Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 03, 2025

Top five economic takeaways from December's manufacturing PMI data as factory conditions worsen

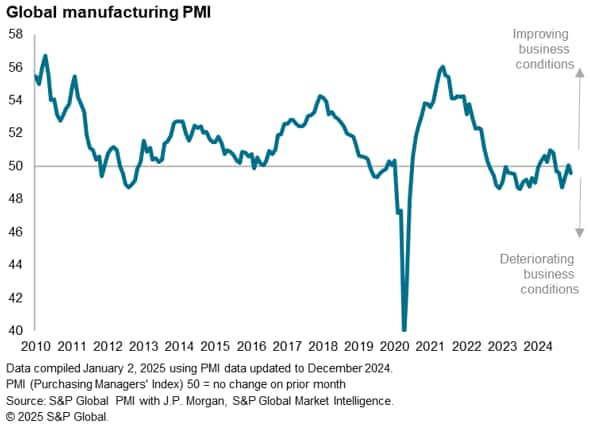

The global manufacturing sector fell back into decline in December, having stabilised in November, meaning business conditions have deteriorated in five of the past six months. At 49.6, down from 50.0 in November, the Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, nevertheless signalled only a very modest worsening of operating conditions.

Regional variations were again marked, however, with business conditions again being affected by the possibility of US tariffs being imposed in the coming year.

Here are our top five takeaways from December's manufacturing PMI surveys sub-indices, which provide a deeper insight into manufacturing business conditions by analysing varying trends of output, demand, inventories, supply chains, employment and prices.

1. Europe and the US act as increasing drags on global production

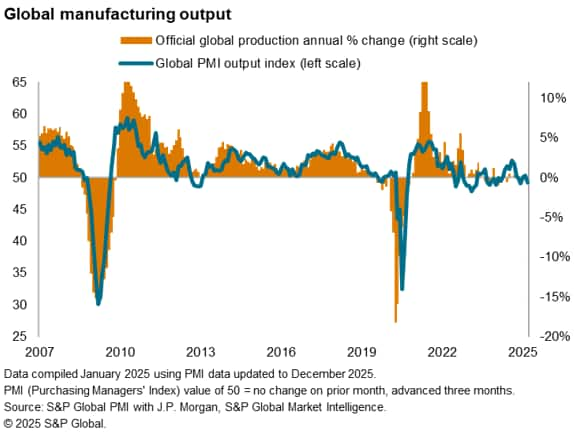

The PMI survey's sub-index of production, which tracks actual month-on-month changes in factory output, fell back into contraction after eking out marginal gains in October and November. The decline was only modest, however, suggesting that output broadly stagnated over the fourth quarter as a whole.

The broadly flat fourth quarter picture masked marked variations in production trends around the world, which persisted into December.

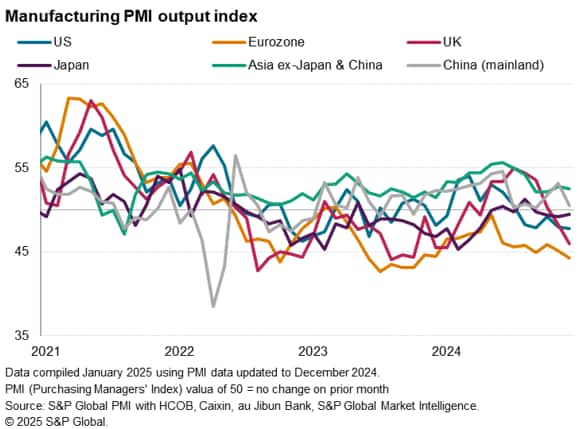

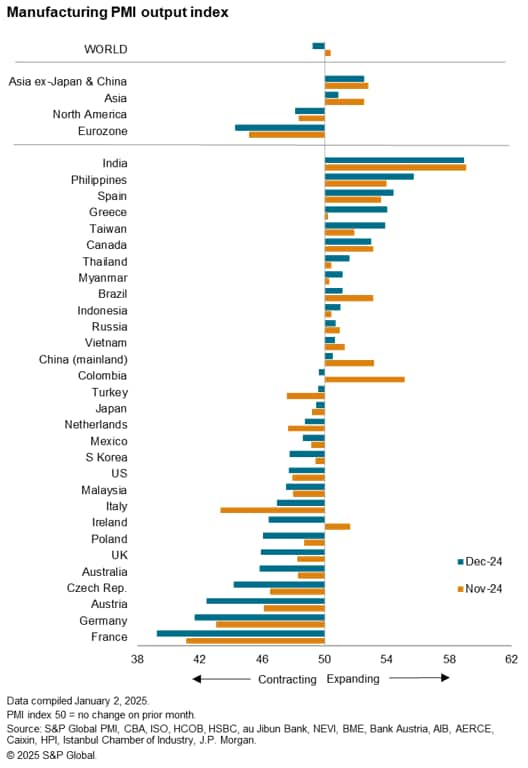

In total, output rose in just 12 of the 30 individual economies for which PMI data are so far available for December (data publication for Romania and Kazakhstan is delayed due to holidays) and only six economies reported PMI output index readings of 53.0 or higher, a level above which noteworthy gains are signaled.

India reported the strongest expansion of production for a nineteenth successive month, and by a sustained wide margin, followed by the Philippines, Spain, Greece, Taiwan and Canada.

The accelerating growth seen in Spain and Greece bucked a wider eurozone production downturn, which hit the fastest for 14 months in December to again register the worst performance of the major regions of the world. France, Germany and Austria saw the three steepest production declines of the 30 economies surveyed, underlining the sub-par performance of many eurozone member states, including the Franco-German core.

However, the eurozone has become less of an outlier in terms of its disappointing manufacturing performance, as accelerating and steep downturns were also recorded in both the US and the UK, where output fell in December at the fastest rates for 18 and 11 months respectively.

2. Mainland China reports slower expansion

In contrast, further output growth was recorded in mainland China and near-stable production was recorded in Japan, with the rest of Asia again reporting solid growth - the latter helped in particular by the outperformance seen in India. But producers in mainland China nonetheless reported a notable downshifting in production growth compared to the uplift seen in November, registering only a marginal increase to act as a further drag on the global picture.

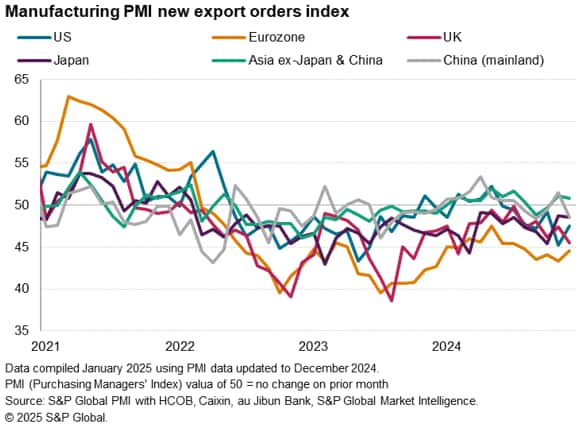

3. Global goods trade picture worsens

Key to the worsening global production trend was a further marked decline in global goods trade flows, as indicated by the PMI's New Export Orders index falling further into contraction territory in December, slipping to a three-month low. The respective index acts as a useful guide to official trade data, and has signaled a cooling of trade growth after the brief revival seen earlier in 2024.

Only a handful of economies reported higher export orders in December, with the eurozone again seeing an especially disappointing performance. US, UK and Japanese producers also reported declining exports, but so did factories from mainland China. Whereas the latter had reported a resumption of trade in November, linked in part to the buying of goods from the US ahead of potential tariffs in 2025, December saw some payback from this advance purchasing.

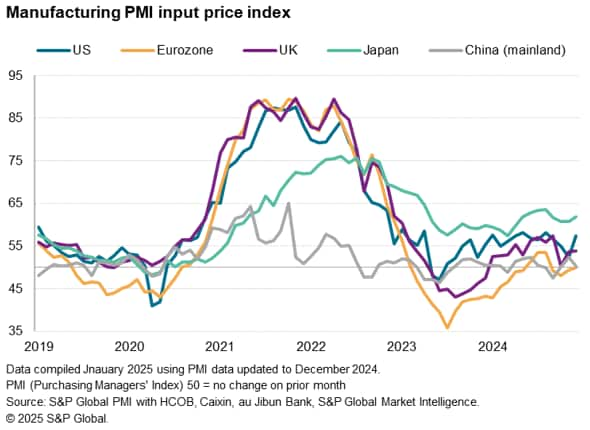

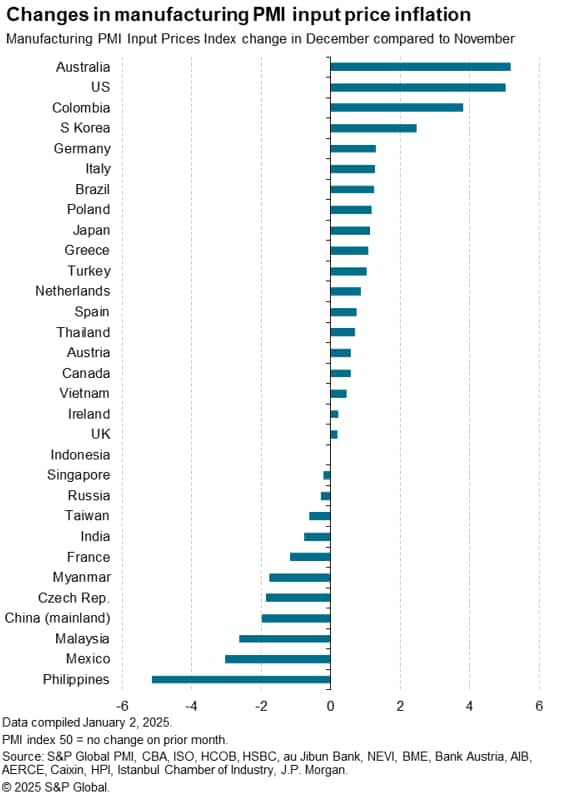

4. US producers see outsize jump in input price inflation

US producers meanwhile reported a larger than average rise in input prices in December. In fact, of the 30 economies for which December PMI data were available, only Australia saw a steeper jump in raw material cost inflation than US factories. US firms consequently reported a steeper rate of increase than counterparts in Europe and mainland China. Japanese producers nevertheless continued to report the strongest cost increase among the world's major manufacturing economies, linked to higher import prices resulting from the weakened yen.

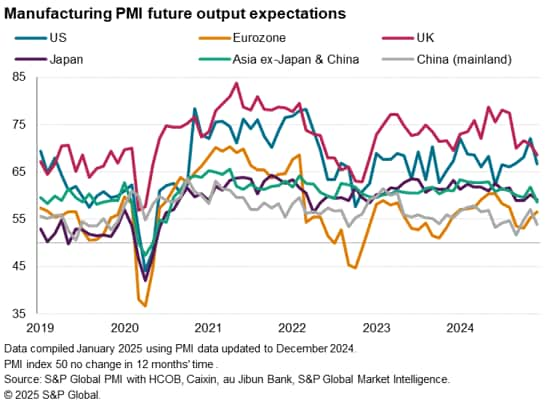

5. Global business optimism relapses

Having slumped to its lowest for nearly two years back in September, global manufacturing confidence about the year ahead had since revived, hitting a six-month high in November. However, December saw some of this optimism wane, pulling confidence back down to a three-month low.

Besides Russia, South Korea - the latter suffering a political crisis - and the Philippines, the biggest slump in business confidence was reported in the US. While the pull-back in sentiment in the US needs to be looked at in context of a marked improvement in November following the Presidential Election, the December survey reflected growing concerns about the potential for tariffs and immigration policies to cause further price hikes and supply chain disruptions.

However, confidence also fell in the UK, largely in response to concerns over newly imposed taxes on employment, as well as across Asia on tariff concerns. Bucking the gloomier trend was the eurozone, with confidence rising from an especially low base. However, sentiment continues to be dented by political uncertainty and additional concerns over US-imposed tariffs.

In summary therefore, a disappointing end to the year for the global manufacturing economy has been accompanied by either falling or low confidence about the outlook for 2025, with sentiment dented by political uncertainty and the prospect of potential trade wars.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-decembers-manufacturing-pmi-data-as-factory-conditions-worsen.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-decembers-manufacturing-pmi-data-as-factory-conditions-worsen.html&text=Top+five+economic+takeaways+from+December%27s+manufacturing+PMI+data+as+factory+conditions+worsen+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-decembers-manufacturing-pmi-data-as-factory-conditions-worsen.html","enabled":true},{"name":"email","url":"?subject=Top five economic takeaways from December's manufacturing PMI data as factory conditions worsen | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-decembers-manufacturing-pmi-data-as-factory-conditions-worsen.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+five+economic+takeaways+from+December%27s+manufacturing+PMI+data+as+factory+conditions+worsen+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-decembers-manufacturing-pmi-data-as-factory-conditions-worsen.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}