Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 24, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week, plus names identified at risk of experiencing a short squeeze.

- Microphone supplier to Apple and Samsung is the most shorted in North America

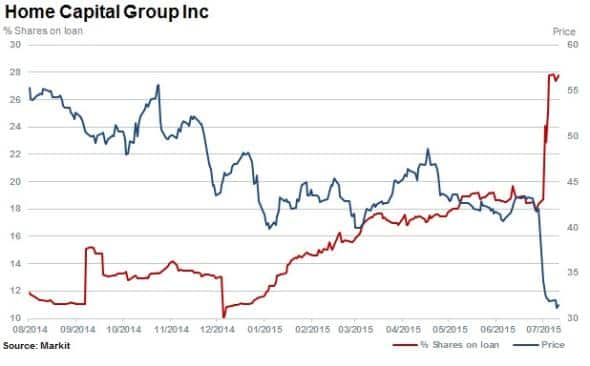

- Surge in short interest in Canadian subprime lender Home Capital after slow down reported

- Casio short sellers grimacing as stock surges 40%, while relishing Sharp's 45% decline

North America

Most shorted in North America ahead of earnings is Knowles Corp with 43% of shares outstanding on loan. The company makes specialty micro-acoustic components for mobile and consumer electronics. The company recently acquired Audience, which has struggled since losing Apple as a key client in 2012.

Knowles supplies both Apple and Samsung but has faced increasing competition from other manufacturers and legal challenges in China.

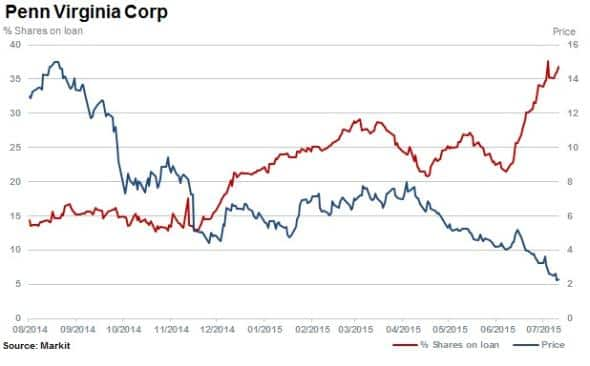

Second most shorted is oil and gas exploration company Penn Virginia which saw a strong spike in short interest in the last month, rising 60% to 36% of shares outstanding on loan while the stock dipped lower by 50%.

Penn began its fresh decline after contradicting reports of a rejection to a potential takeover by BP surfaced. These were subsequently found to be false. The recent oil price weakness has also seen shares continue to decline with short sellers flocking to the stock.

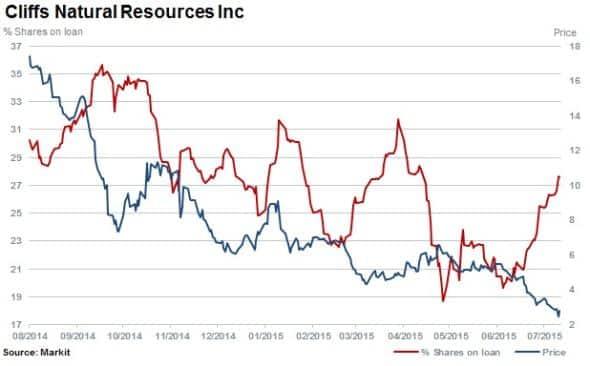

Oil's price decline has also seen short sellers return to consistently shorted Cliffs Natural Resources. Shares outstanding on loan have increased by 37% in the last month with the stock falling 41%. Since declining by 37% in October 2014 the stock has continued to fall a further 72%.

Canadian subprime mortgage lender Home Capital saw shares drop by 20% on July 13th as analysts downgraded the stock after the company reported residential mortgages have fallen more than expected in the second quarter of 2015.

High risk of squeezing

Among firms reporting earnings in the week ahead, a handful rank in the top decile of Markit's Short Squeeze model*;

These include, Adeptus Health, Altisource Portfolio Solutions, Overstock Com, Proto Labs, Genisis Energy, Exelixis and CNH Global.

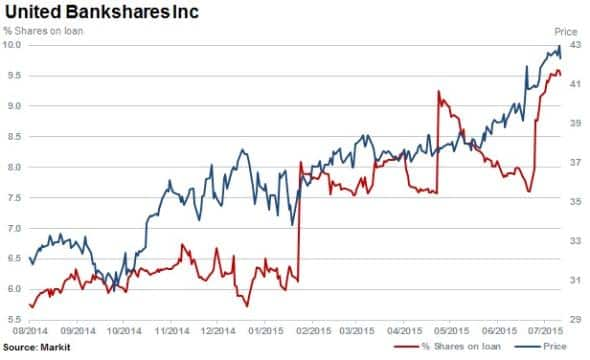

Most likely to squeeze ahead of earnings is United Bankshares, where 97% of short sellers are out of the money. The stock is up by 64% year to date and shares outstanding on loan currently stand at 10%.

Europe

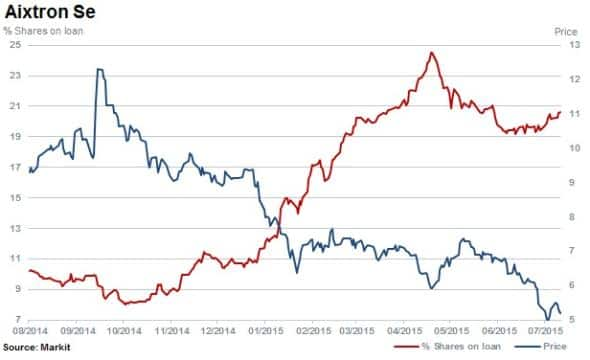

Most shorted ahead of earnings in Europe is German based Aixtron which supplies equipment to the semiconductor industry, where sentiment has turned bearish in recent weeks. Shares out on loan currently stand at 21%, doubling over the last 12 months while the stock price has declined by half.

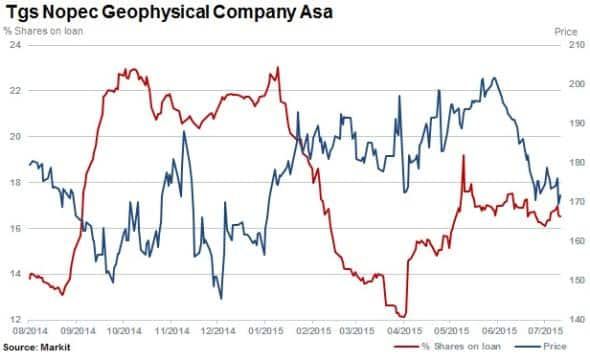

European short sellers in TGS Nopec, a geological consultant to the oil industry, had built positions up by 40% post April 2015 and have benefited from a recent 15% share price decline since the stock's recent high on June 11th.

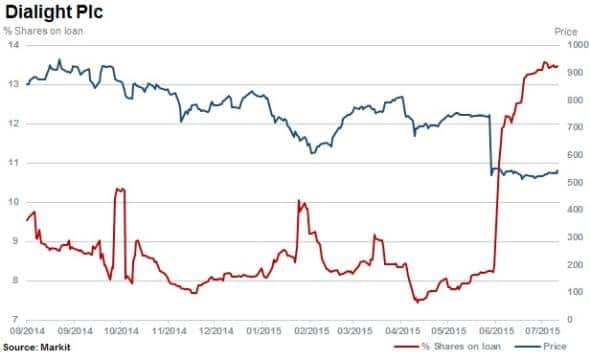

Energy efficient LED lighting provider Daylight has seen a sharp rise in short interest after shares slumped as the company released a trading statement on June 10th. The statement indicated that operating profit will be significantly below expectations and is "linked in part to a slowdown in the oil and gas sector".

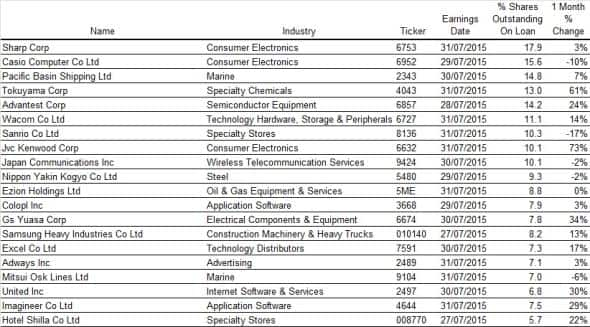

Apac

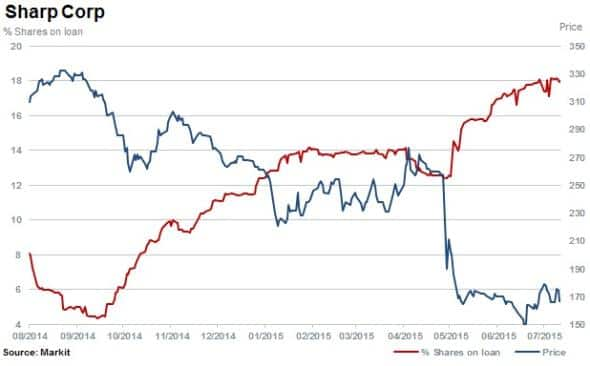

Most shorted ahead of earnings in Apac are two well-known large consumer electronics businesses in Japan. Struggling TV maker Sharp has continued to attract short sellers with shares outstanding on loan increasing by 40% in the last three months with the share price retreating over 35%.

Financially healthier Casio stills sees short sellers attracted to the stock despite analysts expecting 30% higher earnings for the 2016 financial year. Shares outstanding on loan are flat over the past 12 months at 15.6% while the stock has risen some 41%.

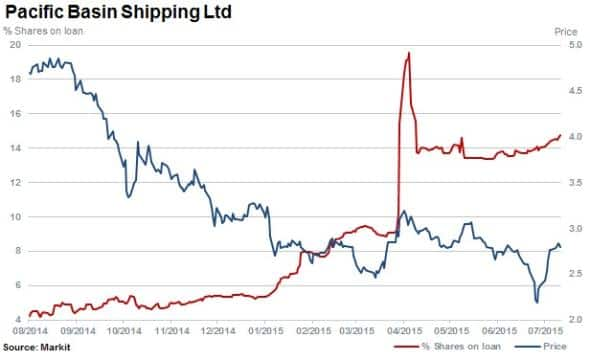

Dry bulk shipping and towage services provider Pacific Basin has witnessed a spike in short interest in April and levels remain high at 18% of shares outstanding on loan. Headquartered in Hong Kong, the firm is exposed to the energy sector and continued depressed prices in the shipping industry.

*To receive more information on short interest data or our Short Squeeze model please contact us.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}