Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Nov 05, 2024

By Matt Chessum

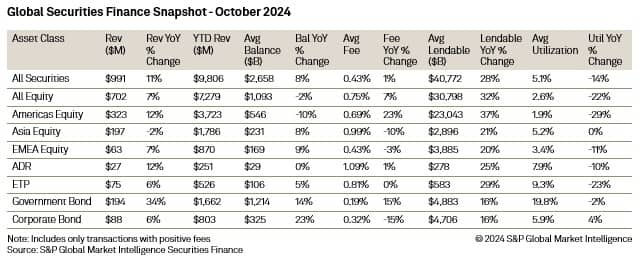

In the securities lending markets October revenues reached $991 million, reflecting an 11% year-over-year increase. Average balances grew by 8% year-over-year as lendable securities expanded significantly, increasing by 28% YoY to $40.77 trillion.

In the equity sector, revenues remained strong, rising 7% year-over-year to $702 million. Although balances saw a slight decline of 2% year-over-year, the 7% increase in average fees mitigated any negative impact from this decrease. However, utilization rates fell by 22% year-over-year to 2.6%. Compared to September, equity lending showed improvement, with revenues increasing by 3% and average fees rising by 8%.

Revenue growth was observed across all equity regions except Asia in October. In the Americas, equity revenues surged by 12% year-over-year, while EMEA revenues increased by 7% year-over-year, marking the largest comparative YoY growth observed in 2024. Significant revenue gains were noted in several countries, including France (+64%), Switzerland (+26%), Italy (+59%), Poland (+160%), and Greece (+115%). Conversely, Asian equity revenues dipped 2% year-over-year to $197 million, primarily due to declining average fees across most markets.

Exchange-traded products (ETPs) and depositary receipts also recorded year-over-year revenue increases of 6% and 12%, respectively, bolstered by rising balances in ETPs and higher average fees across depositary receipts.

In the fixed income markets, government bonds outperformed, achieving their strongest monthly revenues year-to-date. Year-over-year revenues surged 34%, with month-on-month revenues slightly increasing from $192 million to $193 million. Average fees rose from 18 basis points in September to 19 basis points in October, driven by heightened borrowing of U.S. Treasuries ahead of the presidential election and a recalibration of bond yields.

Corporate bonds also posted their highest revenues year-to-date, marking the first monthly year-over-year increase in revenues. Average fees climbed to 32 basis points from 30 basis points, with utilization rising to 5.87%. The growing demand for corporate bonds, fuelled by high issuance and increased liquidity needs, has further supported this trend.

As the market entered the final quarter of the year, securities lending revenues remained robust. Thematic investment strategies linked to the U.S. presidential election, anticipated interest rate changes, and ongoing geopolitical tensions continue to benefit lenders. October's notable volatility in both equity and bond markets positions the securities lending market for a strong finish, with year-to-date revenues currently at $9.806 billion, suggesting another year of solid returns ahead.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.