Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 13, 2018

Regulatory changes will shape Latvian banking sector

On 23 February 2018, in light of significant liquidity strains, the European Central Bank (ECB) and the European Single Resolution Mechanism declared ABLV Bank, formerly Latvia's third-largest bank with a 13% market share in terms of assets, "failing or likely to fail" and ordered its closure. The Latvian bank's ability to meet its financial obligations was significantly compromised after it suffered large deposit withdrawals prompted by the US Department of the Treasury's allegations on 13 February that the bank was facilitating a breach of US sanctions against North Korea through largescale money-laundering operations. ABLV Bank has denied these allegations. Money-laundering allegations against ABLV Bank along with separate bribery allegations against the governor of the central bank, Ilmārs Rimšēvičs, has triggered a regulatory overhaul in Latvia. These regulatory reforms are expected to change the structural profile of the banking sector. Non-resident-focused banks, smaller commercial and private banks servicing mainly non-resident customers, will have to shift strategy and implement new business models, encouraging banking sector consolidation.

Non-resident deposit outflows are expected to continue

in the near term

In April 2018, Latvia undertook a first initiative towards

tightening the country's Anti-Money Laundering/Combating the

Financing of Terrorism (AML/CFT) regulatory framework when

Parliament adopted a law forbidding banks from servicing shell

companies, which are believed to be used primarily for money

laundering purposes. The bill, gave banks 60 days from 9 May to

break their current business ties with such companies. It is likely

that these companies rushed to retrieve their funds from the

Latvian banking sector, upon threats that they would be blocked and

their withdrawal subject to regulatory checks following the end of

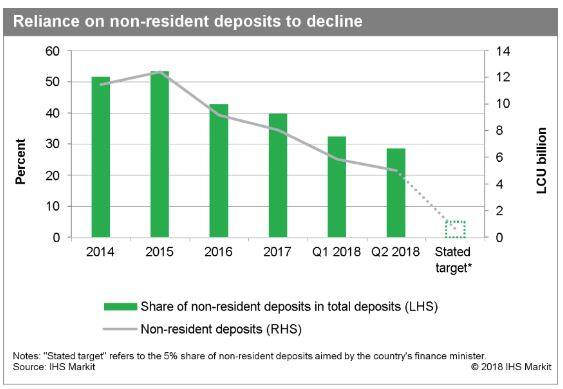

the transition period. Non-resident deposits declined by almost 38%

in the first half of 2018, driving the total deposit base down by

around 14%.

Further initiatives to reduce the sector's reliance on non-resident deposits are expected in the near term. Latvian Finance Minister Dana Reizniece-Ozola has publicly stated a goal of reducing the share of non-resident deposits to just 5% of total deposits, from almost 29% in June 2018 and 40% in 2017. Reaching this target would imply additional deposit outflows totaling EUR4.3 million, equivalent to one-fourth of the sector's total deposit base as of mid-2018, assuming a stable domestic deposit base.

Although significant for the sector as a whole,

non-resident-focused banks are likely to suffer the most, in some

cases threatening their financial stability and longer-term

viability. However, banks known for their domestic focus are

unlikely to suffer deposit outflows. In fact, resident-focused

banks could even be viewed as safe havens given their very small

reliance on non-resident deposits. The resilience of the largest

banks significantly mitigates potential spill-overs to the entire

banking sector.

Outflows of non-resident deposits are expected to

reshape the liquidity and structural profiles of the Latvian

banking sector

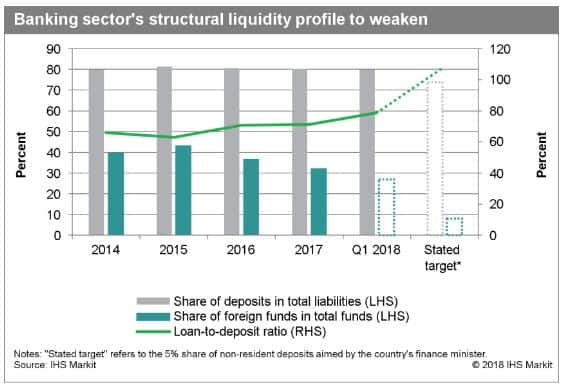

Reducing the share of non-resident deposits in total deposits to

the authorities' 5% target would imply an additional 26% decline in

total deposits, assuming stable resident deposits, significantly

stretching banks' structural liquidity position. According to our

calculations, all else being equal, the share of deposits in total

liabilities would decline from 80% in 2017 to 72%. The

loan-to-deposit ratio would increase from 79% in March 2018 to

110%, after already increasing by almost 8 percentage points in the

first quarter of the year.

It is likely that the gap between the large resident-focused banks' and non-resident-focused institutions' structural liquidity profile will deepen. Members in the former group are likely to be viewed as safe havens by domestic depositors, strengthening their deposit base and their structural liquidity position. Among these are the country's three largest banks - Swedbank, SEB banka, and Luminor Bank - which jointly hold 48% of assets and 54% of deposits. However, smaller, non-resident-focused banks are likely to experience sharp asset deleveraging as liquidity conditions tighten and will be forced to revise their business model as it becomes obsolete. Ten banks report more than half of their deposits are foreign, including six banks with more than 86% of their deposits coming from non-residents. These 10 institutions represent 30% of banking sector assets in aggregate and hold around 90% of total foreign deposits according to IHS Markit calculations. The regulatory initiatives to reduce reliance on non-resident deposits is likely to undermine these banks' ability to operate under their current business models.

Non-resident-focused banks submitted to the regulator (Financial and Capital Market Commission: FCMC) strategic plans to pursue their activities without reliance on shell companies for funding and, to a larger extent, non-resident deposits. Such plans likely involve an activity shift towards commercial banking activities and funding shifts towards domestic depositors. As banks' business models become more homogeneous towards traditional commercial banking activities, competitive pressure and increased cost structure most likely will force consolidation of players. Non-resident-focused banks could merge with peers, turn into non-bank financial institutions, or relocate to a formal offshore banking sector, for example.

Latvia likely to continue efforts to strengthen its

regulatory framework and enhance supervision, but initiatives at

the Eurozone also needed

Following recent initiatives targeting banking operations with

shell companies, we expect significant additional tightening of the

Latvian AML/CFT framework in the near term. The parliamentary

majority led by the center-left Union of Greens and Farmers (ZZS)

is likely to adopt amendments aimed at tightening banking

regulation. There is a relatively broad consensus within Latvia on

the need to comply with international anti-money-laundering

standards in light of the US Treasury Department's allegations

against ABLV Bank from February. The financial regulators, the

ministry of finance, the Association of Latvian Commercial Banks,

and experts from the non-profit sector have proposed more than 20

measures aimed at enhancing the stability of Latvia's banking

sector. Among others, these include measures to enhance

information-sharing among financial institutions and between

financial institutions and authorities. These initiatives also will

support a stronger supervisory framework.

Given the cross-border aspect of money-laundering operations, it is likely that European authorities will need to harmonize the AML/CFT framework across European Union countries, or at least the Eurozone, and increase communication and cooperation among local regulators and the ECB.

Outlook and implications

The expected regulatory overhaul and change in the banking sector's

structural profile will help to rebuild trust in Latvian banks,

after it has been severely hurt by the ABLV Bank case. While these

efforts come at an economic cost - the International Monetary Fund

has estimated that the outflows of non-resident deposits will cost

Latvia between 0.5% and 1.0% of its GDP growth per year - reforms

most likely will have long-term positive effects on the country and

its banks' reputations. Wider efforts to rebuild trust in the

European Union's banking sector also will be needed as the ABLV

Bank case has revealed several regulatory and supervisory

loopholes. In particular, recent events have highlighted

discrepancies in the repartition of powers between European and

local regulators, which will need to be tackled to ensure the

stability of the European banking sector and the sustainability of

a banking union.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-changes-will-shape-latvian-banking-sector-81318.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-changes-will-shape-latvian-banking-sector-81318.html&text=Regulatory+changes+will+shape+Latvian+banking+sector+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-changes-will-shape-latvian-banking-sector-81318.html","enabled":true},{"name":"email","url":"?subject=Regulatory changes will shape Latvian banking sector | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-changes-will-shape-latvian-banking-sector-81318.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Regulatory+changes+will+shape+Latvian+banking+sector+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fregulatory-changes-will-shape-latvian-banking-sector-81318.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}