Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 16, 2015

Markets shrug off Greek risk in wake of QE

Seven years on from the global financial crisis, the market's risk perception of European credits returns to pre-crisis levels.

- ITRAXX-Europe 5-yr spread now at December 2007 levels

- Volatility in Europe's credit markets has dropped since ECB QE announcement

- European markets appear unfazed by neighbouring Greek and Ukraine problems

This week the IMF released its latest economic outlook, with Euro area growth projections for 2016 receiving an update 0.2% higher than forecast at the start of the year. Since the ECB decided to expand its nonstandard monetary policies and announced sovereign bond QE in January, the eurozone has accelerated its path to recovery. As a result, there has been a notable pickup in demand for credit, while medium term inflation expectations are returning to normality.

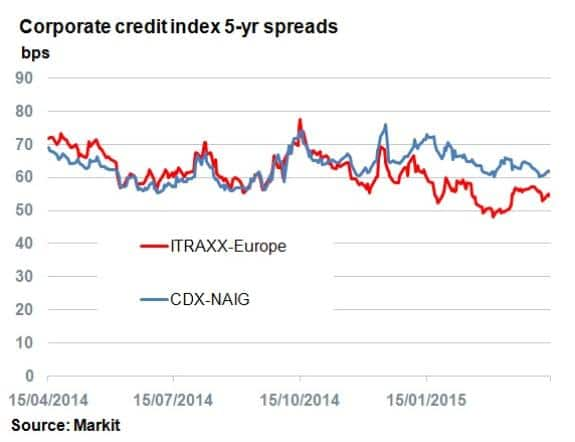

The ECB held its latest policy meeting this week and president Mario Draghi was quick to highlight Europe's progress. Risk in credit markets has been declining ever since Draghi's famous "whatever it takes" speech in July 2012, with the ITRAXX-Europe Main descending steadily from a spread of 180bps in July 2012 to 54bps as of the latest EOD price. Credit risks attached to European corporations haven't been this low since December 2007, highlighting the extent to which market participants have regained confidence in Europe's credit markets.

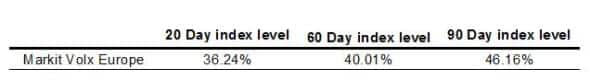

Volatility in the credit derivatives market has also been suppressed. The Markit Volx, which tracks realised volatility and is based on the ITRAXX-Europe, has seen volatility drop from a rolling 90 day average of 46.15% to 36.24% over the last 20 trading days.

Interestingly, European credit has been largely unfazed by regional geopolitical risks. Reignited fears over a Greek euro exit have reached fever pitch with 5-yr CDS spreads reaching 50% upfront, the highest at any point this year, yet fears of contagion among core Europe have been largely shrugged off.

This marks a stark contrast to the reaction seen in 2011-2012, when periphery Europe was engulfed in a sovereign debt crisis. Meanwhile in Eastern Europe, Russia's next move remains a mystery following its controversial intervention in neighboring Ukraine, leaving the country's credit spreads implying a 93.5% chance of defaulting in the next year. While the knock on effects remains unclear, Russia has seen its own economy recovering even as western sanctions hold firm.

It remains to be seen whether European credit spreads tighten further amid the improving economic backdrop. A comparison to a similar situation seen in the US would indicate so, as US corporate spreads tightened past their European peers when the country was undergoing its own QE exercise.

That trend has since reversed in the wake of European QE. The spread difference between the ITRAXX Europe and CDX-NAIG started to diverge in November last year and has further increased from 3bps to 7bps year to date.

With US credits' stumbling over the last few months, in part due to the strong dollar, weak oil prices and interest rate uncertainty, QE has helped European credit spreads tighten below their US peers.

This tightening is driven partly by the mix of index constituents as the CDX is much more exposed to struggling oil names such as Transocean, Parker Drilling and Chesapeake, as well as Ukraine and Venezuela, with the single names dragging the CDX down. Its European ITRAXX peer is much less exposed to the sector and has much more exposure towards banks and consumer services for example; names which have benefited from the recent ECB action.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Credit-Markets-shrug-off-Greek-risk-in-wake-of-QE.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Credit-Markets-shrug-off-Greek-risk-in-wake-of-QE.html&text=Markets+shrug+off+Greek+risk+in+wake+of+QE","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Credit-Markets-shrug-off-Greek-risk-in-wake-of-QE.html","enabled":true},{"name":"email","url":"?subject=Markets shrug off Greek risk in wake of QE&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Credit-Markets-shrug-off-Greek-risk-in-wake-of-QE.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Markets+shrug+off+Greek+risk+in+wake+of+QE http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f16042015-Credit-Markets-shrug-off-Greek-risk-in-wake-of-QE.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}