Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 12, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Rex Energy leads oil and gas shorts as oil weakness continues

- Anglo American seeing record short interest as shares rally

- Australian mining and oil & gas firms dominate Apac: Dividend suspension forecast for nickel producer Western Areas

North America

Most shorted ahead of earnings in North America is Rex Energy Corp which this week suspended its preferred dividend in order to improve cash flows. Shares have plummeted 84% in the 12 months since last featuring as the most shorted stock in North America ahead of earnings. Short sellers have however become more invigorated as of late, with shares out on loan increasing 20% year to date, currently at 43% of shares outstanding on loan.

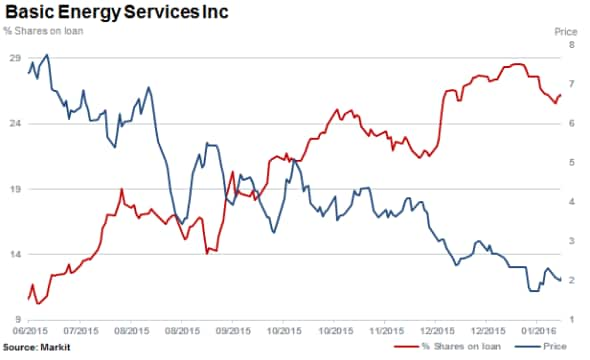

Second most shorted, servicing the US oil gas sector with just over a quarter of its shares currently shorted is Basic Energy Services. It too has suffered, with shares falling almost 80% in the last 12 months as oil and gas operations nationwide have been scaled back.

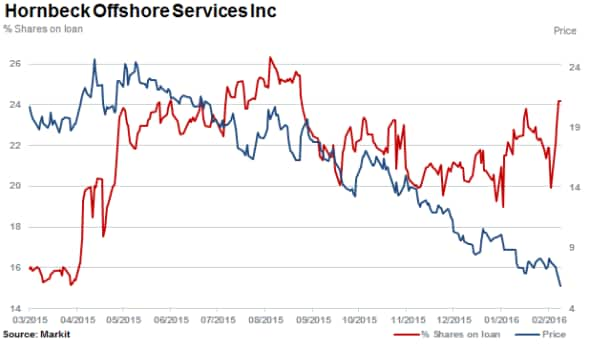

In third place is Hornbeck Offshore Services with nearly a quarter of shares currently sold short. The shipping firm is also currently the most shorted stock in the shipping industry globally. The company has 'stacked' almost half its vessels that are uniquely designed to service the offshore exploration activities in the Gulf of Mexico.

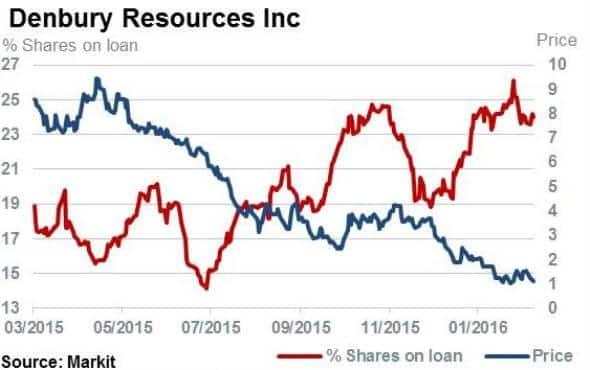

Suspending its quarterly dividend in the third quarter of 2015 is Denbury Resources with 24% of shares outstanding on loan. The company's shares have lost almost 90% in the last 12 months.

Europe

Most shorted ahead of earnings in Europe is Vallourec SA with 19% of shares outstanding on loan. The French based company manufactures tubular solutions primarily destined for the energy and industrial sectors. Shares in Vallourec have declined by 84% in the last 12 months.

Second most shorted company ahead of earnings this week in Europe is FTSE 100 constituent Anglo American which is battling arguably its toughest operating period in its 99 year history.

Diversified miners continue to struggle with decade low commodity prices and in a speech this week in Anglo American CEO Mark Cutifani said "business as usual is no longer an option - business as usual means some will go out of business". Short sellers are in agreement, with an all-time high of 18% of Anglo American shares currently sold short. The stock has however been seen rallying, up 15% in the past two weeks alone. However, including recent rise the stock is still down some 75% over the past 12 months.

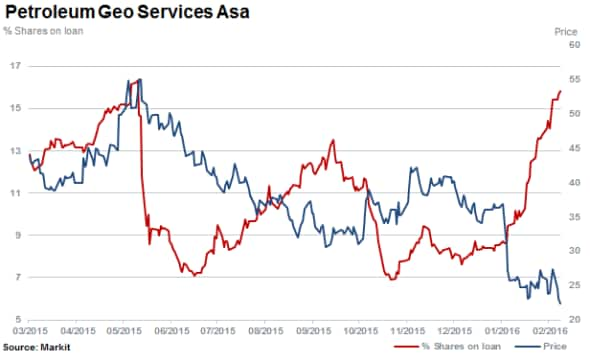

Third most shorted in Europe is Petroleum Geo Services. The marine geophysics company has seen an 81% increase in shares outstanding on loan since the start of the year reaching 15.4% currently.

Apac

Most shorted ahead of earnings this week in Apac is Monadelphous Group with 22% of shares outstanding on loan. The heavy civil and engineering firm is currently involved in a number of large scale energy and resources projects in Australia. Short interest has increased almost 100% in the last 12 months while the stock has declined by 40%.

Australian contract miner Mineral Resources is the second most shorted in Apac with 17% of shares outstanding on loan. Short sellers had been covering in the miner as shares declined in 2015; down 50% over the last 12 months. However since November 2015, short interest has increased by almost a quarter as weaker commodity prices persist.

Third most shorted in Apac is Westerns Areas with 14% shares out on loan. The Australian miner of has seen shares fall half in the last 12 months. MarkitDividend Forecastingexpects a suspension in the company's dividend due to the firms' cash balance halving to AUD 29.9m as of Q2 FY16 from AUD 59m in Q1, driven by payment for the Cosmos Nickel Complex in 2015.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}