Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 11, 2016

Dividend conundrum in store for big oil

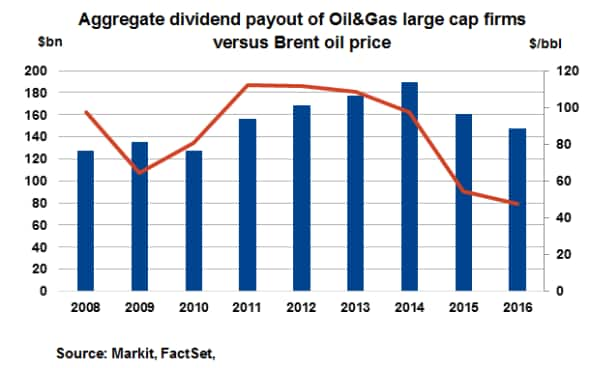

Despite being set to fall by a quarter from the highs seen in 2013, the dividend payments made by large cap oil and gas firms have proven relatively resilient, but for how long?

- Global oil & gas dividends set to fall by $12bn in 2016 as supply glut continues

- Risks to blue chip oil dividends increase as pay-out ratios surge as earnings dwindle

- Credit rating has taken precedence to dividends in recent dividend shakeup

Markit Dividend Forecastinghas released a report highlighting Global Oil & Gas Dividend expectations in 2016. For the full report please contact us.

The global oil oversupply has continued in the face of a sustained fall in capital expenditure as oil firms are continuing to pump out oil at record pace. This has seen the price of a barrel of oil fall to its lowest level in 12-years as the IEA reported that the glut of oil is far larger than previously anticipated which; sobering news for even the largest oil producer.

While exploration, high cost and generally smaller sized firms have been less equipped to ride out the collapse in prices, large caps are now in focus, as industry watchers start to warn of a longer downturn than previously thought.

The dismal picture is now starting to filter through to dividend policies with Markit Dividend Forecasting expecting global dividends from large oil & gas companies (above $10bn in market cap) to decline by 9% to $147bn in 2016. This adds to last year's decline which means that dividends in 2016 are forecasted to be 22% off their 2014 peak.

However, these sustained falls in dividend payments have been far less pronounced than the collapse in crude. The surging pay-out ratios and yields as well as the lack of dividend declines may indicate that oil majors are adopting the 'sit and wait' strategy in anticipation of a near term rebound in oil prices.

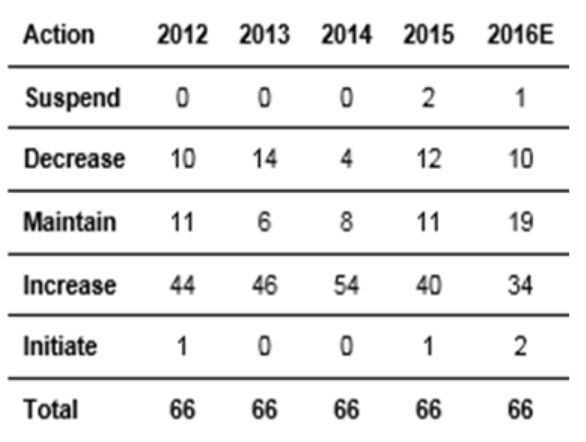

Of the above universe of large oil & gas firms, Markit expects 10 companies to cut dividends in 2016 on top of 12 that had already trimmed payments in 2015. Astonishingly, half of companies are expected to to increase dividends. Almost double the amount of firms in 2016 is expected maintain payments compared to 2015 as firms attempt to ride out the low prices.

Keeping the dividend taps on

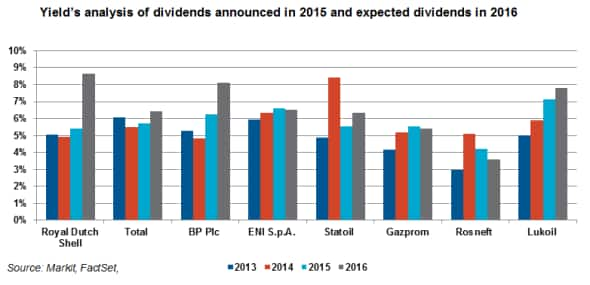

A large part of this relatively optimistic strategy rests on higher near term prices driven by an easing of the supply glut seen in recent months. Pay-out ratios from Europe's ten largest payers now stand at a massive 88% which highlights the precarious positions of current dividend policies should low prices continue.

Yields across the region are also way above their previous levels which could give producers some breathing space should they wish to trim payments.

Debt before dividends

Anadarko Petroleum (APC) slashed its dividend by over 80% to $0.05 to preserve cash and focus on maintaining its investment grade rating.

Ironically, Anadarko's decision to cut its dividend payments has opened the door for short sellers as its decision to slash its dividend saw demand to borrow its shares surge to 1.6% of shares outstanding.

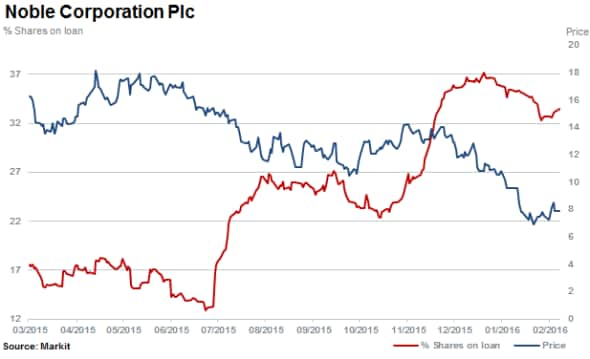

Noble Corporation is another firm tipped to revisit this dividend policy in the quarter and continues to see more than a third of its shares outstanding on loan.

Marathon Oil who has already reduced dividends and sold off assets is expected to take further action if the current conditions persist, including suspending the dividend altogether. A recent spike in short interest to 5.3% indicates short sellers may be anticipating a cut.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Equities-Dividend-conundrum-in-store-for-big-oil.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Equities-Dividend-conundrum-in-store-for-big-oil.html&text=Dividend+conundrum+in+store+for+big+oil","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Equities-Dividend-conundrum-in-store-for-big-oil.html","enabled":true},{"name":"email","url":"?subject=Dividend conundrum in store for big oil&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Equities-Dividend-conundrum-in-store-for-big-oil.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dividend+conundrum+in+store+for+big+oil http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022016-Equities-Dividend-conundrum-in-store-for-big-oil.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}