Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 17, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the second week of the third quarter results season.

- Jetblue is the most US shorted company ahead of earnings

- Energy services firms are the target of heavy short interest in Europe

- Hong Kong firms dominate the most heavily shorted firms announcing earnings in Asia

North America

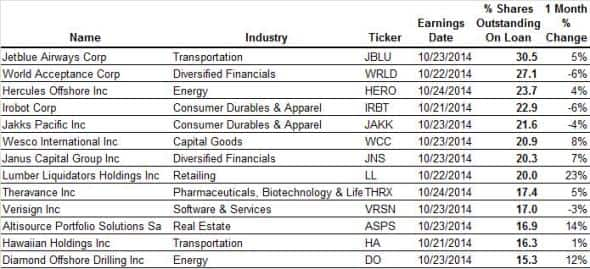

While last week's market turmoil saw earnings take second place in the headlines, the third quarter earnings season continues in earnest next week. Of the 200 firms announcing results across the region next week, 15 see heavy shorting activity with more than 15% of shares out on loan.

The most shorted company worldwide announcing results next week is budget carrier Jetblue Airways, which had just over 30% of its shares out on loan ahead of Thursday's earnings announcement. Demand to borrow shares in this company looks to be partly driven by its large stock of convertible debt which is susceptible to make a large part of the short base arbitrage driven rather than directional. This looks to be reinforced by the fact that the recent market stumble appears to have benefited US airlines as the cost of oil now hovers at five year lows; this has seen airlines shares outperform the market in recent days.

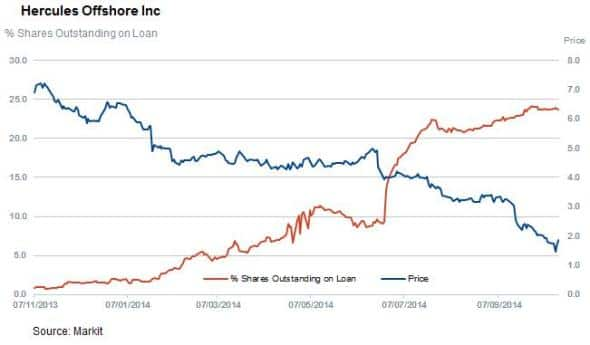

One set of firms lamenting the recent collapse in the price of oil are offshore drilling companies, which stand to see the demand for their relatively high production methods come out of favour as oil exploration firms lose the incentive to invest in new capacity. This trend sees two oil drilling rig operators make this week's most shorted firms ahead of earnings. More shorted of the two is Hercules Offshore which has 23.7% of shares out on loan, followed by Diamond Offshore with 15.3%. Both firms have seen shorts add to their positions in the last four weeks in the wake of large price tumbles.

The largest increase in shorting activity ahead of earning was seen in Lumber Liquidators, which has seen demand to borrow shoot up to 20% of shares outstanding in the last few weeks. Last time around the company announced worse than expected guidance which saw shares fall by over 25%.

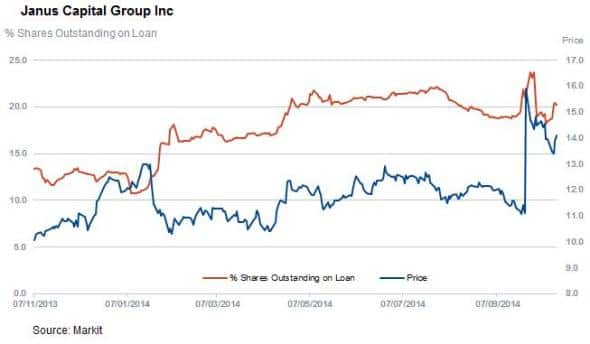

Another firm which has seen shorts hold steady in the last few weeks is Janus Capital which has seen shorts jump by 7% in the last month to take it near the highs seen prior to it announcing that Bill Gross was joining the firm. While shorts had covered in the days immediately following the announcement, which sent its shares up sharply, they have returned to their pre-Gross highs in the last month.

Europe

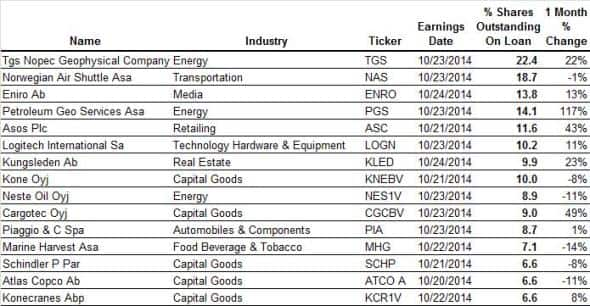

Europe also sees strong earnings activity next week with eight firms announcing results with over 3% of their shares out on loan.

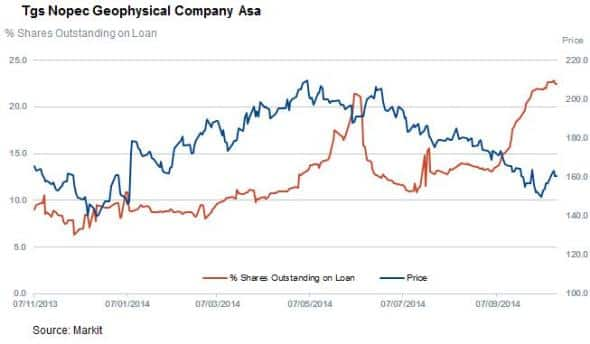

The oil price collapse looks to be driving European short sellers as well, with two firms that provide geological consulting to oil drillers coming in among the most shorted firms. This includes TGS Nopec which has 22.4% of shares out on loan making it the most shorted company announcing results in Europe this week. TGS's competitor, Petroleum Geo Services also makes the most shorted list after seeing its short interest double in the last month to 14.1% of shares outstanding.

Capital foods firms make up the largest sector within the most shorted firms in the region as questions linger about the state of growth in Europe and abroad. The firms that short sellers expect to face headwinds by the recent developments are Finnish crane and heavy equipment firms Kone, Cargotec, and Konecranes, along with Shindler in Switzerland and Swedish firm Atlas Copco.

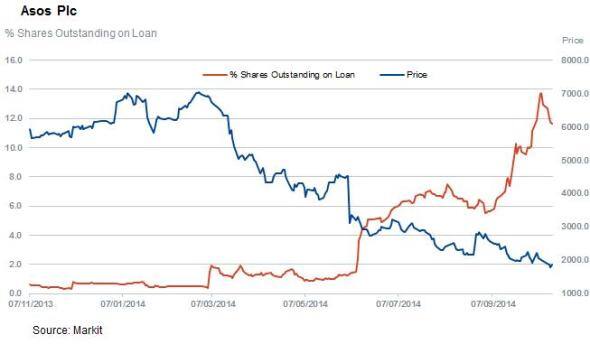

The one UK firm to make the most shorted list is web fashion retailer Asos, which has seen shorts redouble in the wake of poor earnings and a warehouse fire which has hurt operations. These events have driven the firm's sales to the lowest level in over two years while short interest surged to a new all-time high.

Asia

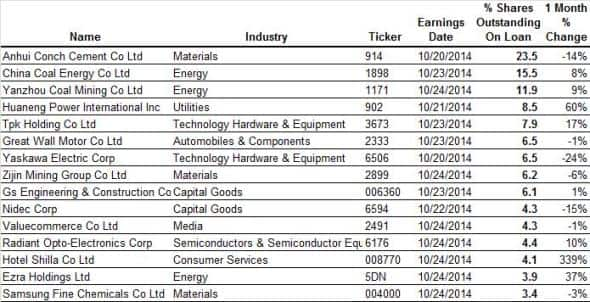

In Asia, Hong Kong-based firms continue to make up the largest group of shares seeing heavy demand to borrow in the early stages of this earnings season, with six of the 15 companies with more than 3% of shares out on loan ahead of results.

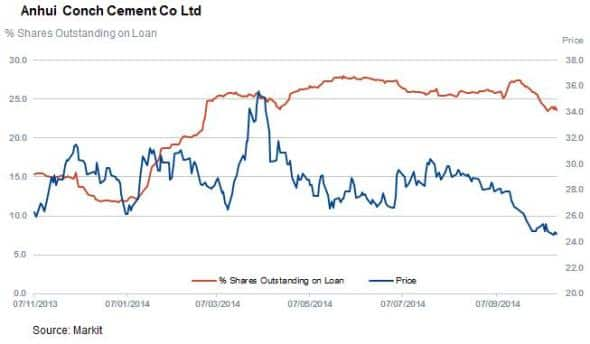

This is led by Anhui Conch Cement which has 23.5% of shares out on loan ahead of results. The firm has proved a tough short since the start of the year, but China's weakening growth rate looks to have proven short sellers right in the end as its shares have recently fell to new yearly lows.

wo other Hong Kong perennial shorts round out the three most shorted Asian firms ahead of results as China Coal Energy and Yanzhou Coal both see 15.5 and 11.9% of shares out on loan respectively.

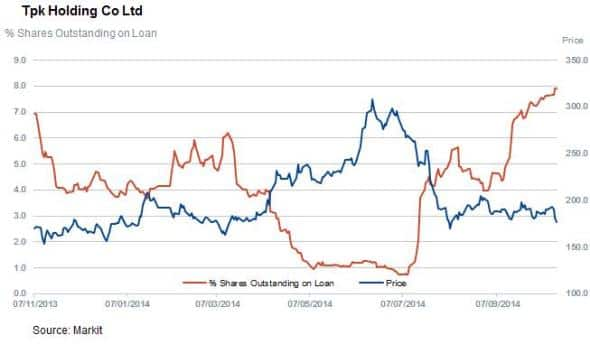

Outside of Hong Kong, Taiwanese firm Tpk Holding sees just under 8% of its shares out on loan, a number that has grown by 17% in the last couple of weeks in the wake of Samsung's disappointing smartphone sales.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f17102014-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}