Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 09, 2015

UK trade deficit widens as exports fall to near four-and-a-half year low

UK exports slumped to their lowest in over four years in February as the strong exchange rate and weaker growth in the US appear to have hampered overseas sales. The data add to signs that the UK has become increasingly reliant on consumers in the home market to sustain the economic recovery, further confounding hopes of a rebalancing away from domestic consumption towards exports.

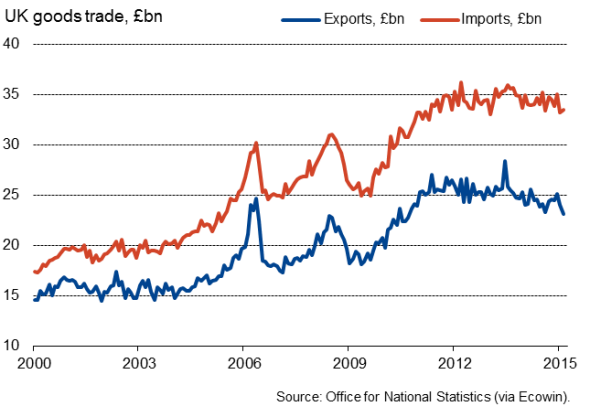

UK goods imports and exports

However, survey data suggest that the reviving eurozone and a renewed pick up in US economic growth will have helped boost exports in March, and lower oil imports are helping keep the deficit down. On this basis, the trade deficit should start to improve in coming months.

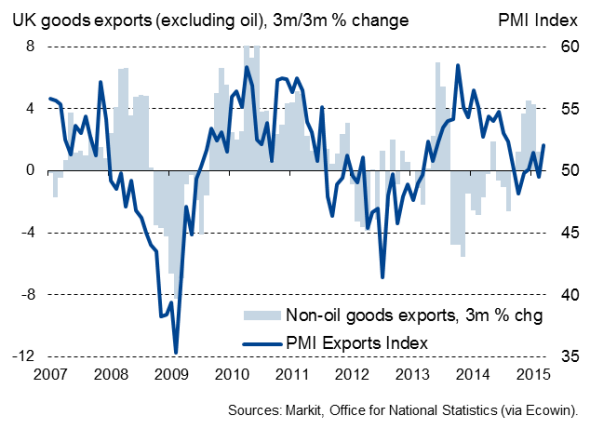

Survey and official export data

Trade deficit widens

Data from the Office for National Statistics showed the total value of UK goods exports dropping to "23.16bn in February, their lowest since September 2010. The ONS attributed the deterioration largely to weakened demand from the US.

The fall in exports caused the goods trade deficit to widen to "10.34bn, a seven-month high. If services are included, the deficit rose from "1.54bn to "2.86bn.

The trade data are volatile, however, and looking on a three-month basis the overall deficit has narrowed to "6.5bn, down from "6.9bn in the three months to November, aided by lower imports, which is in turn most likely linked to the slump in the price of crude oil since last summer.

Exports set to revive

Furthermore, exports look to have risen in March. PMI survey data showed the largest increase in overseas orders since last August. Although the strong pound continues to hamper the competitiveness of UK goods sold abroad (on a trade-weighted basis sterling is up 3% so far this year, with a 7% gain against the euro), the survey data indicate that the adverse currency impact is being offset by rising demand as the eurozone economy in particular revives. The eurozone PMI, a key indicator of economic growth, rose in March to signal a pace of expansion not exceeded since the first half of 2011. There are also signs of faster growth appearing in the US after the slowdown seen at the turn of the year, offsetting subdued growth across much of Asia and the rest of the Americas.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-UK-trade-deficit-widens-as-exports-fall-to-near-four-and-a-half-year-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-UK-trade-deficit-widens-as-exports-fall-to-near-four-and-a-half-year-low.html&text=UK+trade+deficit+widens+as+exports+fall+to+near+four-and-a-half+year+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-UK-trade-deficit-widens-as-exports-fall-to-near-four-and-a-half-year-low.html","enabled":true},{"name":"email","url":"?subject=UK trade deficit widens as exports fall to near four-and-a-half year low&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-UK-trade-deficit-widens-as-exports-fall-to-near-four-and-a-half-year-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+trade+deficit+widens+as+exports+fall+to+near+four-and-a-half+year+low http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09042015-Economics-UK-trade-deficit-widens-as-exports-fall-to-near-four-and-a-half-year-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}