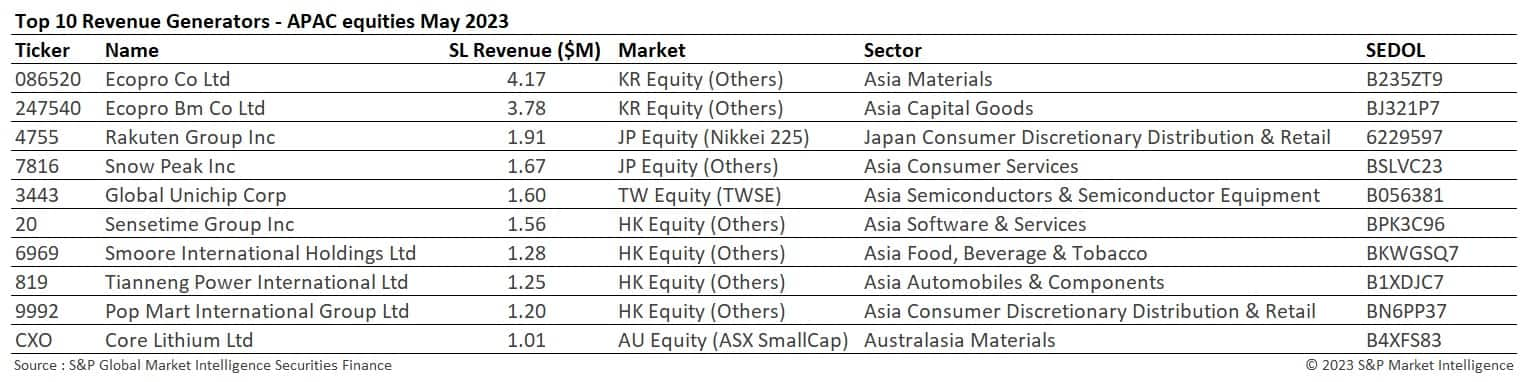

The highest revenue generating stocks of the month are similar to those seen during April. Ecopro Co Ltd, which was covered in last month's snapshot, continued to produce strong revenues for lenders and helped contribute stronger returns for South Korea. The percentage of shares outstanding on loan continued to grow over the month, reaching 8.27% on 31st May.

Rakuten Group Inc (4755) released plans to issue new shares during the month, as the company looks to raise $2.4B. This made its share price fall by over 2% once the news was released. Core Lithium Ltd (CXO) also appeared in the top revenue generators as investors became concerned about the medium-term outlook for lithium prices and the potential for lithium miners to be overvalued given the recent price increase in the commodity.

Snow Peak Inc (7816) $8.6M YTD, Sensetime Group Inc (20) $7.76M, Smoore International Holdings Ltd (6969) $8.2M YTD and pop Mart International Group Ltd (9992) $8.9M YTD all remain popular borrows across the region.

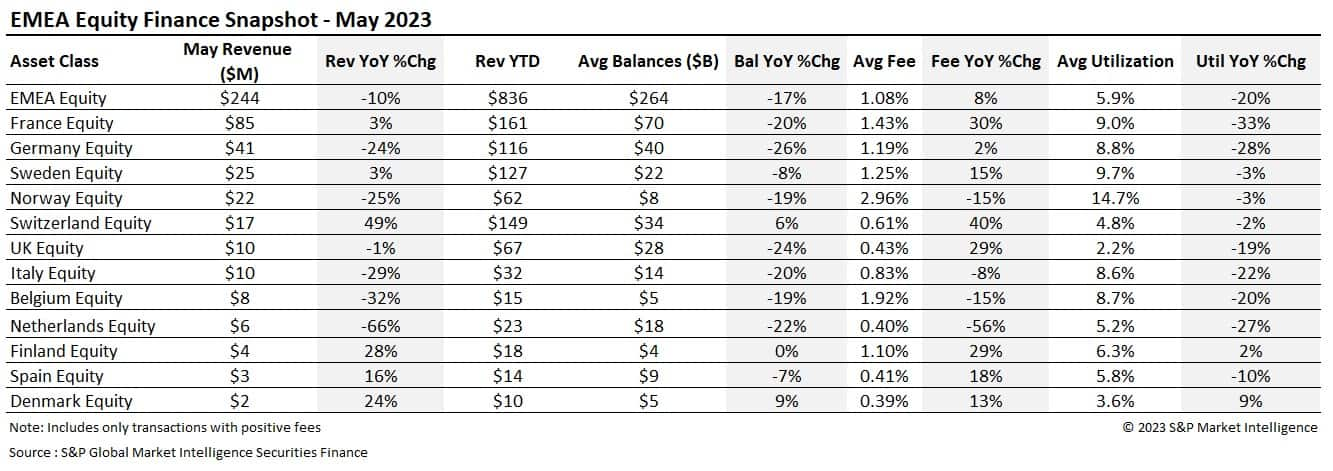

May securities finance revenues declined by 10% YoY even though they reached their highest level for 2023 so far. Despite the decline across one of the most lucrative months for the region, YTD revenues for 2023 currently stand at $836M which is substantially higher than the $722.6M that were generated at the same point thought 2022 ($650.9M 2022 and $537M during 2021).

Average fees of 108bps were recorded throughout the month which is the highest average fee since September 2021 (122bps). As with the Americas and APAC regions, balances declined over the month by $5.5B and utilization declined across most countries.

EMEA revenues were driven by the borrowing of French equities over the month as many French companies paid their annual dividends. Revenues increased 3% YoY, despite a fall in balances (-20%), as higher average fees (+30% YoY) helped to push returns higher. Despite the 3% increase seen YoY, revenues remain substantially lower than those seen throughout May 2021 ($93.8M).

Average fees across Germany reached their highest level since January 2021 (135bps) during the month and utilization hit its lowest level of 2023 so far. Both lendable and balances declined MoM as the Dax hit an all-time high during the month.

Across the rest of Europe, revenues remained strong across Switzerland, marking the best May for many years. Revenues were supported by a higher average fee (+40% YoY). Revenues in Norway, despite declining YoY are still aligned with those YTD for 2022 ($62M) as a higher average fee has helped maintain the strong level of return.

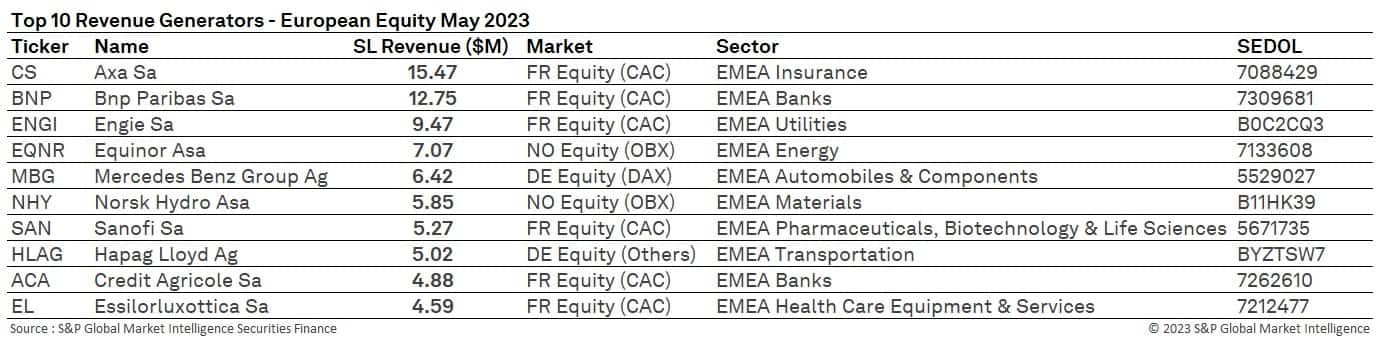

Specials revenues across the region increased 28% YoY to $45.9M. Specials balances also increased 1.2% YoY to just under $3.88B. YTD specials activity across the region has generated $241.2M making the YTD figure the strongest since 2008 (best YTD figure was May 2016 $246.2M).

A majority of the top generating stocks over the month were French equities and were mainly linked to seasonal activity.

ADR revenues continued the marked improvement that has been seen throughout the year. Both revenues and average fees increased YoY despite declining slightly MoM. Revenues for the asset class remain substantially higher than those seen YTD during 2022 (2023 $164M vs 2022 $98.5M).

Many of the top revenue generators remain familiar. Despite monthly revenues continuing to decline in Xpeng (XPEV) it remains the most expensive borrow. Belite Bio (BLTE) was the only stock in the table that was not dividend related. Biotech companies remain in focus given the challenges to raise capital and the impact that recent increases in interest rates are having on the cost of funding.

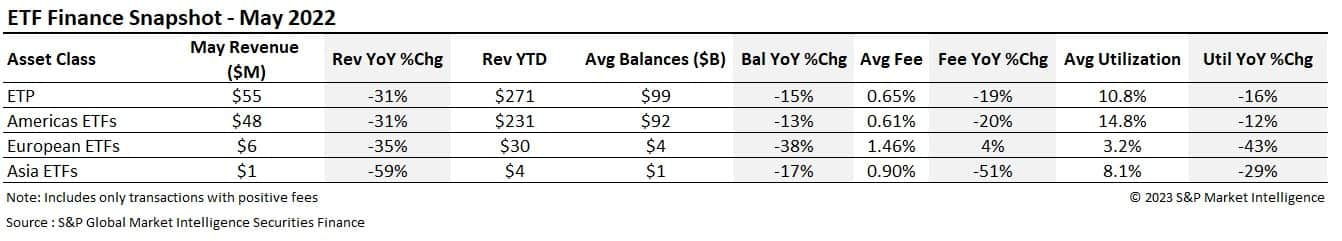

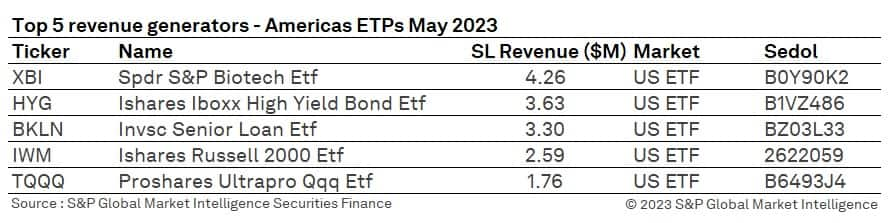

Borrowing activity across exchange traded products continues to decline following the multi-year highs that were experienced throughout 2022. Revenues declined 31% YoY but maintained a similar level seen during April ($54.7M May vs $54.5M April). Balances also remained aligned MoM ($98B) despite the decline seen YoY.

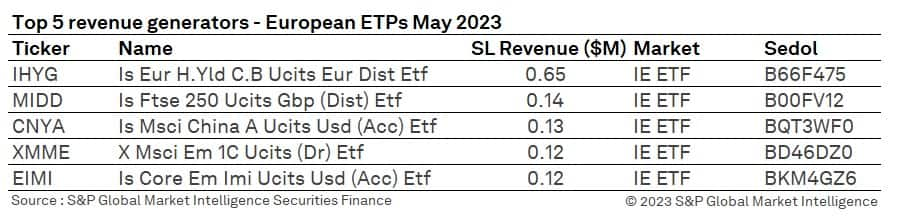

A similar story played out across all regions. Revenues declined YoY but remained similar MoM. The only difference is the average fee that was seen across European ETFs which increased 4% YoY and is at the highest May level since 2020.

As discussions regarding a probable pause in the Fed hiking cycle gained popularity, some marked changes in the top US ETP generators were seen during the month. Many of the interest rate related ETFs have given way to either Biotech focused ETFs or those following the tech sector. As discussed previously, the recent hikes in interest rates continue to put the Biotech sector under pressure. TQQQ the Proshares Ultrapro QQQ ETf offers 3x leveraged exposure to moves in the NASDQ 100. Any investors who believe that the NASDAQ has now hit a high may look to borrow these shares, sell them short and wait patiently for the index to fall before buying them back.

Across Europe, small and mid-cap indices, high yield, and Emerging Market trackers remain popular. Against a backdrop of relatively high, stubborn inflation, monetary tightening, lower economic growth and ongoing Geopolitical tensions, many of these ETFs remain popular tools for investors to take positions to express their confidence on any potential improvements to the economic situation.

Government bond markets continue to experience one of their most volatile periods on record. During the month, discussions surrounding the US debt ceiling and the possibility of the US government defaulting on their debt added uncertainty and volatility to the US treasury market.

The Fed, the ECB and the BOE all increased interest rates over the month by 25bps and whilst inflation does appear to be falling across much of the Western hemisphere, markets do not yet seem convinced that central bankers have the situation fully under control.

After the recent rate increases, the Fed rate now stands at a 16-year high and whilst the market is pricing in cuts later in the year, Powell remains adamant that the inflation outlook does not currently support that assumption.

The European Central Bank and the Bank of England do now appear to be on a slightly different trajectory to the Fed. Markets can expect to see a divergence going forward as tightening efforts start to differ. Both the BOE and the ECB are expected to raise rates at least twice more this year.

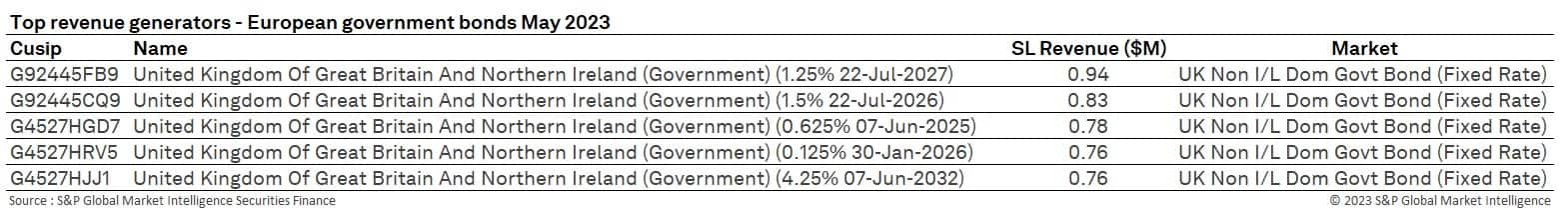

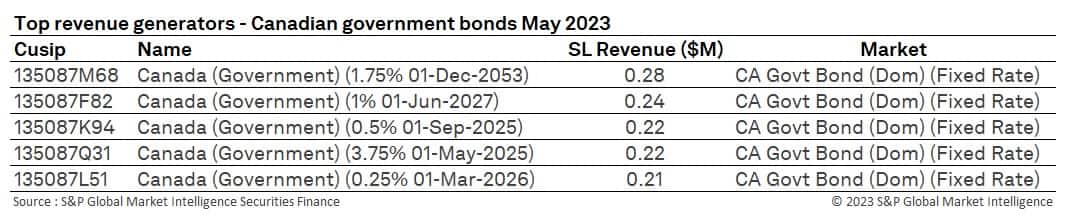

Government bond revenues experienced their second-best month of the year during May ($170M March) as revenues increased 16% YoY and 8% MoM. Average fees increased to 19bps; a level last seen during January. Revenues across US treasuries increased 23% YoY and 8% MoM to $87.9M whilst revenues across European government bonds increased 9.6% YoY and 9% MoM. Average fees across both US treasuries and European governments were both 19bps. Balances in European government bonds increased by $1B over the month. Across Canada average fees were 15bps and on loan balances remained flat MoM ($101B). Lendable increased to its highest point of the year so far at $458B.

As during previous months, the top revenue generators focused mainly the short-dated maturities (as they remain sensitive to interest rate moves). In the US, both the May and year end T-Bills were popular borrows as investors looked to hedge their risks in relation to the debt ceiling.

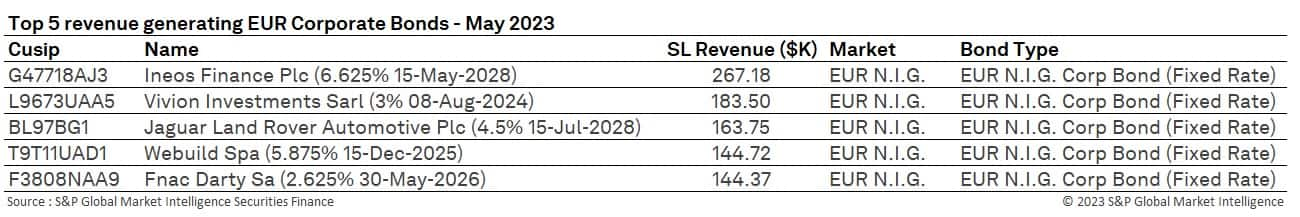

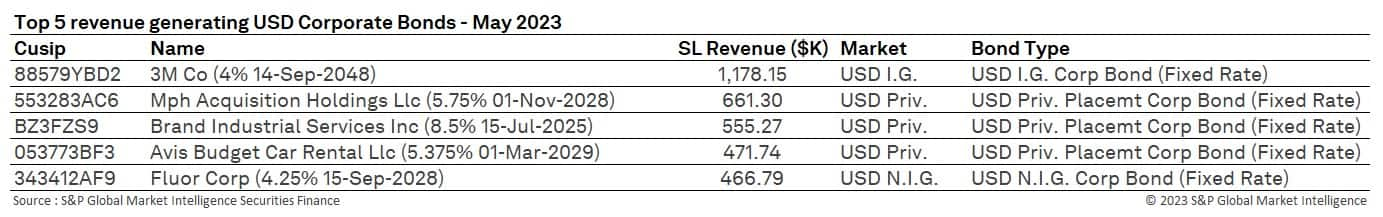

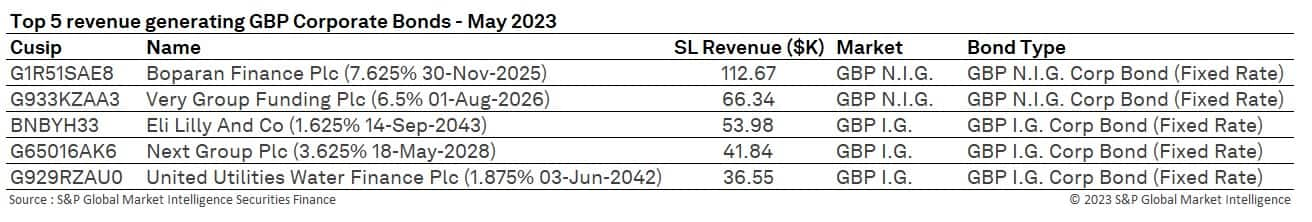

Corporate bonds continued to outperform, producing over $100M during the month of May. Revenues continued their YoY increase (+26%) and average fees remained at 45bps. The asset class experienced a record-breaking year during 2022 given the impact of the interest rate moves and the changes seen in both access to credit and issuance. This trend has continued throughout the year and YTD revenues are currently +40% YoY. Balances declined over the month (-$3.8B) despite lendable increasing to the highest level since August 2022.

The increases in interest rates continue to make corporate bonds attractive to borrowers. Risk of default reportedly continues to grow, and downgrades continue to outweigh upgrades especially in the high yield space.

As during previous months securities finance revenues remained robust throughout the month. Loan balances did decline throughout May as short covering took place and shares were returned. As greater consensus regarding the future interest rate environment takes hold it is likely that some of the market volatility that securities finance transactions have benefitted from over recent months will start to dissolve, resulting in a fall in overall demand during H2. Many potential risks do still exist however which may be supportive of a strong borrowing environment. Geopolitical tensions remain high with the ongoing impact of the war in Ukraine and previous economic assumptions regarding inflationary pressures have the potential to be proved wrong.

Heading into the last month of H1, many lenders will be grateful for the extra revenues that securities lending continues to add to their investment portfolios. The specials market remains an important and extensive source of additional revenues for those lenders who hold those positions in size.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.