Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 01, 2015

Dutch manufacturing adds to recovery hopes, bucks trend of wider Eurozone slowdown

PMI survey data showed the Dutch manufacturing economy growing at the fastest rate for three months in April, adding to evidence that the economy is building on last year's modest expansion. The upturn contrasts, however, with a worrying slowdown in the wider flash Eurozone PMI seen during the month.

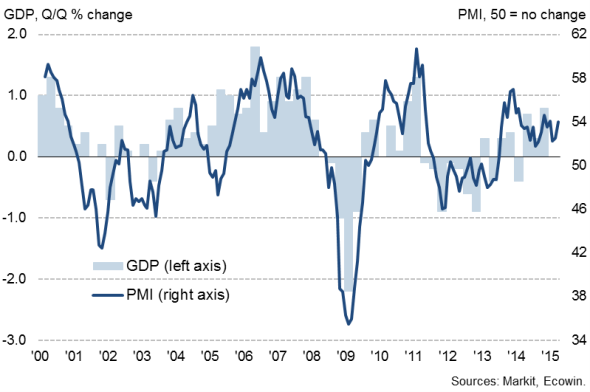

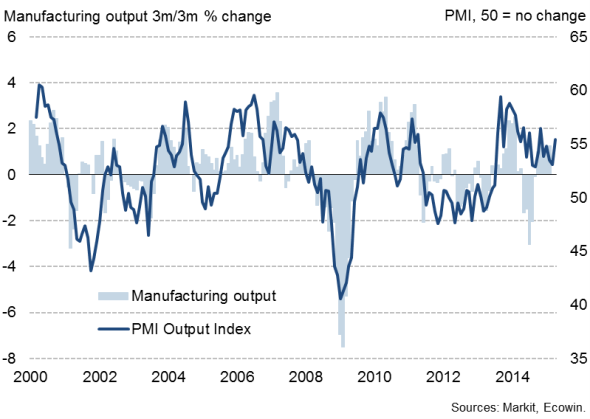

The rise in the headline NEVI PMI, produced by Markit, from 52.5 in March to 54.0 is roughly consistent with GDP growing at a quarterly rate of 0.5-0.6% at the start of the second quarter, representing an improvement after a 0.3-0.4% increase signalled by survey data in the opening quarter. Despite covering just manufacturing, the headline PMI acts as a reliable advance indicator of economic growth, exhibiting a correlation of 74% with quarterly changes in GDP since the PMI was introduced in 2000.

Netherlands NEVI PMI survey and economic growth

The survey therefore adds encouragement to expectations that the economy is set to build on the 0.7% expansion of GDP seen last year. GDP growth is forecast to accelerate to 1.4% this year and to 1.7% in 2016, according to European Commission forecasts.

The upturn is being fuelled by improvements in both domestic demand and export growth. Companies reported that new orders showed the largest monthly rise since January, buoyed in particular by rising exports orders. Factory output meanwhile grew at the strongest rate since November.

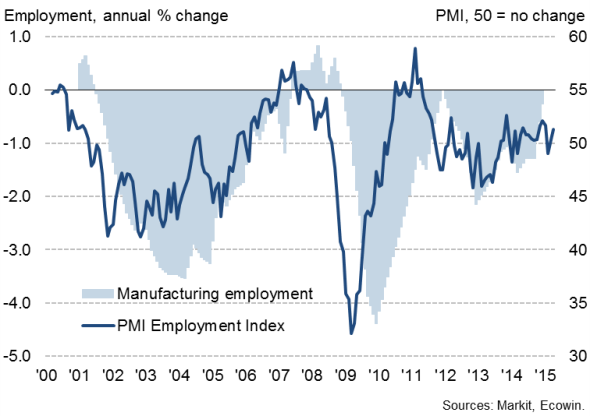

Improved hiring trend

The improved order book and production trends have prompted a change in hiring attitudes since earlier in the year. Whereas manufacturing headcounts were cut for the first time in almost a year in February as companies grew cautious amid a darkening business outlook, employment growth accelerated in April. However, although picking up, employment growth remains only modest and well below the rates of job creation seen in late-2010 and early-2011.

Netherlands NEVI PMI survey and employment

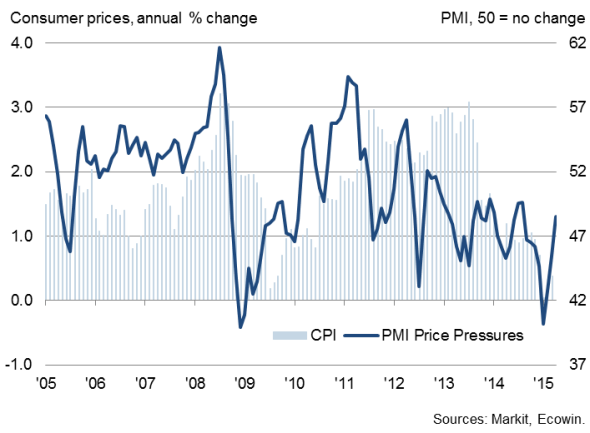

Price pressures revive

The survey also brought indications of deflationary pressures easing. Average prices charged for manufactured goods fell for the eighth time in the past nine months, though the decline was only very marginal. Furthermore, with input costs having jumped higher in April, rising for the first time since last August as busier suppliers were increasingly able to hike prices, inflationary pressures are reviving.

Consumer price inflation therefore looks set to increase further in April, having already picked up from zero in January to 0.4% in March.

Netherlands NEVI PMI price pressures* and inflation

* Price pressures index is derived from PMI suppliers' delivery times and input cost indices.

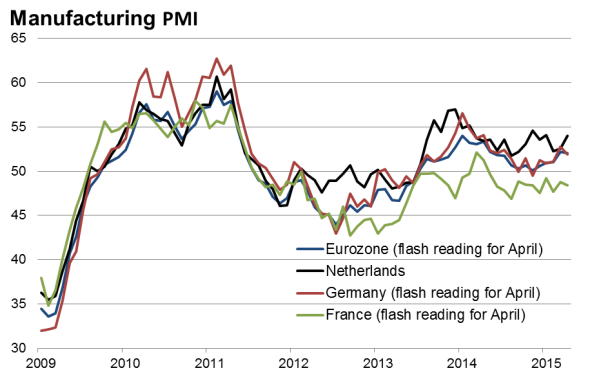

Upturn helps limit Eurozone slowdown

The upturn in the Netherlands bucked a disappointing trend of weakness seen in the PMI at the eurozone level. The Markit Eurozone Manufacturing PMI edged down from a ten-month high of 52.2 in March to 51.9 in April, according to the preliminary flash reading. The deterioration confounded widespread expectations that ECB stimulus would help the goods-producing sector build on the nascent upturn seen earlier in the year, benefitting in particular from the weakened euro.

The weakness in the flash Eurozone PMI was led by a slowing in the rate of growth in Germany and an accelerating downturn in France.

The Netherlands PMI has now signalled an outperformance of the country's manufacturing economy against that of the Eurozone as a whole in all month bar one since the start of 2012.

Source: Markit.

Netherlands NEVI PMI and manufacturing output

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-Dutch-manufacturing-adds-to-recovery-hopes-bucks-trend-of-wider-Eurozone-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-Dutch-manufacturing-adds-to-recovery-hopes-bucks-trend-of-wider-Eurozone-slowdown.html&text=Dutch+manufacturing+adds+to+recovery+hopes%2c+bucks+trend+of+wider+Eurozone+slowdown","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-Dutch-manufacturing-adds-to-recovery-hopes-bucks-trend-of-wider-Eurozone-slowdown.html","enabled":true},{"name":"email","url":"?subject=Dutch manufacturing adds to recovery hopes, bucks trend of wider Eurozone slowdown&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-Dutch-manufacturing-adds-to-recovery-hopes-bucks-trend-of-wider-Eurozone-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dutch+manufacturing+adds+to+recovery+hopes%2c+bucks+trend+of+wider+Eurozone+slowdown http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-Dutch-manufacturing-adds-to-recovery-hopes-bucks-trend-of-wider-Eurozone-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}