Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 09, 2015

Week Ahead Economic Overview

First quarter GDP data are updated in China, while the European Central Bank announces its latest monetary policy decision. Labour market data are meanwhile released in the UK, while industrial production, retail sales and inflation figures are highlights in the US.

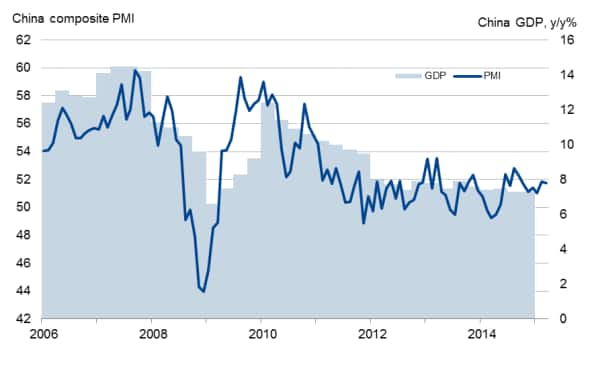

One of the data highlights of the week is undoubtedly the release of first quarter GDP data for China, alongside retail sales, industrial production and investment data. The authorities have set a lower growth target of "around 7%" for 2015 compared to 7.5% in 2014, which would be the lowest expansion for quarter of a century. However, even this lower target looks to be in jeopardy: the latest HSBC Composite Output Index signalled only modest increases in activity at both manufacturers and service providers and employment fell for the first time in six months. This weakness of the survey data suggests that the authorities will seek to address the slowdown.

China GDP and the PMI

Sources: Markit, HSBC, Ecowin.

No change is meanwhile expected at the European Central Bank's latest monetary policy meeting. With the ECB's policy of quantitative easing under way, the eurozone's economy is already seeing signs of improvement. Survey data showed the pace of economic growth in the region picking up speed in March, with the Composite PMI the joint-highest since the first half of 2011. While the PMIs are currently indicating GDP growth of around 0.3%, the important message from the survey is that the pace of expansion looks set to gather pace in coming months.

Industrial production and inflation data are also updated for the currency union, and are expected to add to the flow of good news. In January, industrial output rose 0.1% and PMI data signalled that the manufacturing upturn gathered further momentum in March.

Eurozone inflation slipped to -0.6% at the start of the year but then eased to -0.1% in March according to flash data.

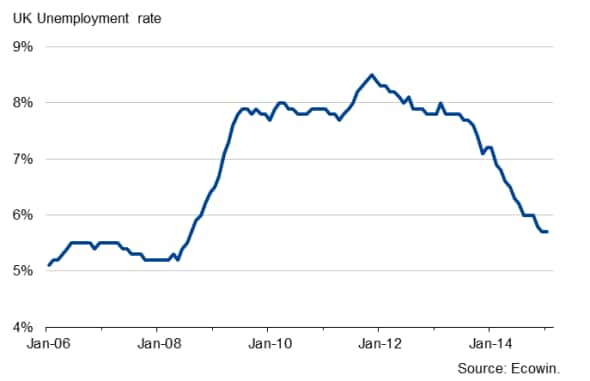

In the UK, a labour market update and inflation numbers will be the highlights of the week. Last month's data from the Office for National Statistics showed employment rising further in the three months to January, with the unemployment rate holding steady at 5.7%. However, average weekly earnings rose just 1.8% on a year ago, dipping from 2.1% at the end of last year. A survey of just under 1,000 UK employees furthermore shows an ongoing lack of pay pressures in the economy, with employee earnings expected to rise by just 1.1% in 2015. PMI data meanwhile showed that employment growth remained close to record highs in recent months, suggesting that we should expect another positive labour market report, albeit with disappointing pay data.

UK unemployment rate

UK inflation is meanwhile likely to fall into negative territory for the first time on record, having already slipped to zero in February.

With policymaking in the US 'data dependent', all eyes will be on industrial production and inflation updates. The minutes from the latest FOMC meeting showed policymakers split on whether to start hiking rates in June or use current low inflation as a reason to wait until later in the year, or even 2016, amid uncertainty over the health of the US economy. Industrial production and retail sales both fell for a third successive month in February, providing some of the key causes of concern. However, PMI data showed that the US manufacturing sector regained momentum in March after a slow start to the year. Any rebound in the official data will add to calls for an early rate rise.

US manufacturing output and the PMI

Monday 13 April

The England & Wales Regional PMI is released alongside the Bank of Scotland and Northern Ireland PMI.

Trade balance data are issued in China, while India sees the release of inflation numbers.

Italy sees the publication of industrial output figures and current account numbers are updated in France.

Tuesday 14 April

The latest UK Commercial Development Activity Report is released by Markit and Savills.

Business confidence data are meanwhile issued in Australia.

Wholesale price numbers are out in India and Germany.

Inflation figures are out in Italy, Spain and the UK, with the latter also seeing the release of BRC retail sales data.

Eurostat issues industrial production data for the currency bloc.

In Brazil and the US, retail sales numbers are updated, with the US also seeing the publication of the latest NFIB Business Optimism Index.

Wednesday 15 April

Consumer sentiment data are out in Australia.

China sees the release of first quarter GDP numbers, industrial output figures and retail sales data.

In India, M3 money supply information are published, while industrial production data are out in Japan and Russia.

Inflation numbers are meanwhile updated in France and Germany.

The European Central Bank and the Bank of Canada announce their latest monetary policy decisions, while the currency union also sees the release of trade data.

Industrial output numbers are issued in the US.

The OECD launches its Japan 2015 Economic Survey.

Thursday 16 April

The latest IPA UK Bellwether Report is published.

In Australia, labour market data are updated.

Meanwhile, Italy sees the release of trade balance numbers.

Initial jobless claims numbers and building permits data are out in the US.

Friday 17 April

Consumer confidence data are issued in Japan.

Russia sees the release of inflation numbers, retail sales figures and unemployment data.

The UK sees a labour market update, including wage data and the ILO unemployment rate.

Current account data and inflation figures are out in the eurozone.

Inflation numbers are also issued in Brazil, the US and Canada, with the latter also seeing retail sales data.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}