Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — May 25, 2023

By Matt Chessum

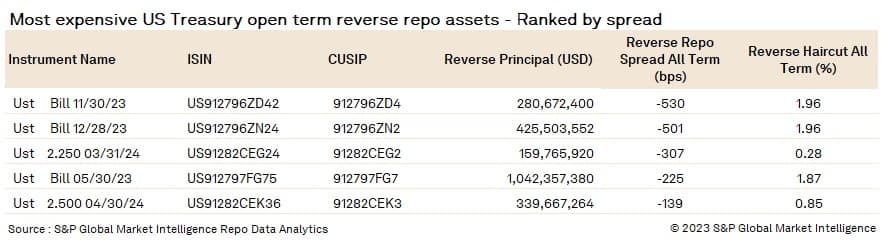

Uncertainty regarding the debt ceiling discussions in the United States of America is causing certain T Bill issues to become more expensive in the repo markets. Those T-Bills that mature close to the expected debt ceiling X-date (the date when the US Treasury is unable to pay its bills), currently assumed to be June 1st, 2023, are trading more expensive with higher-than-average haircuts.

Longer dated T-Bills are also trading more expensive as market participants start to hedge exposures and look to position their books against both positive and negative outcomes. The UST-Bill 11/30/23 and the UST-Bill 12/28/23 are currently trading above SOFR (5.056444 May 17th).

For more information on how to access this data set, please contact the sales team at: Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.