Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 15, 2018

Canadian FTAs help boost trade

- Canada trades predominantly with the United States. But Canada has effectively established strong trade relationship with the rest of world, having 12 free-trade agreements (FTA).

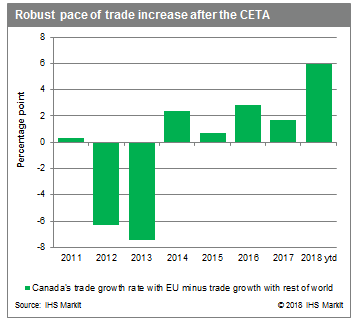

- Canada's trade with the European Union substantially jumped at three times as fast as total non-EU trade growth since the FTA.

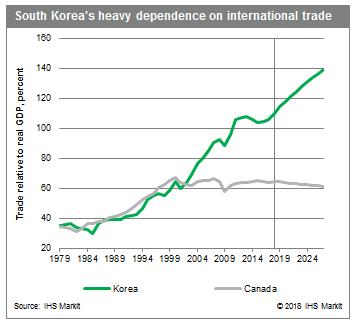

- Given the South Korean economy's high dependence on international trade including natural resources, Canada's natural resource trade will rise further with the FTA.

Strong boost in bilateral trade after CETA

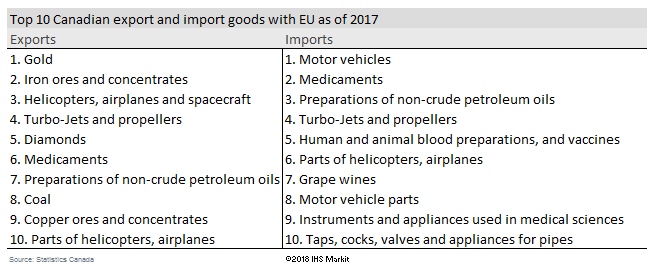

CETA is the most recently enforced FTA (starting in September 2017) and the second-biggest FTA following NAFTA, as Canadian trade with the European Union is 8.9% of Canadian total trade, as of 2017. Typically, gold is Canada's single largest export good to the European Union. Gold exports to the United Kingdom accounts for more than 30% of all Canadian goods imported by the European Union; in the United Kingdom, Canadian gold is used for investment purposes on the London exchange and for jewelry. Other than gold, the most popular goods exported to the European Union are iron ores and concentrates (5%) and helicopters, airplanes, and spacecraft (5%). On the other hand, imports of EU goods into Canada are relatively varied.

In the early stages of CETA negotiation, a joint study by the European Commission and the Government of Canada reported that CETA could increase bilateral trade by 20%. After CETA was enforced late last year, total trade for both parties substantially increased, supporting the joint Canada-EU study. For 2018 year-to-date (January to June 2018), Canadian total trade growth with the European Union, up 9.1% year on year (y/y), was approximately three times as fast as total non-EU trade growth (up 3.2% y/y). Reflecting Canada's solid domestic demand, Canadian imports from the European Union surged 11.8% y/y while exports to the European Union jumped 5.0% y/y. The value of imports rose solidly in most goods categories while significant hikes were led by tanks and parts, pharmaceutical products, crude oil products, and motor vehicles. Similarly, the overall export gain was mainly due to the surge in oil products and passenger motor vehicles. As of the start of 2018, the United Kingdom sharply increased its imports of crude. Portugal imported Canadian oil for the first time this year and the Netherlands, France, and Ireland imported Canadian oil again after a long break.

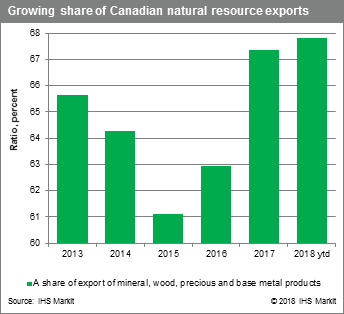

Canada's natural resource trade is expected to rise further with CKFTA

South Korea's economy is lacking natural resources and heavily dependent on international trade as the shares of South Korea's real exports and imports relative to real GDP were relatively high at 54% and 52% in 2017. As such it is befitting that Canada is tapped as a supply of natural resources. This is well reflected in South Korea's top imported goods from Canada in 2017, namely coal and solid fuels, which accounted for 25% of total Canadian exports to South Korea; copper ore (14%); iron ores (7%); unwrought aluminum (5%); and wood pulp (4%). Meanwhile, South Korean passenger vehicles were the top Canadian import, followed by preparations of non-crude petroleum oils, motor vehicle parts, and telephones.

Since CKFTA came into force, Canadian coal exports to South Korea have jumped 61.2% along with unwrought aluminum, copper, and iron ores. South Korea is not yet importing oil from Canada. But South Korean oil refinery companies interested in diversifying their oil suppliers are likely to look to Canada. Internal tests by South Korean refinery companies indicating superior quality of Canadian oils point to huge potential for Canadian oil industry growth in South Korea.

Another notable increase since CKFTA is in aerospace likely because of South Korea's new aircraft programs, which include the South Korean fighter aircraft, the light armed helicopter, and the light civil helicopter. In addition, given strong South Korean demand for seafood, Canadian exports of crustaceans, largely lobsters, surged 211% from 2014 to CAD96.4 million in 2017.

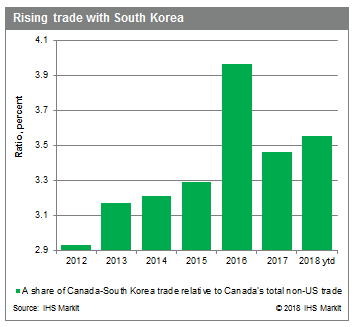

Overall, the share of Canada-Korea trade value to total non-US trade value has trended higher, benefiting both parties as the Canada-Korea trade value surged 22.7% as of 2017 while the trade value with the rest of world has advanced 6.5% since CKFTA.

Conclusion

Canada has built firm trade relationships with the European Union and South Korea through CETA and CKFTA as the value of trade for both parties to the FTAs substantially jumped. As more trade opportunities are anticipated in the short term given the solid economic outlook in the European Union and South Korea, CETA and CKFTA will help further boost Canadian trade. In addition, Canada signed the CPTPP, which will connect Canada with 10 more countries in the Asia-Pacific region. Increased market access to this diverse group of economies will further increase Canadian trade in the long term and proportionally reduce reliance on trade with the United States.

Want more on trade war implications? Read our ongoing analysis

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcanadian-ftas-help-boost-trade-81518.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcanadian-ftas-help-boost-trade-81518.html&text=Canadian+FTAs+help+boost+trade+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcanadian-ftas-help-boost-trade-81518.html","enabled":true},{"name":"email","url":"?subject=Canadian FTAs help boost trade | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcanadian-ftas-help-boost-trade-81518.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Canadian+FTAs+help+boost+trade+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcanadian-ftas-help-boost-trade-81518.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}