Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Aug 16, 2023

By Matt Chessum

On July 24th, Johnson & Johnson (JNJ) announced its intention to split off 80.01% of the shares that were recently issued during the IPO of Kenvue Inc (KVUE), through an exchange offer. According to the company's website, "through the planned exchange offer Johnson & Johnson shareholders can exchange all, some or none of their shares of Johnson & Johnson common stock for shares of Kenvue Inc common stock, subject to the terms of the offer".

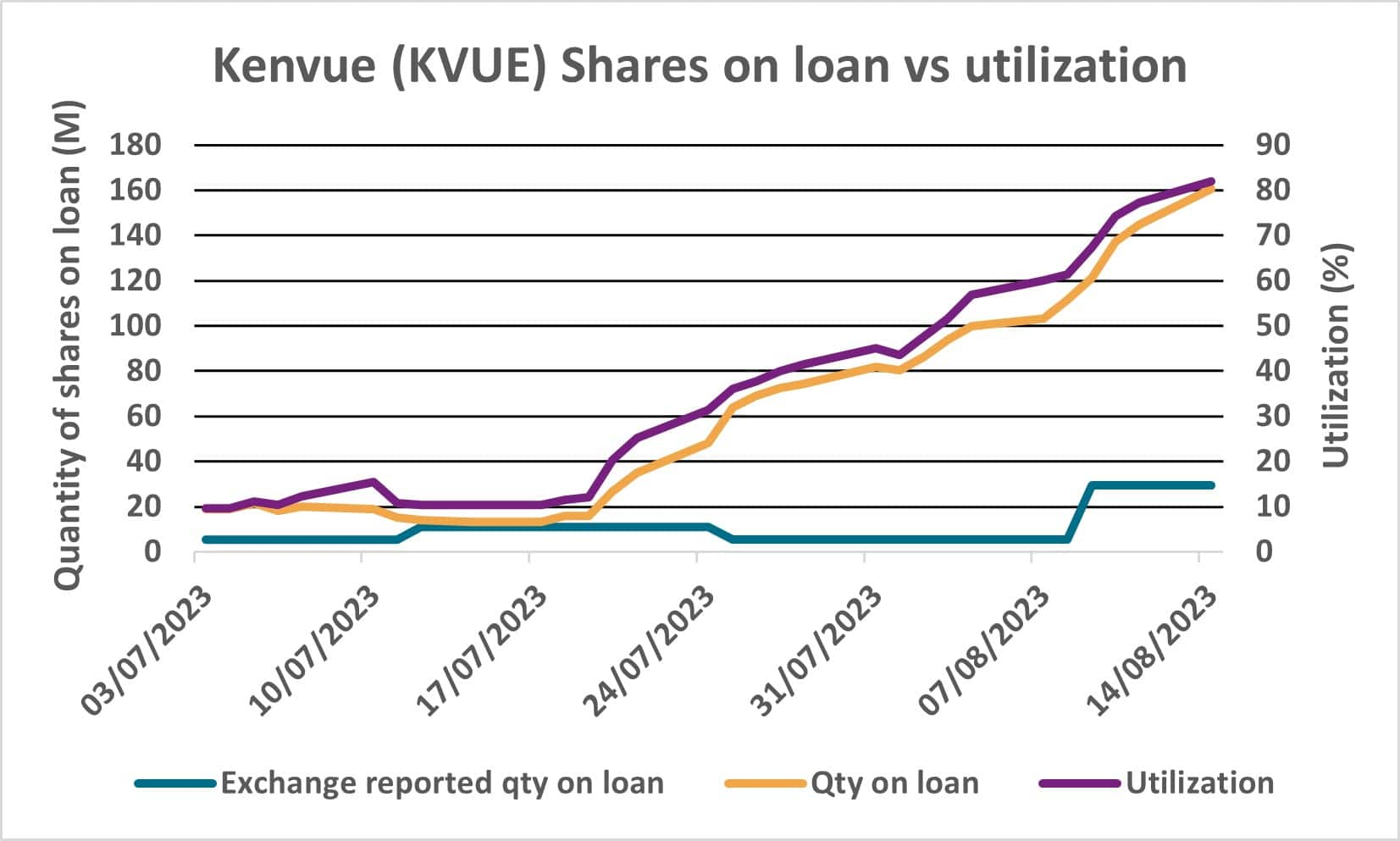

Since the offer allows holders of Johnson & Johnson shareholders to exchange their shares for common stock of Kenvue Inc at a 7% discount, an arbitrage opportunity has presented itself between the two lines of stock, sending both demand to borrow, utilization and securities lending fees increasingly higher over the last few weeks.

The discount offered through the share exchange allows market participants to borrow Kenvue Inc shares, sell them short in the cash market, tender their Johnson & Johnson shares, receive the 7% discount, and generate additional income. As borrowing fees increase and stock on loan becomes harder to source however, potential profits may be impacted.

For more information on how to access this data set, please contact the sales team at: Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.