Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 24, 2020

Eurozone deflation worries to persist

- IHS Markit monitors various inflation metrics to better gauge the risk of deflation.

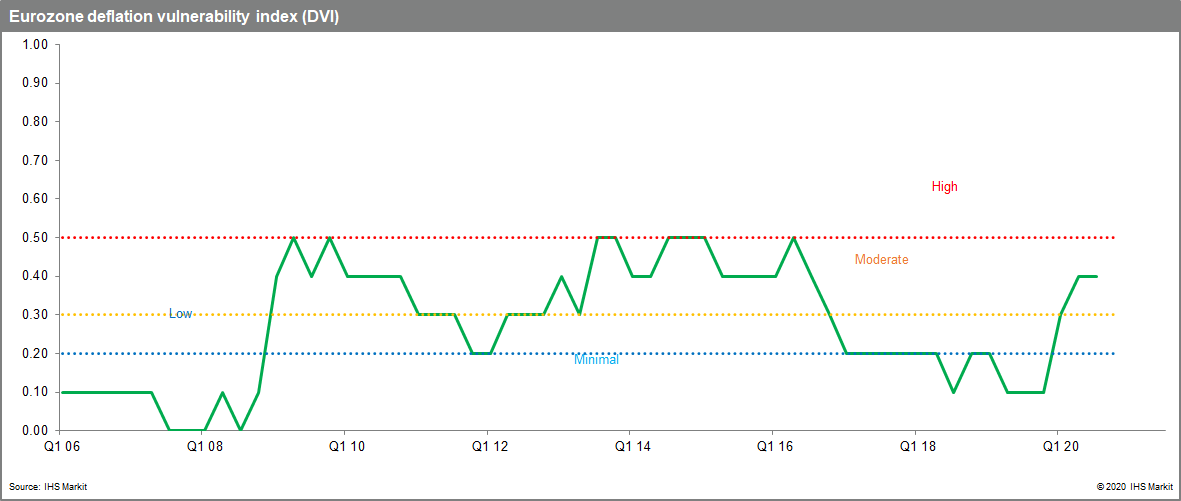

- The deflationary vulnerability index for the eurozone rose markedly in the first half of 2020, following the pattern of previous adverse shocks like the GFC.

- While the index held steady in Q3, further increases are likely.

- The ECB is stepping up its policy stimulus but the cavalry may be arriving too late.

What is deflation and why is it such a problem?

Deflation can be defined as a sustained decline in the general level of prices. This is different to a temporarily negative consumer price inflation rate due, for example, to a drop in crude oil prices (though this is often described as deflation).

Deflationary episodes have been comparatively rare in modern times but as Japan's experience highlights, it can be very difficult to extricate an economy from deflation once it has set in, with long-lasting consequences. A prime concern is that a deflationary spiral may result, exacerbated by high levels of debt (which rise in real terms during deflation) and negative feedback loops between the financial sector and the economy

Eurozone vulnerability reflects range of factors

We have previously highlighted our concern over the

vulnerability of the eurozone to deflation and its potentially

pernicious consequences. This vulnerability reflects a range of

factors including persistent low inflation expectations, prior

policy errors and a series of adverse economic shocks, including

the most recent, the COVID-19 pandemic.

Given its potential significance, we created a Deflation

Vulnerability Index (DVI) to monitor the risk, based around a

series of economic and financial indicators. The methodology

divides the DVI readings into four categories of risk: minimal,

low, moderate and high.

The eurozone DVI rose markedly over the first half of 2020, to its highest level since 2016, though it remained below its historic peaks and within the "moderate risk" category.

The key factors generating the increase in deflation vulnerability were the plunge in the HICP inflation rate and collapsing GDP, which led to a surge in the output gap. These factors continued to contribute to the DVI in Q3 2020, though as there were no additional contributions, the index remained unchanged.

Vulnerability index set to rise further

Over the coming quarters, the DVI is likely to rise further for

a number of reasons.

First, there are significant lags between the maximum intensity of

negative shocks and subsequent peaks in the DVI. This was the case

in the aftermath of the two previous major adverse shocks, the

Global Financial Crisis (GFC) from 2008-9 and the subsequent

eurozone crisis from 2011-12.

Second, the factors already contributing to the DVI are likely to continue to do so in the coming quarters. While GDP rebounded more strongly than expected in Q3 2020, it remained well below its pre-pandemic level and the output gap remains very large. With a "double dip" for the economy now in train, it will widen further.

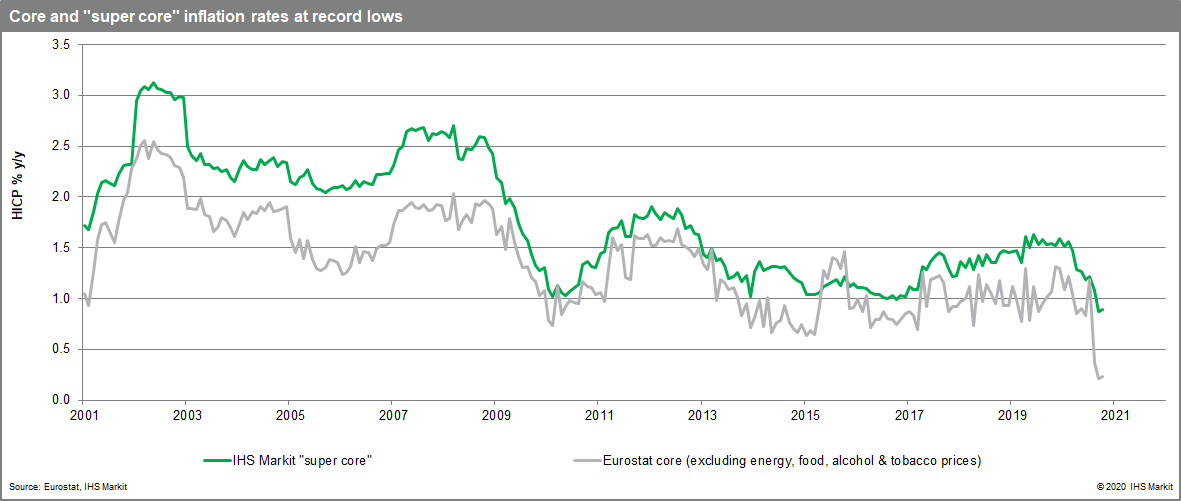

Third, other indicators are also likely to start pushing up the DVI, including the core HICP inflation rate which has recently fallen to record lows, which is not fully captured in Q3 2020's data. The DVI's threshold for appreciation of the real effective euro exchange rate (which has risen towards its historic highs) is also likely to be met in Q4 2020, meaning that the eurozone DVI could rise into the "high risk" bracket for the first time in its history.

The "good" news is that the swift and substantial response of monetary and fiscal policy to the COVID-19 shock will likely prevent some of the other DVI inputs, including bank lending and house prices, from contributing to an even bigger rise.

Other inflation metrics also highlight the risk

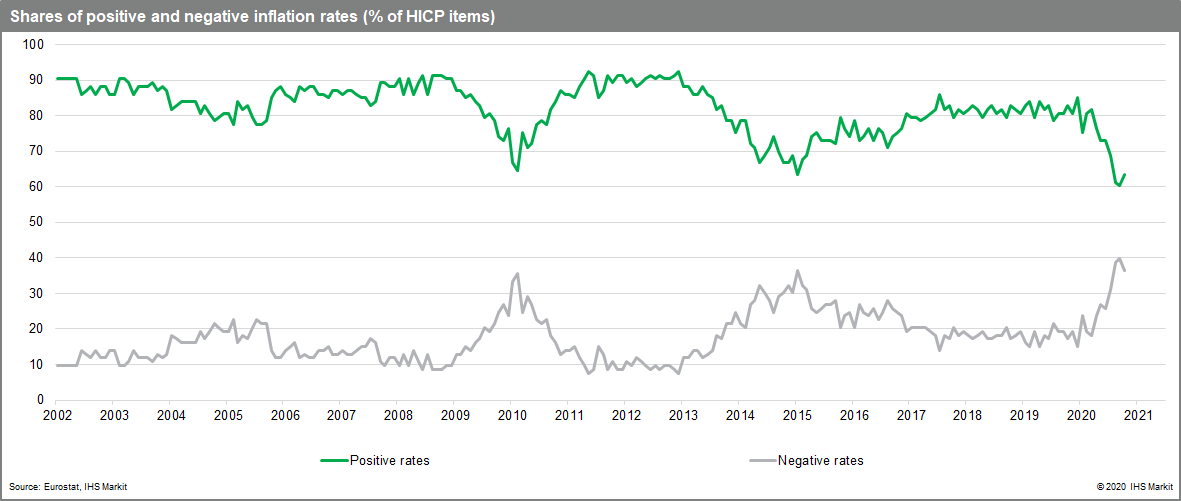

We monitor other price metrics to keep tabs on the risk of deflation, including the monthly evolution of the distribution of positive and negative inflation rates across all HICP items in the eurozone.

The proportion of negative inflation rates has shot up since the COVID-19 shock, echoing the trends after the GFC and eurozone crisis, hitting a record high in September.

ECB to the rescue?

Unusually, the ECB has already confirmed its intention to announce additional policy stimulus in December (an indication of its concerns), centred on its Pandemic Emergency Purchase Programme (PEPP) and long-term loans to banks.

The less good news is that although the ECB has (rightly) been ramping up its policy response to the COVID-19 shock, this follows a long period of persistent low inflation and inflation expectations in the eurozone. What the ECB is doing is welcome but from a deflation risk perspective, it might be a case of too little, too late.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-deflation-worries-to-persist.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-deflation-worries-to-persist.html&text=Eurozone+deflation+worries+to+persist+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-deflation-worries-to-persist.html","enabled":true},{"name":"email","url":"?subject=Eurozone deflation worries to persist | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-deflation-worries-to-persist.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+deflation+worries+to+persist+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-deflation-worries-to-persist.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}