Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 27, 2015

Commodities strain Latam corporate credit

The recent commodity downturn has sent Latam corporate bond yields surging, just as the US looks set to raise interest rates.

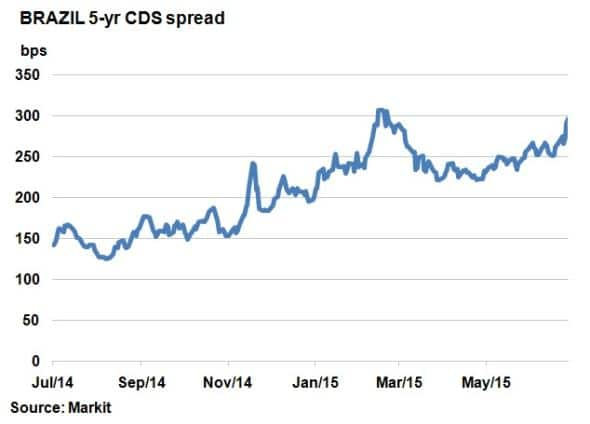

- Brazil's 5-yr CDS spread has widened 31bps over the past week as commodity slump hits

- Latam corporate bond yields have diverged from their emerging market peers

- Petrobras' 2024 bond yield back above 7%, but still 1% below the highs seen in March

Market sentiment around Brazil is turning sour again. Weaker commodity prices, the health of the economy and strong US dollar are all weighing in on Latam's largest economy.

Coinciding with the recent commodity downturn, Brazil sovereign 5-yr CDS spread, a measure of credit risk, widened 31bps last week to 297bps. This level is just 9bps away from the March 16th yearly high of 306bps, which was hit when the price of WTI crude oil hit a six year low.

Commodities play a major role in Brazil's export sector, with significant industries in mining (especially iron ore) and energy (oil). But for a period between April and June, Brazil's credit risk receded as the price of oil stabilised and the Petrobras scandal subsided.

While Brazil maybe the biggest economy in South America, it is far from isolated. Neighbouring Chile, Peru and Colombia, all major commodity exporters, saw their respective CDS spreads widen 9bps, 14bps and 15bps respectively over the past week.

Corporates on the edge

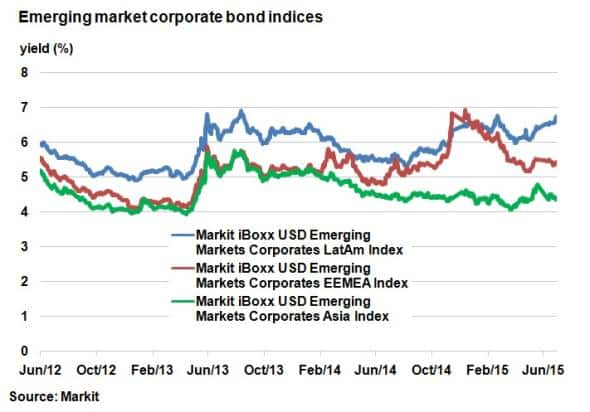

The wider implications of the recent commodity slump are uncertain, but the US Fed may play a part. Many emerging markets corporates, in Latam but also in Asia and EEMEA, issue debt in US dollars. Rate hikes, expected later this year therefore have the potential to further strain corporate debtors as the US dollar strengthens. Brazil, for example, has already lost 15% to the US dollar over the past two years. The potential impact of a stronger dollar was the primary reason that the IMF warned the Federal Reserve against an interest rate rise this year.

The Markit iBoxx USD Emerging Markets Corporates LatAm Index yield is currently 6.75%, over 60bps wider month to month month and a new year to date high. This is in sharp contrast to the Markit iBoxx USD Emerging Markets Corporates EEMEA Index which is 18bps wider and the Markit iBoxx USD Emerging Markets Corporates Asia Index which is 3bps tighter this month. The differences in yield movements highlight the Latam region's sensitivity to commodities.

2013's 'taper tantrum' was an example of how potential interest rate rises in the US could impact emerging market corporate debt yields. During the period between May and September 2013, Latam corporate debt yields spiked from 5% to nearly 7%, showcasing the dangers of rising rates.

A similar move in rates in an already fragile environment in the Latam region could trigger defaults. In today's integrated global economy, it comes as no surprise the IMF remains deeply concerned about the Fed's impending decision.

Biggest decliners

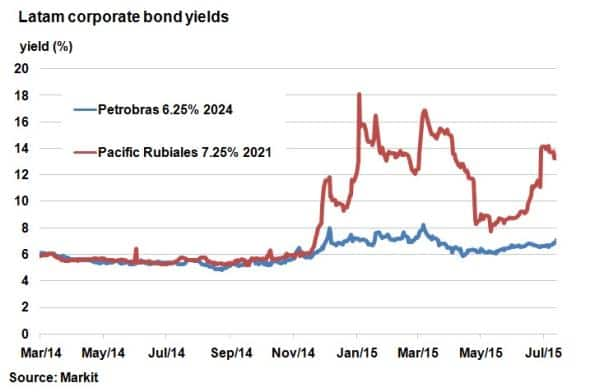

Making headlines during oil's bottom in March was Brazilian state owned oil and gas firm Petrobras. Its 6.25% bond due 2014 has seen its yield surge 40bps this month to 7.11%. This is the first time the 7% threshold has been breached since March, but it remains over a percentage point below 2015's high of 8.2%, according to Markit's bond pricing service.

It's worth noting that the broader Brazilian corporate debt market has widened 44bps this month, according to the Markit iBoxx USD Corporates Brazil Index.

It also comes as no surprise that Chilean copper miner Codelco and Peruvian miner Minsur have seen credit spreads widen. Pacific Rubiales, an oil and gas producer in Colombia and Peru, was one of the biggest losers in the Markit iBoxx USD Emerging Markets Corporates LatAm Index this month, with its bond due 2021 widening 255bps.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Credit-Commodities-strain-Latam-corporate-credit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Credit-Commodities-strain-Latam-corporate-credit.html&text=Commodities+strain+Latam+corporate+credit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Credit-Commodities-strain-Latam-corporate-credit.html","enabled":true},{"name":"email","url":"?subject=Commodities strain Latam corporate credit&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Credit-Commodities-strain-Latam-corporate-credit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Commodities+strain+Latam+corporate+credit http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f27072015-Credit-Commodities-strain-Latam-corporate-credit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}