Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 17, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Coal firms feature predominantly in the US and Asia as commodity prices remain weak

- Covering seen in geophysical short TGS as oil prices rally ahead of earnings

- Strong results and 100th birthday dividend sends Yaskawa Electric shorts covering

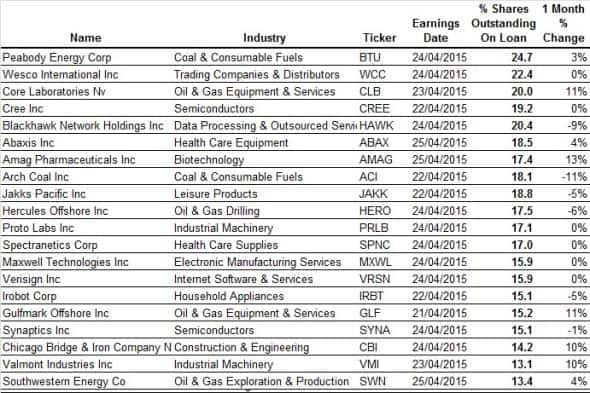

North America

Most shorted ahead of earnings this week in North America is coal giant Peabody energy which currently sees a quarter its shares outstanding on loan. Declining global commodity prices and weak Asian demand have put pressure on coal firms such as Peabody. The company's shares have declined by 72% in the last 12 months.

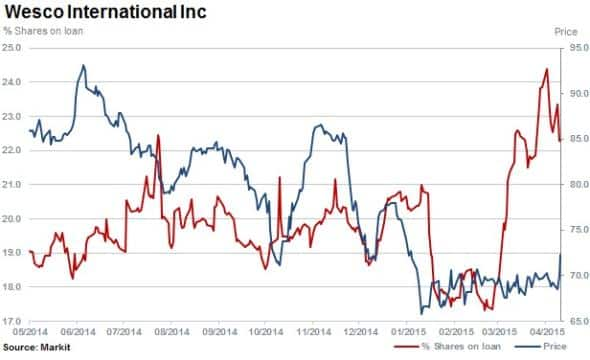

Second most shorted ahead of earnings is Wesco International, an electrical product distributor which provides maintenance, repair and operating supplies to industry.

Short interest in Wesco has climbed above 22% since the beginning of March. Analysts recently lowered their expectations for Wesco due to slowing industrial activity in the US, a sharp pullback in shale oil developments and a strong dollar continuing to impact earnings, foreign earnings and competitiveness.

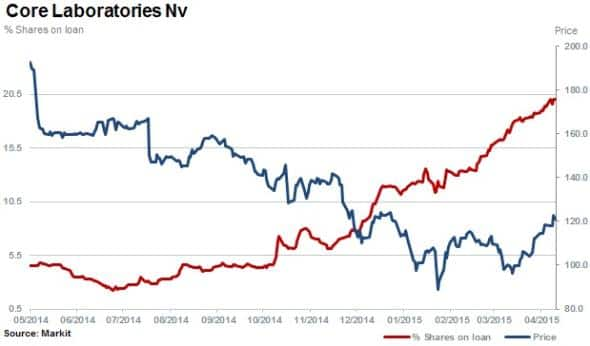

Short interest in Core Laboratories has climbed to 20% while the stock price has declined by more than a third in the last 12 months. The company provides the global oil industry with reservoir mapping and management services including measurement and recovery maximisation.

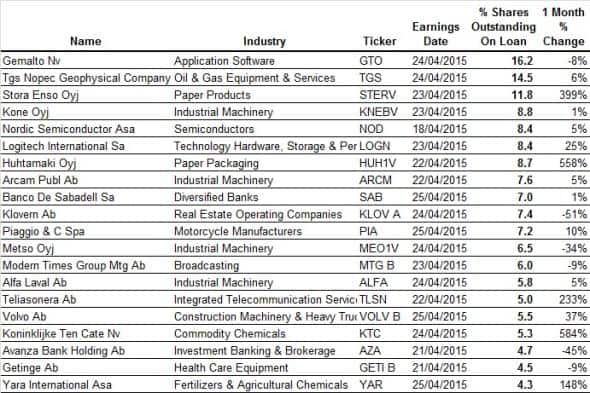

Western Europe

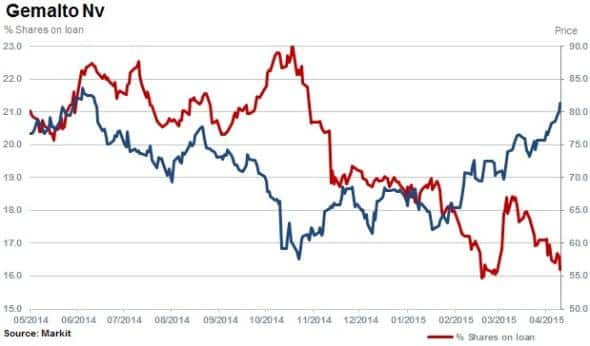

Currently the most shorted in Europe ahead of earnings is Dutch sim card maker Gemalto. The long-time short in Europe has seen covering as shares outstanding on loan have decreased to 16% but demand to short sell remains strong with an annualised fee of more than ~4% to borrow stock.

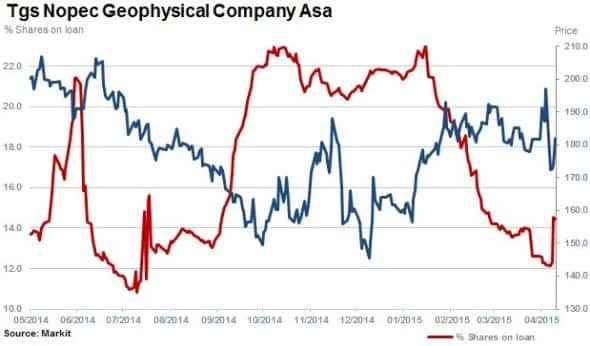

Second most shorted ahead of earnings is TGS with 14% of shares outstanding on loan. The company provides seismic and geoscience data to the oil and gas industry.

Shorts sellers have shed positions in TSG with shares out on loan decreasing from 22% in late January to 14% currently. During this time the share price has rallied as markets witnessed the first sustained oil price recovery.

Asia Pacific

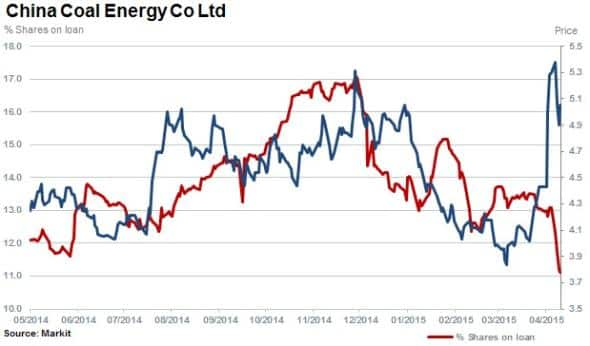

China Coal is the second most shorted company in Apac ahead of earnings with 11% of shares outstanding on loan. Short sellers seemed to have been squeezed out in recent weeks as the share price increased by 20%.

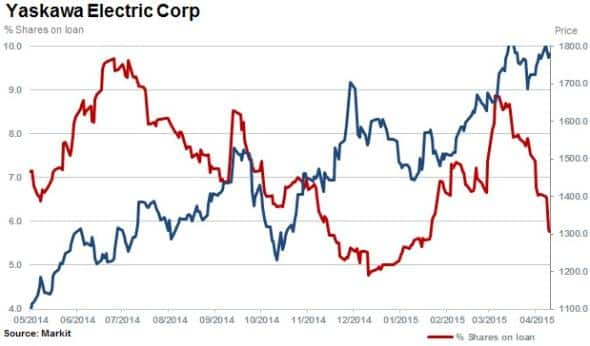

Yaskawa Electric has sent short sellers covering positions by a third in the last month. The company posted strong revenue expansion across its Motion Control and Robotics business segments in the third quarter on the back of growing demand from smart phones and automobile-related industries, especially in the Chinese market.

These strong numbers resulted in an improved outlook for dividend payments and Markit dividend forecasting expects the company to double last year's payment. The firm has guided that not only will it increase the final payment but it will also declare a special dividend in commemoration of its 100th anniversary.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17042015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}