Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Sep 06, 2023

By Matt Chessum

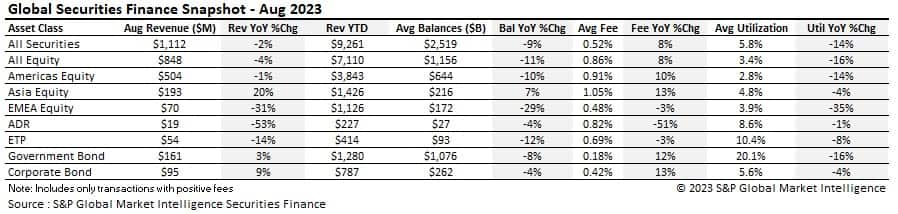

Securities lending activity generated $1.112B in revenues during the month of August. This represents a decrease of 2% YoY and 1% MoM. Despite this decline, revenues during the month remained significantly higher when compared with both August 2021 ($897M) and August 2020 ($648M). Revenues are also approximately 9% higher YTD when compared with 2022, 28% when compared with 2021 and an impressive 46% higher when compared with 2020.

Fees across all securities increased 8% YoY whilst balances declined 9% and utilization fell by 14% YoY. This is a common theme throughout the securities lending market during this year - higher revenues supported by higher fees but smaller on loan balances.

Equities across Asia performed well throughout the month posting an increase in revenues of 20% YoY. Revenues declined across the Americas and Europe, with EMEA being the only region to also show a decline in average fees (YoY).

In the fixed income markets, continued strength was seen across both government and corporate bonds. Revenues continued to grow YoY, posting increases of 3% across government bonds and 9% across corporate bonds. Balances continued to decline across both asset classes over the month, but average fees remained strong, despite corporate bonds posting their lowest monthly average fee (42bps) of the year so far.

The S&P 500 ended July with the longest monthly winning streak since the summer of 2021. July gave the index the fifth consecutive monthly gain, while the Nasdaq composite posted an increase of 4% over the month. During August this trend was reversed when both the NASDAQ (-2.2%) and the S&P 500 (-1.8%) posted their first monthly declines since February. When looking at the YTD gains however, NASDAQ +42% and S&P 500 +17.4%, these falls look insignificant.

Trading in US markets remained choppy throughout the month as traders reacted strongly to data flow. Jerome Powell's much anticipated speech during the annual Jackson Hole conference did little to guide markets as the tone remained neutral on the likelihood of future rate rises. At one point during the month the S&P 500 was down almost 5% and the NASDAQ fell by close to 8%, but both indices rebounded after "bad news" regarding weaker than expected jobs growth and data, suggesting continued improvement in inflationary pressures gave investors' confidence that the Fed may be done hiking rates.

Americas equities generated $504M during the month of August. USA equities generated 94% of these revenues ($472M) whilst Canadian equities generated 5% of the total ($28.9M). Revenues across Americas equities declined 1% YoY and 2% MoM. Average fees remained elevated at 91bps (USA equities 94bps and Canada 63bps). Average fees across the Americas have surpassed 90bps on four occasions during 2023 compared to just once during 2022. The specials market continues to push average fees higher. Balances declined 10% YoY whilst utilization fell below 2.8% for the first time since January 2022. Lendable inventory increased by 4% YoY however, declining slightly from July's year high of $17.9T.

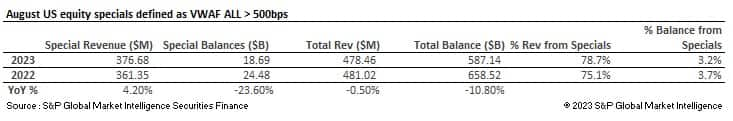

Specials activity across US equities remained robust throughout the month generating $376M. YTD, an incredible $2.8B of revenues have been generated from specials activity alone. YoY specials revenues increased 4.2% and specials balances declined by 23% during August. This portrays a decreasing pool of special names commanding higher fees.

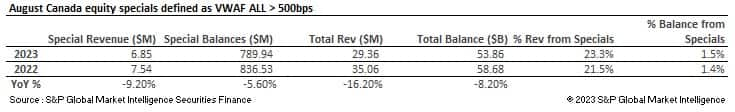

Across Canada specials revenues declined 9.2% YoY. YTD specials revenues stand at $73.4M which is an increase of 19% YoY. Specials balances accounted for a very small proportion of all on loan positions at approximately 1.5%.

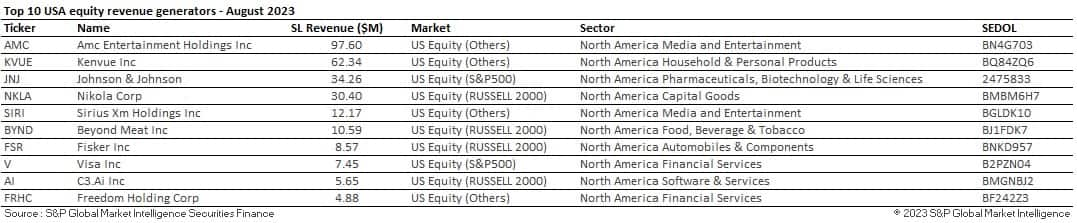

Despite the conclusion of the AMC / APE conversion halfway through the month of August, AMC was still by far the highest revenue generating stock of the month. Kenvue (KVUE) and Johnson & Johnson (JNJ) also featured in the table after the announcement of the recent tender offer.

Freedom Holding Cop (FRHC) generated $4.88M in revenues during the month after short seller Hindenburg announced that it was betting against the Kazakhstan based corporation. Shares in the company fell by approximately 5% on the news despite elevated trading volumes. Hindenburg stated in its report that Freedom Holding Corp had acted as a conduit for sanctions evasion in the wake of the Russian invasion of Ukraine whilst also fabricating revenues and manipulating its own share price.

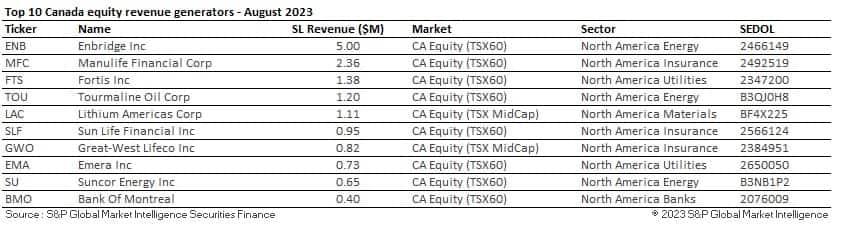

In Canada, the top ten revenue generating stocks accounting for $14.6M in revenues during the month, approximately 49% of the monthly revenues, with seasonal activity increasing borrowing demand in most of the names.

Economic activity within China dominated the headlines during the month as weaker than expected economic data continued to show softness in the economy. Deflation within the country is adding pressure to policy makers to set up monetary and fiscal support even as signs that the decline is temporary may limit any stimulus. Meanwhile the economic situation in Japan continues to improve with the country posting a 6% increase in GDP for the second quarter of the year. The TOPIX posted a gain of 0.41% over the month which proved relatively resilient when compared with other regional equity markets, as the MSCI Asia ex-Japan fell by 6.41%.

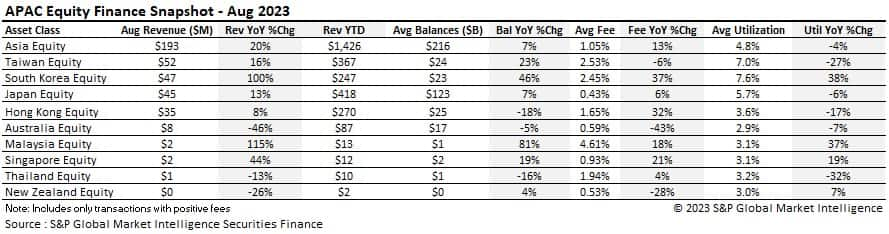

Asian equities generated $193M in revenues during the month of August. This represents an increase of 21% YoY but a slight decrease of 1% MoM ($195M). Asia bucked the trend over the month with an increase in balances of 7% YoY and 5% MoM. Whilst the largest increases could be seen in South Korea (+46%), Malaysia (+81%) and Taiwan (+23%), most markets across the region experienced an increase in value on loan. The increases seen in loan balances across both South Korea and Malaysia subsequently led to YTD highs in terms of revenues.

Taiwan generated $52M in revenues during the month continuing the trend seen since June of increasing revenues and balances YoY. Average fees in the market have decreased MoM (-5%) and YoY (-6%), possibly due to greater availability of stock, as lendable has increased by approximately 65% since January.

Demand for South Korean equities also strengthened over the month with both revenues and average fees hitting YTD highs. Average fees of 245bps in the country are the highest since January 2022 (248bps). As in Taiwan, loan balances have increased rapidly over the year, starting 2023 at $7.6B and reaching $22.6B during August. Lendable supply has increased only slightly however from $156B in Jan to $167B in August, depicting a market of strengthen borrowing demand. Utilization (7.65%) is now sitting at the highest seen for many years.

In Hong Kong, average fees also hit a YTD high, reaching 165bps during August. Again, this is the highest level seen for many years. Average fees have been driving revenues higher in the market as both balances and lendable have suffered declines over the year.

In Japan, securities finance revenues remained robust, posting a 13% increase YoY. Average fees declined by 10bps during the month from 53bps during July to 43bps during August. Despite this decline, when compared YoY, average fees remained strong showing a 5% increase. Revenues and average fees increased significantly towards the end of the month as the value on loan started to increase. Utilization in the market reached 5.75% which is the highest level since April (6.91%).

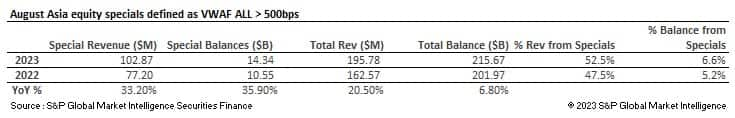

Specials activity across Asia increased by 33% YoY with $102M being generated. YTD $671M of specials revenues have been generated which is 5% higher than at the same point during 2022. August was the highest specials revenues generating month of the year so far, accounting for 53% of all revenues from circa 6.6% of all balances. Specials balances for August increased 3% YoY.

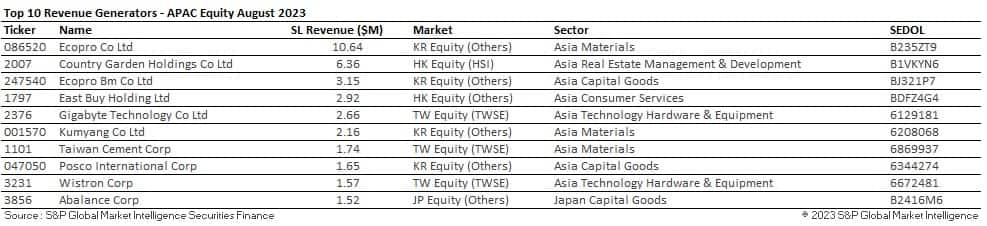

The South Korean stock Ecopro Co Ltd (086520) continued to dominate the top ten revenue table throughout the month. YTD this stock has generated more than $34M with August the highest revenue generating month YTD.

Country Garden Holdings Co Ltd (2007) made a reappearance in the table during the month as the company faced liquidity issues. The delay in the payment of bond interest coupons and the continued downturn in the Chinese property market continues to affect the company's performance.

Taiwanese stocks featured heavily within the top ten table during the month. Gigabyte Technology Co Ltd (2376) paid a dividend at the beginning of the month, Taiwan Cement Corp (1101) has been affected by the slowdown in the property sector in mainland China and Wistron Corp (3231) continues to be affected by US technology sanctions.

Across Europe, equity markets posted negative returns over the month with the MSCI Europe ex-UK declining 2.2% and the UK FTSE All-share index falling by 2.5%. European equity markets were pulled lower during the month by the Italian government's announcement of an additional tax on banks "excess" profits and softening economic data. In the UK, data showing a fall in retail sales during the month and slower than expected business activity weighed upon the index.

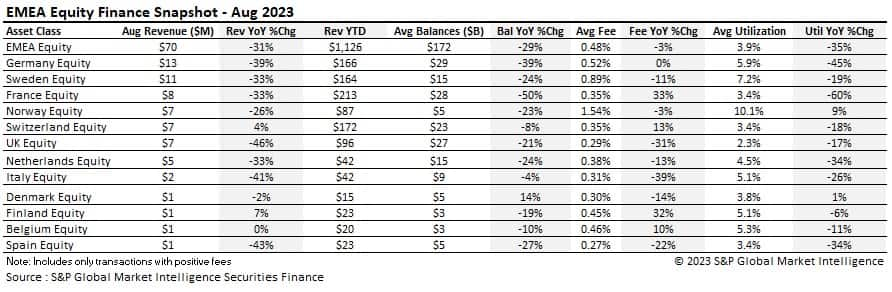

EMEA equities generated $70M in securities finance revenues during the month. This represents a decline of 31% YoY and 12% MoM making August the lowest revenue generating month of the year for the asset class and the lowest monthly revenues since before 2020. Despite this, when comparing revenues YTD, EMEA equity revenues are still outperforming 2022 (+7%), 2021 (+12%) and 2020 (+12%).

All markets suffered a decline in revenues (YoY) with only Finland and Switzerland posting gains. Average fees, balances and lendable all declined MoM. Balances declined across all markets leading to the lowest on loan level across EMEA equities since January 2020. YoY Balances were 29% lower, whilst lendable increased 7% (YoY). This subsequently led to utilization falling to 3.87%, its lowest level since September 2021 (3.79%).

Germany posted the highest revenues during the month despite these being the lowest of 2023 so far. Revenues declined steadily during the month despite average fees remaining flat on those seen during August 2022. As with all the EMEA markets, a drop off in balances pushed both revenues and utilization lower over the month.

Sweden continued to impose itself towards the top revenue generating countries for the month. A few specials in the country continue to support stronger revenues across the market. Both revenues and utilization increased MoM as the lendable declined in value. This was also supportive of revenues.

Revenues across the UK continue to disappoint following on from a relatively strong start to the year. The UK posted its lowest monthly revenues and average fee since pre-2020 during the month despite only a modest decline in utilization MoM (-7%). As with many European markets, the strongest revenues appear to have been during the first quarter of the year and have been in decline ever since. Average fees are in decline and the number of specials is falling.

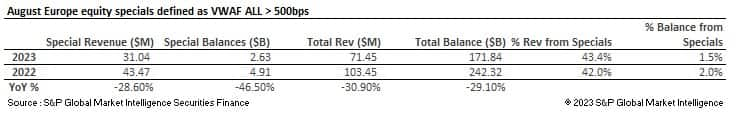

Specials activity across Europe also hit a year low during the month. $31M of specials revenues were generated from approximately 1.5% of all on loan balances. YTD specials have generated $348.3M which is an increase of 14% YoY and the highest YTD total since this metric started to be tracked in 2008.

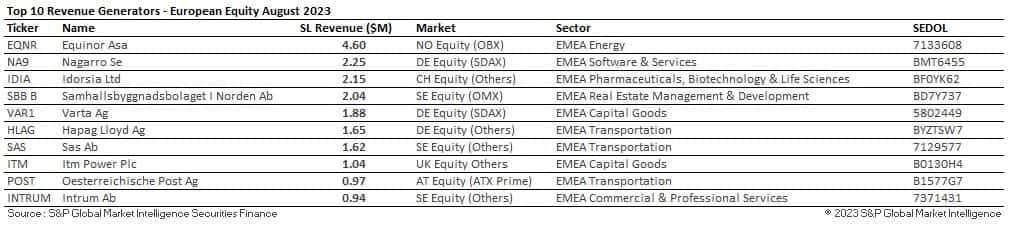

Over the month the top ten highest revenue generating stocks generated $19.14M which accounts for approximately 27% of the total revenues. The highest revenue generating stock over the month was the Norwegian energy producer, Equinor Asa (EQNR) which generated $4.6M. The company paid a dividend during the month.

Nagarro (NA9) was a new edition to the table during the month. This stock issued a profit downgrade during August which sent its stock price lower, experiencing a decline of circa 65% from its all-time highs at the end of 2021.

Hapag Lloyd AG (HLAG) also joined the top ten during the month. Shipping rates have recently fallen back down to 2019 levels following a sharp increase during the pandemic. Shipping company shares have fallen as a result and with ongoing talk of a global recession due to the steep increases in interest rates, shipping company share prices are expected to fall further as profit margins contract. Hapag Lloyd's share price declined approximately 10% during the month of August.

In the UK ITM Power Plc (ITM) a London AIM listed stock was heavily borrowed as the company's full year pre-tax loss widened and revenues continued to fall.

Securities lending revenues across ADRs fell to $18.8M during the month of August. This represents a decline of 53% YoY and 2% MoM. August also represents the lowest monthly revenues for the asset class YTD. Average fees remained steady at 82bps over the month along with balances and utilization. Average lendable and balances remained steady over the month.

Naas Technology (NAAS) appeared in the top revenue generating table for the first time this month. Naas Technology provides electric vehicle charging services in China and recently reported a $40M private placement of a convertible note.

Ehang Holdings ADR (EH) remained a popular borrow during the month. Ehang is an aerospace company focused on autonomous aerial vehicles, including some big enough to transport passengers around cities. It is one of several so-called "flying taxi" start-ups competing for investor attention. The company has made progress working toward regulatory certification in China and has been running trials of its passenger craft. Despite its progress to date, investors remain aware of the fact that the company represents emerging technology, and being currently priced at circa 120 times earnings, a lot of future, potential growth is priced into its share price.

AMTD Digital (HKD) became a popular borrow throughout the month as the company's share price increased by more than 40% during the month, reaching its highest valuation since April before retreating before the close of trading. The company announced news of a share buyback scheme worth $30M.

Data shared during the month of August reported that global assets within ETFs hit a record $10.9T during the month of July. Throughout the month of August, the largest asset flows were seen heading into large cap Chinese equity funds with the financial press reporting that the large inflows could be related to state activity looking to support the stock market and provide stimulus / momentum to halt falling share prices. Many investors were also looking to invest in 20+ year Treasury funds as the slowdown in the US economy is giving more confidence to those who believe that the Fed has finished raising rates. If this is the case and rate expectations do start to fall, those bonds with the longest duration will benefit the most from any reduction in rates.

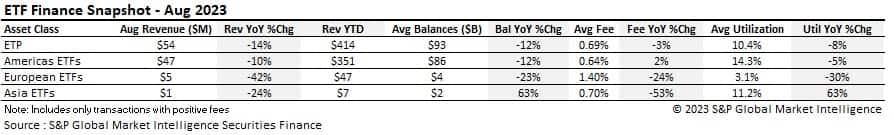

Securities lending revenues continued to decline across the ETF market, with all asset classes seeing a reduction in revenues when compared YoY. Revenues have declined during every month of 2023 so far with YTD revenues 30% lower than at the same point during 2022.

Americas ETFs experienced a slight increase in revenues during August when compared with the previous two months (July $35M, June $37M). Average fees also increased in comparison to previous months reaching 64bps which is their highest level since March (70bps). Balances increased over the month helping utilization to increase to 14.3%.

Despite experiencing a decline of 41% YoY, European ETF revenues were in line with previous months of 2023. Average fees fell to 140bps which is the lowest level for the year so far. Balances also declined by 27% YoY and 2% MoM.

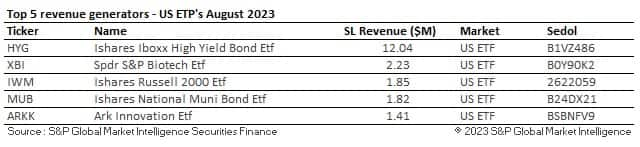

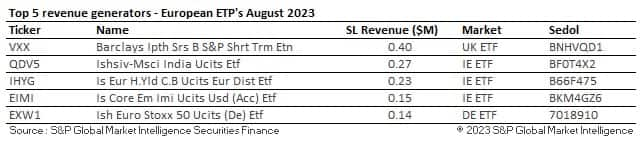

In the US HYG was the highest revenue generating stock. This ETF continues to provide strong revenues for lenders and has generated $41.2M YTD. August was the highest revenue generating month for this stock.

Across Europe, the Barclays S&P 500 VIX short-term futures ETF was the highest revenue generating ETF. Shorting the VXX has been a popular strategy for many years but the 100% hike in the VIX during February 2018 made investors far more cautious. Other popular borrows included the iShares MSCI India ETF, the iShares EUR High Yield and the iShares Euro Stoxx 50.

As during all the previous months of the year, investors remained focussed on the ability of central banks to manage inflation whilst preventing a decline in economic activity. Across the Eurozone inflation declined during the month but core inflation remained unchanged which continued to pose a challenge to the European Central Bank's rate hike strategy.

In the UK, the Bank of England increased interest rates by 25bps to 5.25%, the highest level in 15 years. The central bank's Monetary Policy Committee also noted that "it was too early to conclude that the economy was at or very close to a significant turning point".

In Japan, the changes to the Bank of Japan's yield curve controls tempted asset managers into thinking that the central bank will start to move on from its longstanding ultra-loose monetary policy. Firms have been ether ramping up on bearish bets on Japanese government debt or betting that the Yen will strengthen as a result. During the month, the central bank also announced an unscheduled bond purchase program.

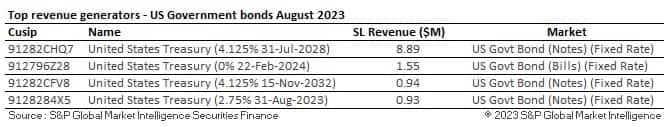

In the US, US treasuries were stripped of their AAA rating during the month based upon the country's ballooning fiscal deficits and an "erosion of governance" that has led to repeated debt ceiling clashes over the last few years. The decision led to a shrinking club of AAA rated debt - now mainly including Singapore and Norway. The treasury also announced the sale of $103B of long-term securities during the month which was more than dealers had anticipated which pushed yields higher as demand concerns weighed on bond prices as the Treasury market swelled to $25.14T.

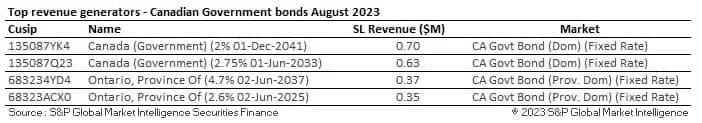

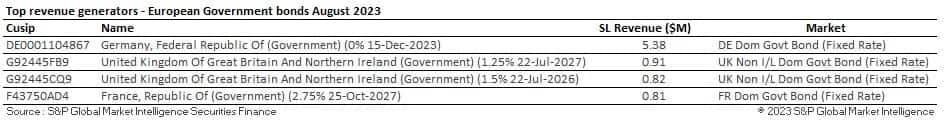

In the securities lending markets government bonds continued to produce strong returns for lenders. Securities lending revenues for government bonds reached $161M marking an increase of 5% YoY and 5% MoM. Average fees increased back up to 18bps (+12% YoY) from the 17bps seen during July. Balances increased MoM whilst lendable remained flat, pushing utilization back above the 20% mark.

As has been the case for many months, short-dated government bonds remain the most popular amongst borrowers.

During the month of August, CDS spreads across the ITraxx Europe, CDX North American Investment Grade, the ITraxx Xover and the CDX-North American high yield indices all continued their recent rally, trading at lows relative to the last twelve months. Despite a circa 7% decline in US company earnings for the second quarter and a downturn in expectations for the third and fourth quarter, credit investors remain optimistic that the US and many European countries will achieve a soft landing. Concerns regarding credit deterioration continue to fall and investors seem to be comfortable investing in investment and non-investment grade risk. High Yield debt sales increased the most in more than a decade according to the final press with US companies having sold $55B of high yield bonds so far this year.

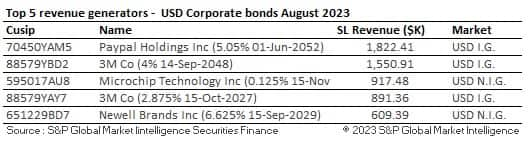

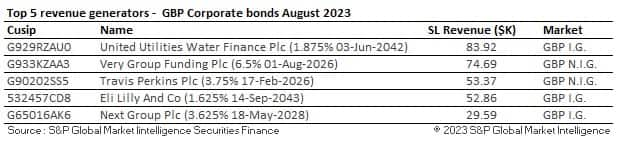

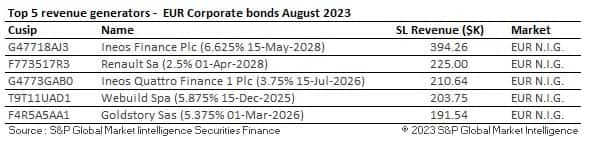

In the securities lending markets corporate bonds remain in demand. $94M was generated through the lending of corporate bonds during August, representing an increase of 9% YoY but a slight decrease of 4% MoM. Average fees declined to their lowest level of the year so far during August, 42bps, marking their lowest level since October 2022. Balances decreased both YoY (-4%) and MoM (-2%) pushing utilization to its lowest point since February 2022.

During the month non-investment Grade corporate bonds continued to dominate the highest revenue generator tables across all currencies.

Securities finance revenues remained robust throughout the month. Revenues rebounded across the APAC region with Taiwan, South Korea and Japan posting strong revenues for the month. Across the US, specials activity continued to be a strong driver of revenues as corporate activity continued to offer arbitrage opportunities to borrowers. Demand and revenues remained weak across EMEA equities however with August seeing a low point for borrowing activity within the region. Across the fixed income markets both revenues and demand remained strong.

Throughout the month the ongoing trend of higher fees and lower balances continued to strengthen. This puts lenders in a strong position heading into the last four months of the year as market participants continue to focus upon risk adjusted returns.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.