Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 16, 2015

Commodities glut spurs on metals shorts

Weak global demand for metals has seen metal and mining firms come under pressure in the run up to the first quarter earnings season.

- Metals & mining sinks to bottom of latest Markit Sector PMI, driven by weak Asia demand

- SPDR metals ETF constituents have 7.5% of shares out on loan on average; an 18 month high

- Firms exposed to steel have been predominate targets for short sellers since January

Metals and mining shares have come under pressure in the opening months of 2015 as the price of steel, copper and aluminium all hit multi year lows. This price slump is reflective of declining global demand, which has seen materials shares come under pressure heading into the first quarter earnings season. Steel and metals & mining shares lead the basic materials sector's earnings revisions over the last three months.

Bottom of the PMI pile

These analyst downgrades coincide with a steep tapering off in output over the last two months, according to the March release of the Markit Sector PMI. Metals & mining respondents indicated the steepest fall in output since May 2013; marking the second month in a row that responding companies indicated a fall in output. This sharp fall in output put metals and mining shares at the bottom of the 23 global sectors which make up the global sector universe for the second month in a row.

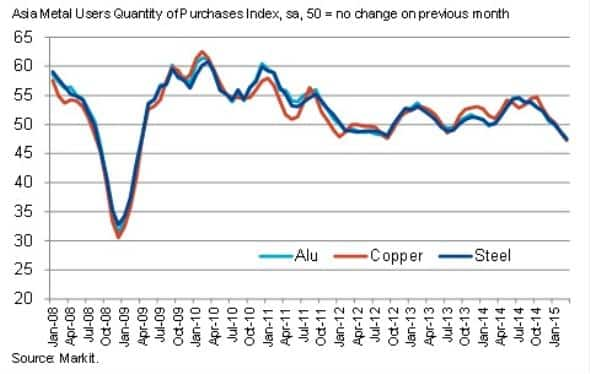

This weak output shows no signs of easing as Asian appetite, which accounted for much of the demand for metals over the last few years, has fallen steeply in recent months. Asian companies which rely heavily on steel, copper or aluminium all reported the steepest drop in input demand in six years in March, which no doubt compounded the recent price slump.

Materials: bearish heading into earnings

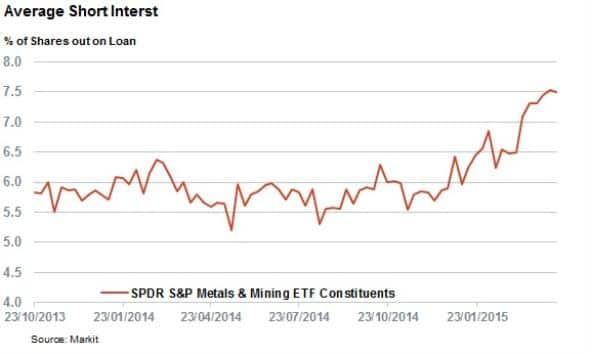

This slump in output has been felt by actors in the metals & mining sector, exemplified by the severe underperformance seen in the SPDR S&P Metals & Mining ETF. The fund has fallen by nearly 10% since the start of the year, with its total return trailing the S&P 500 by 12.1%.

Short sellers have paid attention to this relative underperformance, as the 32 constituents of the ETF have seen their average short interest increase by 20% since January, taking shorting activity to the highest level in over 18 months. This surge in bearish sentiment means the group of shares now has over 7.5% of its shares out on loan on average, as opposed to 2% in the S&P 500.

The surge in demand to borrow has been pretty evenly spread out across the ETF constituents. The number of firms seeing short interest climb has outnumbered those seeing covering by three to one.

Betting against steel

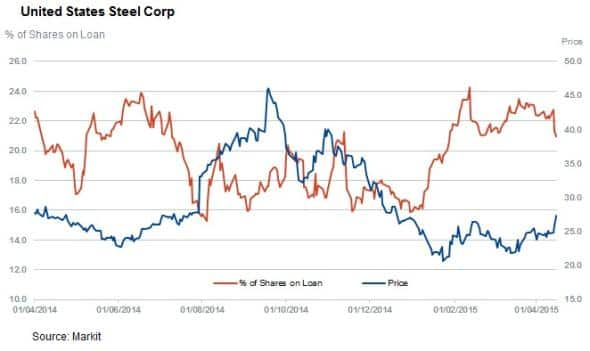

Despite the fairly even distribution of short interest across this group of shares, short sellers have largely concentrated on steel firms. The four most shorted SPDR S&P Metals & Mining ETF constituents are steel firms, which all see more than 17% of shares out on loan.

Short interest within steel firms is led by metallurgical coal firms Cliffs and Peabody Energy which both have more than a quarter of their shares out on loan.

On the pure play steel front, US Steel has seen shorts sellers redouble attentions over the last three months after analysts trimmed their EPS forecast by over 80%.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Equities-Commodities-glut-spurs-on-metals-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Equities-Commodities-glut-spurs-on-metals-shorts.html&text=Commodities+glut+spurs+on+metals+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Equities-Commodities-glut-spurs-on-metals-shorts.html","enabled":true},{"name":"email","url":"?subject=Commodities glut spurs on metals shorts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Equities-Commodities-glut-spurs-on-metals-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Commodities+glut+spurs+on+metals+shorts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Equities-Commodities-glut-spurs-on-metals-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}