Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 12, 2016

Market volatility sparks risk off trades

A tumultuous week in global financial markets saw safe haven government bond yields continue their descent to zero, while UK government credit risk soars.

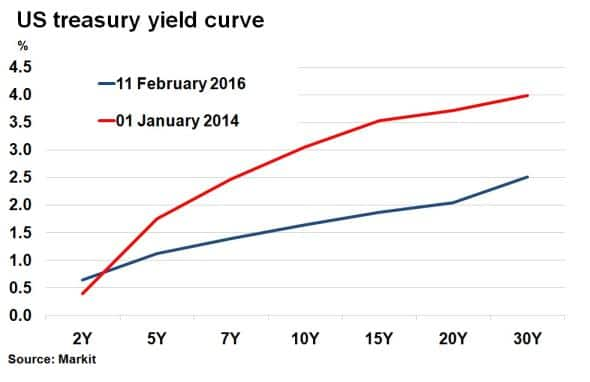

- The yield difference between 2-yr and 10-yr US treasuries has closed to less than 100bps

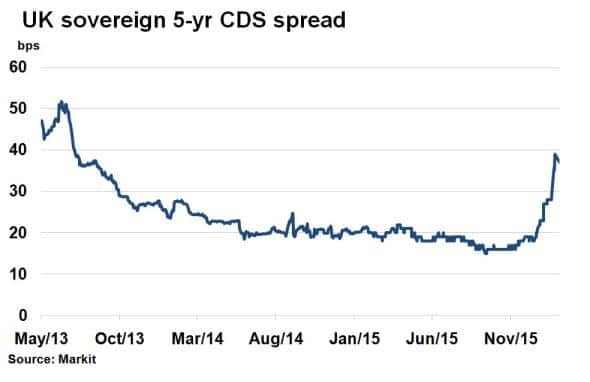

- UK 5-yr sovereign CDS spread has doubled in 2016 and is now at its widest since July 2013

- Markit's Research Signals factor platform have put out new alerts on two Russian banks

Risk off

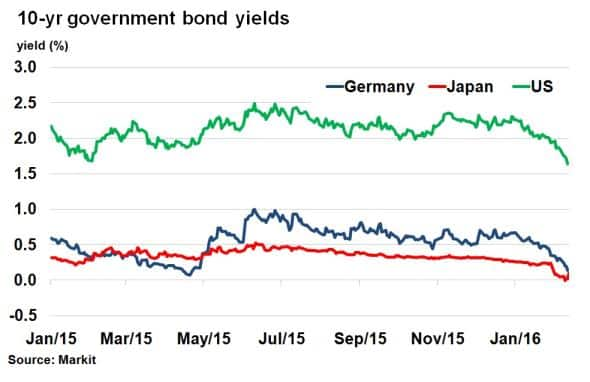

Continued volatility in financial markets saw safe haven government bond yields continue their 2016 decent. Japan's introduction of negative interest rates two weeks ago sent Japanese 10-yr bond yields spiralling downwards and they turned negative this week.

The prospect of negative interest rates in the US was also mentioned in Fed Chair Janet Yellen's most recent testimony to congress, adding further pressure to US treasury yields. 10-yr US treasury yields slid to 1.64% as of yesterdays close, 63bps tighter than at the start of the year according to Markit's bond pricing service.

Over the past two years continued suppression on the long end of the US treasury curve coupled with higher rates on the short end has flattened the curve significantly. The movement has left the yield difference between 2-yr and 10-yr US treasuries close to less than 100bps, typically seen when the bond market signals economic weakness.

Elsewhere, German 10-yr bunds yields have fallen to within the 6bps of all-time lows of 0.07% seen last April. This is due mainly to market turmoil led by banks recently, which in turn has led investors to believe more will be done by the ECB to stimulate the economy in March.

Brexit and banks

British banks have seen around 20% wiped out in value so far this year and have also seen their cost to insure against default rise two fold. Official statistics this week also showed a widening trade deficit as volatile markets and slowing emerging markets hit exports.

All of this has not boded well for the UK's sovereign 5-yr CDS spread, which widened a further 7bps this week to 37bps. The UK's perceived credit risk has now doubled in 2016, the widest level since July 2013 according to Markit's CDS pricing service. Add to the mix the uncertainty surrounding a possible 'Brexit' later this year and investors are hedging their risks.

Russian Banks

The Leading Risk Indicators within Markit's Research Signals factor platform have put out three new alerts on banks today, citing the possibility of further credit deterioration. Deutsche, VTB Bank PJSC and Russian Agricultural Bank appear on the list.

VTB Bank's 5-yr CDS spread has widened to nearly 500bps having once been near 380bps last December. Russia, which acts as a backstop for the bank, recently stated it wanted to reduce its majority owned stake. Russian Agricultural Bank presents a similar conundrum, state owned but also barred by western sanctions from raising long-term financing in foreign capital markets.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-credit-market-volatility-sparks-risk-off-trades.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-credit-market-volatility-sparks-risk-off-trades.html&text=Market+volatility+sparks+risk+off+trades","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-credit-market-volatility-sparks-risk-off-trades.html","enabled":true},{"name":"email","url":"?subject=Market volatility sparks risk off trades&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-credit-market-volatility-sparks-risk-off-trades.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Market+volatility+sparks+risk+off+trades http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-credit-market-volatility-sparks-risk-off-trades.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}