Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 24, 2015

Qualcomm bonds widen; Slovenia reopens Europe

Competition from Asia has forced Qualcomm to reorganise, which has been received with suspicion from investors. Meanwhile in Europe, Slovenia kick starts the eurozone sovereign bond market after Greece saga.

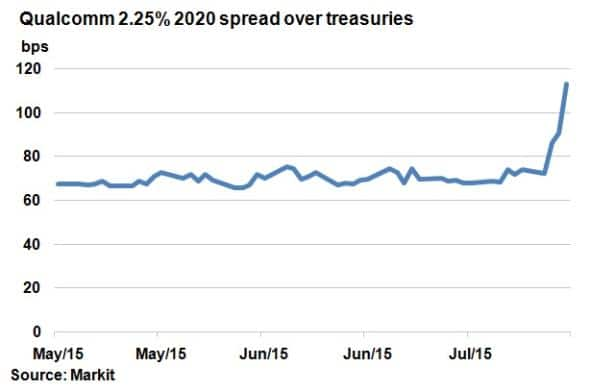

- Qualcomm’s 5-yr bond has seen its credit spread widen 39bps over the past week

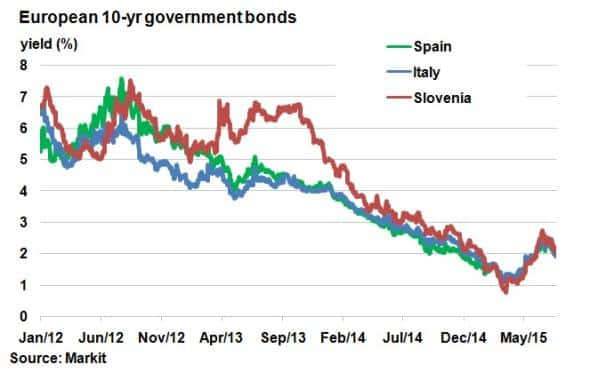

- Slovenia reopened up the primary euro sovereign bond market; yields similar to Spain, Italy

- Targeted by short sellers, Norske Skogindustrier 5-yr CDS upfront is now over 60%

Qualcomm

Fierce competition in the microchip making industry has forced US semiconductor and telecoms conglomerate Qualcomm to strategically review its operations, with talks of a break up.

The prospect of assets being separated has led investors to question the firm’s ability to manoeuvre its debt obligations and manage its financial leverage. Bond investors reacted to the uncertainty with spreads widening sharply.

Apart of Qualcomm’s recent $10bn bond programme was the 2.25% bond due 2020. It saw its spread over treasuries widen from 74bps last Friday to 113bps as of yesterday’s close. It had been trading steadily in the range 65-75bps range in the two months prior.

Periphery 2.0

This week saw Slovenia reopen the eurozone sovereign primary bond market, the first issuance since Austria in mid-June. The past month has seen the primary market dry up as lenders awaited calmer market conditions. With Greece having succumbed to Europe’s bailout conditions earlier this month, conditions were ripe with demand for the €1.25bn 2.125% ten year bond rapturous.

For Slovenia, which joined the eurozone in 2007, the bond market presents a spectacular turnaround for the country after it narrowly missed a bailout in 2013. 10-yr bond yields surpassed 6.5% towards the end of 2013. But spurred on by being included in the ECB’s QE bond buying programme, 10-yr bond yields have rallied since, dipping below 1% in March this year. For a period, the 10-yr rate even traded tighter than the traditional larger European periphery countries, such as Italy and Spain, and remained largely unfazed by any contagion fears arising from Greece.

Index tranching

An interesting trend which has re-emerged lately has been using leveraged credit index tranches to short only the riskiest set of credit entities in an index. The goal is to benefit from the downfall of companies that are struggling to meet costs amid a global market full of uncertainties.

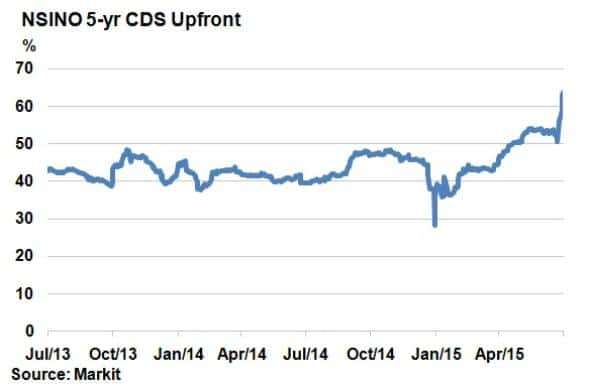

One such targeted name has been Norwegian paper manufacturer Norske Skogindustrier. Its 5-yr CDS upfront has rocketed 10% wider so far this month and spreads now imply an almost certain default Markit’s Research Signals propriety credit risk model[1] issued an alert on the name yesterday, expecting further deterioration

[1] The Leading Risk Indicator enhances Markit’s Research Signals credit factors and is used to evaluate the expected performance of credit default swaps based on fundamental, technical and macroeconomic-based indicators.

Neil Mehta | Analyst, Fixed Income, IHS Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Credit-Qualcomm-bonds-widen-Slovenia-reopens-Europe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Credit-Qualcomm-bonds-widen-Slovenia-reopens-Europe.html&text=Qualcomm+bonds+widen%3b+Slovenia+reopens+Europe","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Credit-Qualcomm-bonds-widen-Slovenia-reopens-Europe.html","enabled":true},{"name":"email","url":"?subject=Qualcomm bonds widen; Slovenia reopens Europe&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Credit-Qualcomm-bonds-widen-Slovenia-reopens-Europe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Qualcomm+bonds+widen%3b+Slovenia+reopens+Europe http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Credit-Qualcomm-bonds-widen-Slovenia-reopens-Europe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}