Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 23, 2015

Week Ahead Economic Overview

The main data highlights are first estimates of second quarter gross domestic product for the US, UK and Spain, with the former also seeing the release of durable goods orders data and flash services PMI numbers. The policy highlights are interest rate announcements in the US, Brazil and Russia.

The Federal Reserve's Open Market Committee (FOMC) will announce their latest interest rate decision on Wednesday. It is widely expected that monetary policy will be left unchanged though Fed chair Janet Yellen has continued to build expectations that rates are likely to start rising later in the year as the economic recovery in the US makes "steady progress". No press conference is scheduled until the next meeting in September, when the possibility of a hike remains firmly on the table.

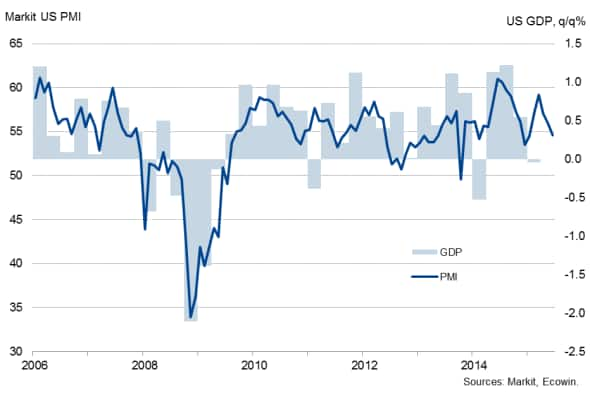

US policy watchers will therefore be also focused on Thursday's second quarter gross domestic product data and Tuesday's flash services PMI numbers for July. The US economy shrank 0.2% (annualised) in the first three months of the year, but looks set to have rebounded in the second quarter. PMI data currently suggest that the US economy expanded by around 2.5-3.0% in the three months to June. However, unexpectedly weak retail sales, stagnant factory output, and disappointing wage growth and business survey data all point to the US economy losing growth momentum again.

Flash services PMI results for July will meanwhile give first insights into the health of the world's largest economy at the start of the third quarter, after June data signalled a growth slowdown. The release of durable goods orders will provide data watchers with additional information about the state of the US economy.

US GDP and the PMI

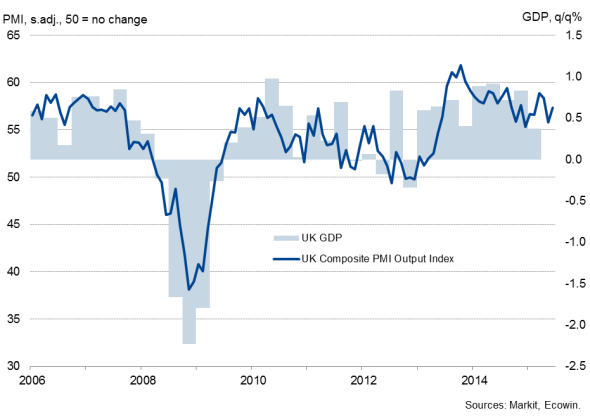

The first estimate of second quarter GDP is also published in the UK, with business survey data signalling a slight acceleration of the economy in the second quarter. A pure historical comparison of GDP with the PMI points to 0.7% growth, in line with the Bank of England's projection, though the ONS's initial estimate may come in slightly below this. The GDP numbers will be important for policy makers in determining when to start raising interest rates, with Mark Carney stating that the decision to start hiking rates is drawing closer.

UK GDP and the PMI

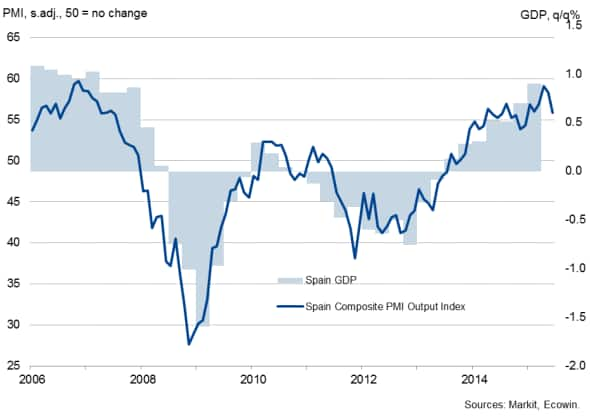

Second quarter GDP data will also reveal whether Spain's economy has retained strong momentum from its positive start to 2015, with GDP rising 0.9% in the first quarter. While the Spanish economy is still facing high unemployment, with the jobless rate well over 20%, PMI data point to further solid GDP growth in the second quarter as companies continued to take on staff at a pace not seen since 2007.

Spain GDP and the PMI

Eurostat meanwhile releases flash inflation numbers and unemployment data for the eurozone. Consumer prices rose at an annual rate of 0.2% in June, down slightly from May's 0.3% and a further slipping in the rate of inflation could be seen. Unemployment meanwhile held steady at 11.1% in May but looks set to have dipped further, albeit with strong variations within the region. While jobless rates will have remained historically low in Austria and Germany, Greece and Spain still struggle with high rates of unemployment.

Outside of Europe and the US, monetary policy announcements in Brazil and Russia are likely to have an impact on the markets. While rates are likely to fall in Russia, Brazil's central bank may feel the need to hike rates further in its fight against inflation.

Brazil's benchmark interest rate, known as Selic, currently stands at 13.75%, with the bank leaving open the option for more rate increases in coming months in the light of inflation running at 8.9% and well above the central bank's target of 4.5% (with a tolerance range of two percentage points in either direction). However rate hikes would also slow growth further. PMI data signalled the strongest decline in private sector output since 2009 in June.

The Russian Central Bank cut its interest rate from 12.5% to 11.5% during the latest meeting, as inflation showed signs of slowing in recent months. A further rate cut to 11.0% is expected by economists polled Thomson Reuters.

Monday 27 July

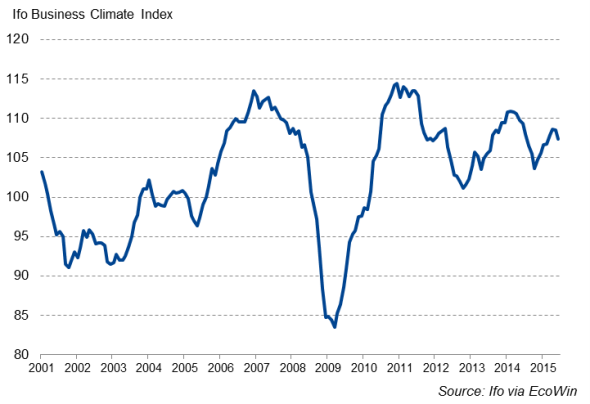

Germany sees the release of import price data and latest Ifo business climate numbers.

Ifo Business Climate Index

M3 money supply information are meanwhile issued for the eurozone.

The Confederation of British Industry publishes orders data.

In the US, building permit numbers and durable goods orders data are out.

Tuesday 28 July

Second quarter unemployment numbers are updated in South Africa.

ISTAT releases latest business and consumer confidence data for Italy.

The Office for National Statistics releases the first estimate of second quarter GDP in the UK.

Home price and consumer confidence data are issued in the US alongside July's flash US services PMI.

Canada sees the publication of producer price numbers.

Wednesday 29 July

Japan sees the release of retail sales figures.

M3 money supply information are published in South Africa.

Retail sales data are updated in Spain and Germany, with the latter also seeing the release of GfK consumer sentiment figures.

In France, consumer confidence numbers are released.

House price data are meanwhile published in the UK.

The Federal Reserve's Open Market Committee and the Central Bank of Brazil announce their latest decisions on interest rates.

Thursday 30 July

In Australia, building permit numbers and trade price data are released.

Meanwhile, industrial output figures are updated in Japan.

Producer price numbers are out in South Africa.

The Bank Austria Manufacturing PMI is released.

Germany sees the release of inflation numbers.

Business climate and unemployment data are issued for the euro area.

Second quarter GDP figures are out in Spain.

In Greece, producer price numbers are updated.

The US sees the release of initial jobless claims numbers and second quarter GDP data.

Friday 31 July

Producer price and private sector credit data are issued in Australia.

In Japan, consumer price and unemployment numbers are released alongside construction orders and housing starts figures.

Meanwhile, trade balance data are published in South Africa.

The Bank of Russia Board of Directors announces their latest interest rate decision.

Flash consumer price numbers are issued in the eurozone.

Eurozone consumer prices

France sees the release of consumer spending and producer price figures.

In Italy, unemployment and producer price numbers are released.

Spain updates its current account data.

Retail sales figures are meanwhile issued in Greece.

GfK consumer confidence numbers are out in the UK.

Brazil sees the publication of budget balance information.

Wage data are issued in the US, while monthly GDP figures are out in Canada.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23072015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}