Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 09, 2015

Vietnam outperforms regional neighbours in early-2015

The Vietnamese economy enjoyed a solid first quarter of 2015 as official data showed GDP rising 6.0% year-on-year and manufacturing PMI data, produced by Markit for HSBC, signalled ongoing expansion. Data also continued to point to downward pressure on prices, mainly linked to reduced fuel costs.

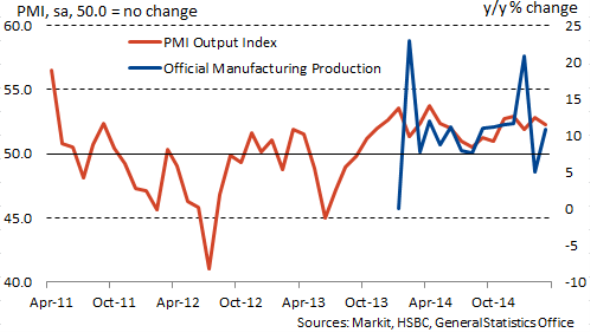

According to March PMI data, manufacturing output increased for the eighteenth successive month, and at a solid pace. Survey respondents reported a general improvement in client demand, causing new business to expand for the seventh month in a row. While the trend in the official manufacturing production data is distorted somewhat by the Tet festival celebrations, the underlying trend implied by the PMI data is one of solid growth during the first quarter of 2015.

Sustained growth of manufacturing output

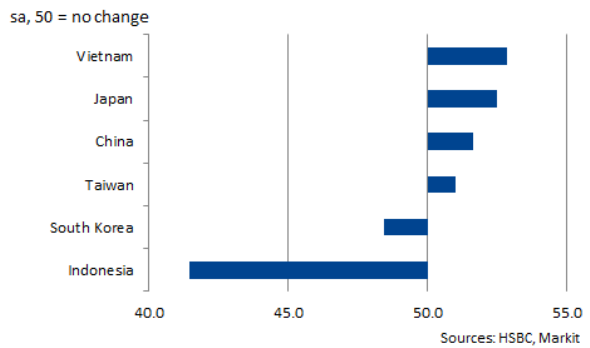

Solid growth in Vietnam contrasts with weaker trends seen in other parts of South East Asia. In fact, March saw Vietnam's manufacturing output expand more quickly than all other South East Asian countries covered by Markit's PMI surveys, with outright contractions registered in Indonesia and South Korea.

Manufacturing PMI Output Indices, March 2015

One factor potentially helping Vietnam's outperformance relative to its neighbours could be the mix of countries that its firms export to. While countries such as South Korea and Taiwan see around one-quarter of their exports heading to China, for Vietnam the figure is just 10%, with the US and EU accounting for larger shares of export sales. With the PMI data for China showing the economy struggling to build momentum, this diversity may be helping Vietnamese firms.

That said, the recent weakness of the euro will make exports to the eurozone harder to secure, as the Vietnamese dong's peg to the US dollar could see manufacturers in Vietnam losing price competitiveness.

Input costs falling sharply

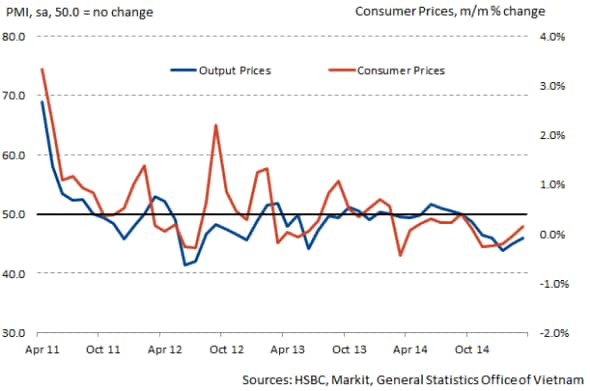

A key feature of the PMI data in recent months has been falling prices. Input costs decreased for the fifth successive month in March, dropping at a sharp pace. Similarly, firms continued to reduce the prices they charge their customers during the month. This is in line with the official consumer price data, which pointed to largely unchanged prices month-on-month in March, with inflation of just 0.9% year-on-year.

PMI Output Prices v Consumer Price Inflation

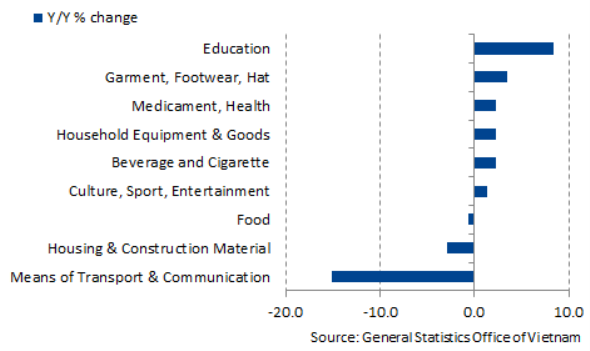

Falling prices were often attributed by panellists to lower fuel costs, and this is backed up by sector inflation data which shows prices for the 'Means of Transport & Communication' sector down some 15.2% over the year to March. That said, after a number of cuts, the Vietnam National Petroleum Group (Petrolimex) raised fuel prices in March, and an increase in environmental taxes on fuel products is set to be implemented in May. These factors may lead to some inflationary pressure returning in coming months.

Vietnamese Consumer Prices by sector

Firms in Vietnam will hope that their efforts to maintain competitiveness will help them to continue to secure new business in coming months, extending the current sequence of production growth. The next release of the HSBC Vietnam Manufacturing PMI report will be on 04 May, covering data for April.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-economics-vietnam-outperforms-regional-neighbours-in-early-2015.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-economics-vietnam-outperforms-regional-neighbours-in-early-2015.html&text=Vietnam+outperforms+regional+neighbours+in+early-2015","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-economics-vietnam-outperforms-regional-neighbours-in-early-2015.html","enabled":true},{"name":"email","url":"?subject=Vietnam outperforms regional neighbours in early-2015&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-economics-vietnam-outperforms-regional-neighbours-in-early-2015.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vietnam+outperforms+regional+neighbours+in+early-2015 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-economics-vietnam-outperforms-regional-neighbours-in-early-2015.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}