Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 27, 2018

Latin American lithium promotion

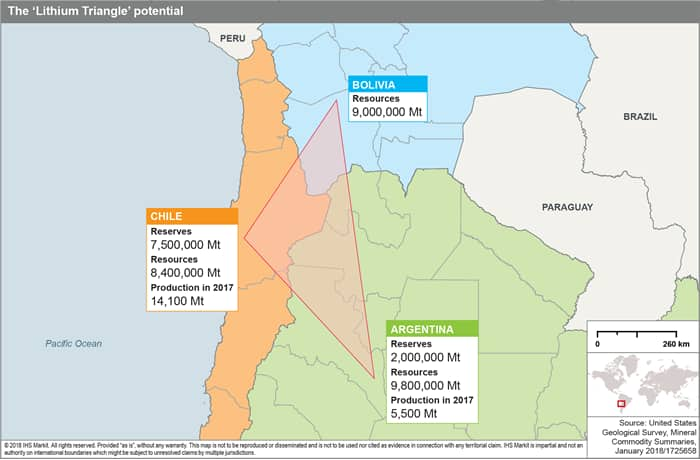

The three countries that form the 'Lithium Triangle' - as they contain 80% of the world's brine lithium - are likely to promote pro-business regulation and favourable contract terms to develop the emergent sector, following increasing global demand and rising prices of the mineral.

- Chile is making efforts to increase competition in the sector, but the classification of lithium as a strategic mineral poses a regulatory barrier.

- Argentina's government is seeking to attract investment into the mining sector, but delays in approving a new framework that standardises policies across provinces and caps royalties is likely to slow down projects.

- Bolivia's government will seek to promote the industry via public-private partnerships, but the government's reluctance to allow foreign companies to exploit natural resources is likely to continue hindering lithium development

The lithium sector has in recent years been prioritised by miners and governments on the back of a rise in lithium carbonate prices (reaching USD13,000 per tonne in 2017), and increasing demand for the mineral, which is used in electric vehicles' batteries. Northwest Argentina, western Bolivia, and northern Chile form the 'Lithium Triangle', holding the largest lithium reserves in the world; 80% of brine lithium is believed to be located there, and the three countries are likely to introduce pro-business regulations and favourable contract terms to promote investment.

Chile's lack of clarity in the terms of contracts has hindered entry of new investors

Chile is the second world's largest lithium producer behind Australia, with most of the country's reserves located in the Atacama salt-lake. The size and climatic conditions of this site give it the potential to be the most competitive place in the world to produce lithium, according to IHS Markit sources. Chile, as the world's largest copper producer, already has a developed mining industry and its related infrastructure can also be used by lithium operators. However, as lithium is considered a strategic mineral under Chilean law, concessions are not allowed, which means that only the state, state-owned companies, or private companies operating under partnerships with the Chilean Production Development Corporation (CORFO) can develop the mineral. There are currently two private operators, the United States' Albemarle and Chile's SQM, but the expansion of production has been limited by the state's quotas. However, over the past 12 months CORFO signed new contracts with both companies, increasing their production quotas in exchange for higher royalties and investment in research and development. The new contracts include a sliding royalty of up to 40% of the value of lithium sales when prices exceed USD10,000 per tonne; requirements to invest in environmental protection, local communities, and the research and development of lithium-related technologies; and a requirement to process 25% of output in Chile.

Previous governments have sought to implement Special Lithium Operating Contracts (Contrato Especial de Operación de Litio: CEOL), which allow companies to explore and exploit a set quota of lithium, with the aim of expanding the sector and bringing more competition. However, uncertainties with respect to how they will work have hindered their use. Legal uncertainty has been exacerbated by the fact that new President Sebastián Piñera (who took office in March 2018) has yet to set a clear stance on lithium development, although he is likely to promote private investment.

Argentina offers lower regulatory barriers as it treats lithium like all other minerals

President Mauricio Macri is keen to attract foreign investment to Argentina's mining sector and develop the lithium industry. Macri has opened the economy by reducing import tariffs, removing currency controls, and eliminating a tax for minerals exports. Argentina's Mining Code offers favourable terms to investors, such as permitting an accelerated depreciation schedule for capital investments, and treats lithium like any other mineral, avoiding additional regulatory barriers like those seen in Chile. In mid-2017, Macri signed a deal with 20 out of 23 provincial governors for a new mining framework that would harmonise mining policies between provinces and cap royalties at 3%, to provide more certainties to investors. The bill has yet to be approved by each of the signatory provincial legislatures and the Federal Congress, likely delaying new projects until after 2018.

A major challenge for Argentina's mining sector traditionally has been opposition by provinces; some of them setting their own barriers, such as bans on open-pit mining or the use of chemicals. However, Catamarca, Jujuy, and Salta, where salt-lakes with lithium resources are located, are pro-mining because of the importance of the sector to their local economies, mitigating risks of local-level regulatory barriers.

Bolivian government's efforts to develop lithium on its own has prevented deals with foreign investors

Bolivia is believed to have 9 million tonnes of lithium resources, but is not yet a major actor in the global market of lithium. The government of President Evo Morales, ideologically opposed to allowing private investment in national resources, has sought to produce lithium on its own. This has prevented any major deal with foreign investors, hindering the development of the country's lithium potential, as the state lacks the required capacity and funds to do so.

The government is now encouraging private investment via public-private partnerships (PPPs); authorised in a January 2018 decree. The specific terms of the PPPs are undetermined, but they will include the requirement for private partners to provide a similar investment to that of the Bolivian state, and guarantee access to advanced technology.

Another challenge facing Bolivia is that almost all the resources are in Uyuni, the world's largest salt-lake, but are less profitable than in Argentina and Chile because the lithium content is relatively low, and the wetter weather means slower evaporation rates, increasing costs.

Outlook and implications

Increasing global demand for lithium, as well as rising prices, are likely to push the three countries to improve the regulatory framework for the sector, with the aim of facilitating investment and opening the market to more players. Examples are CEOLs in Chile, PPPs in Bolivia, and a new mining framework proposal in Argentina. However, legal challenges in the one-year outlook include that there is not yet a clear regulatory framework in any of these countries, considering that lithium development is an emerging sector. In addition, government changes - elections are scheduled in Argentina and Bolivia in 2019 and a new government took office in Chile in March 2018 - increase the risk of policy instability and legal uncertainties, likely delaying projects in the one-year outlook, until when a more solid framework will probably be established.

New contracts (such as CEOLs in Chile or PPPs in Bolivia) will be indicators of the governments' approach to lithium development, in terms of royalties and requirements for companies to operate and compete, and the level of state involvement in the projects. Any legal cases filed by local communities against lithium projects will be an indicator of potential community unrest. In February 2018, local communities in Chile's Atacama region filed a lawsuit to invalidate an agreement between state-owned mining company Codelco and SQM for environmental reasons. Although lithium exploitation is not as invasive as other type of mining, there will still be environmental challenges, as the brine process of producing lithium involves extracting large quantities of water from the salt-lakes, and the creation of large evaporation pools can also affect the fauna.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-american-lithium-promotion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-american-lithium-promotion.html&text=Latin+American+lithium+promotion+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-american-lithium-promotion.html","enabled":true},{"name":"email","url":"?subject=Latin American lithium promotion | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-american-lithium-promotion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Latin+American+lithium+promotion+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2flatin-american-lithium-promotion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}