Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 23, 2015

UK retail sales dip fuels uncertainty over policy outlook

Falling retail sales and widespread price discounting will strengthen the conviction of dovish policymakers that underlying inflationary pressures remain benign, and that the economy still faces a deflation risk.

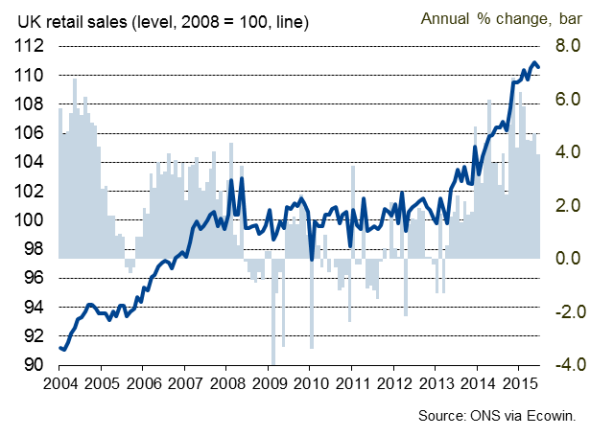

UK retail sales fell 0.2% in June, drawing an end to a somewhat disappointing quarter. In the three months to June, sales volumes rose 0.7%, down from 0.9% in the three months to March. That makes the second quarter's sales performance the weakest since the third quarter of last year.

In year-on-year terms, the performance was better, with sales up 4.0%. However, in price terms, sales were up just 1.3%, highlighting how broad-based price falls are continuing to be seen. There seems little sign that fierce price competition among retailers is abating, with average store prices down 2.9% on last June, the twelfth successive annual fall. Some of this deflation can be blamed on falling petrol prices, down 10.0% on a year ago, but price falls were in fact seen in all store types.

Retail sales

Rhetoric has been building at the Bank of England that interest rates could start rising around the turn of the year, and the minutes of the July Monetary Policy Meeting highlighted a growing hawkishness building among the rate setters. However, the lacklustre retail performance in June will strengthen the case of the doves, and notably the Bank's Chief Economist Andy Haldane, who has recently expressed the view that rates are as likely to fall as to rise.

Consumer anxiety

There's certainly some evidence that consumers may be starting to feel a little more nervous about their financial situation. Survey data showed optimism about future finances sliding to a one-year low in July, with households worried about rising interest rates, an upturn in inflation and public sector spending cuts. The drop in optimism was concentrated on public sector employees.

On the other hand, it's always unwise to place too much emphasis on one month's data, and the fact that sales rose 0.7% over the second quarter as a whole supports the view that the economy retains reasonably strong growth momentum, and long-term prospects remain encouragingly solid. GDP looks to have grown by at least 0.5% in the second quarter, perhaps even as much as 0.7% according to PMI data, suggesting the economy continues to eat up slack. The retail sales fall nevertheless is a reminder that the policy outlook remains hugely uncertain.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-economics-uk-retail-sales-dip-fuels-uncertainty-over-policy-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-economics-uk-retail-sales-dip-fuels-uncertainty-over-policy-outlook.html&text=UK+retail+sales+dip+fuels+uncertainty+over+policy+outlook","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-economics-uk-retail-sales-dip-fuels-uncertainty-over-policy-outlook.html","enabled":true},{"name":"email","url":"?subject=UK retail sales dip fuels uncertainty over policy outlook&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-economics-uk-retail-sales-dip-fuels-uncertainty-over-policy-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+retail+sales+dip+fuels+uncertainty+over+policy+outlook http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-economics-uk-retail-sales-dip-fuels-uncertainty-over-policy-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}