Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 24, 2015

Chinese manufacturers report steepest downturn for 15 months at start of third quarter

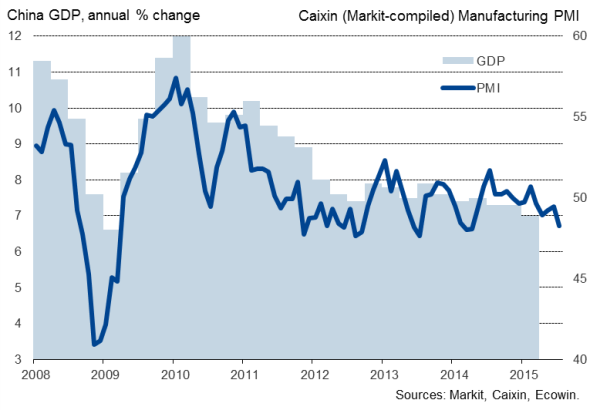

The Chinese economy started the third quarter with the steepest contraction of manufacturing activity for 15 months, according to survey data. The Caixin Flash China General Manufacturing PMI, compiled by Markit, fell from 49.4 in June to 48.2 in July, its lowest since April of last year. The latest reading signalled a contraction of the manufacturing economy for a fifth consecutive month.

Factory output fell for a third successive month, showing the largest monthly drop since March of last year as the rate of decline gathered pace considerably compared to prior months.

Economic growth

Jobs cut amid waning demand

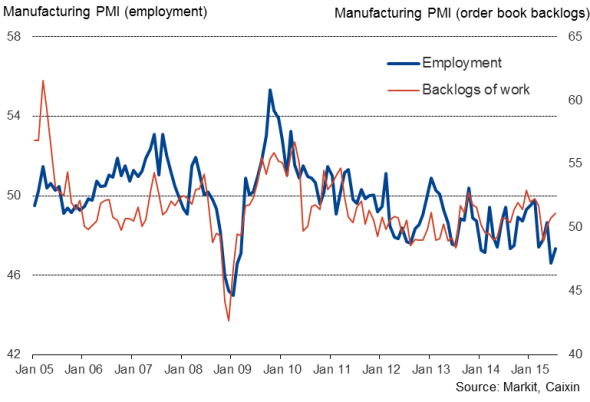

Some consolation could be sought from the rate of job losses easing compared to June's six-year high, though the pace of ongoing cuts to workforce numbers remained worrying high and indicative of a sector that continues to cut capacity in the face of waning demand.

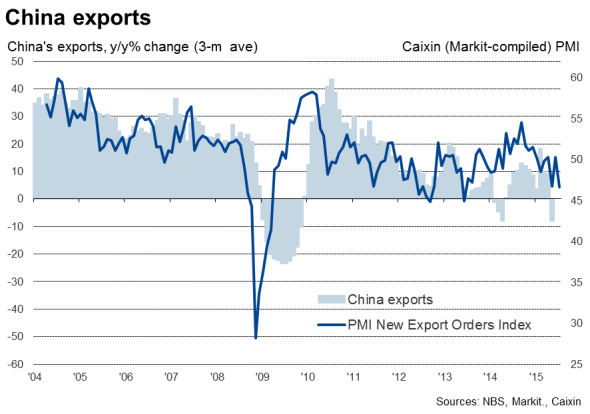

Inflows of new orders, which dropped for the fourth time in the past five months, fell at the fastest rate since April of last year. Export orders fell especially sharply, down for the second time in the past three months and suffering the largest monthly decline for over two years.

In a sign of factories further streamlining production and cutting capacity in coming months, purchases of raw materials fell at the fastest rate since February 2012, leading to a renewed drop in inventory holdings.

Employment and capacity

Price discounting

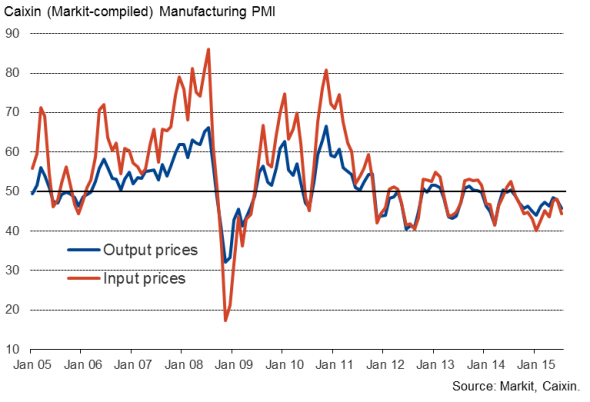

Not surprisingly, price pressures eased further alongside the weakening of demand and downturn in activity. Average prices paid by manufacturers for their inputs fell at the fastest rate since April amid low global commodity prices and a growing trend of suppliers offering discounts to win sales.

Price discounting was also increasingly common among manufacturers themselves, causing average selling prices to drop at the steepest rate since January.

Prices

China slowdown spreading across Asia

The weak start to the third quarter piles further pressure on a Chinese government that is struggling to achieve an economic growth target of around 7.0% this year, which itself would be the weakest growth seen for a quarter of a century. The slowdown is also having an increasing impact on other countries. June PMI data, for example, showed Taiwan and South Korea to have suffered the steepest downturns of all countries covered by Markit's manufacturing surveys, linked to tumbling export sales to China.

Weak demand in China therefore looks set to take an increasing toll on global economic growth in the third quarter if the downturn seen in July continues or escalates in coming months, which could therefore have an impact on policymaking in the developed world. Both the US Federal Reserve and the Bank of England have cited concerns about slower global economic growth as factors which could cause interest rate hikes to be delayed.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Chinese-manufacturers-report-steepest-downturn-for-15-months-at-start-of-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Chinese-manufacturers-report-steepest-downturn-for-15-months-at-start-of-third-quarter.html&text=Chinese+manufacturers+report+steepest+downturn+for+15+months+at+start+of+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Chinese-manufacturers-report-steepest-downturn-for-15-months-at-start-of-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Chinese manufacturers report steepest downturn for 15 months at start of third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Chinese-manufacturers-report-steepest-downturn-for-15-months-at-start-of-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+manufacturers+report+steepest+downturn+for+15+months+at+start+of+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24072015-Economics-Chinese-manufacturers-report-steepest-downturn-for-15-months-at-start-of-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}