Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 01, 2015

UK manufacturing growth slumps as exports and investment goods orders fall

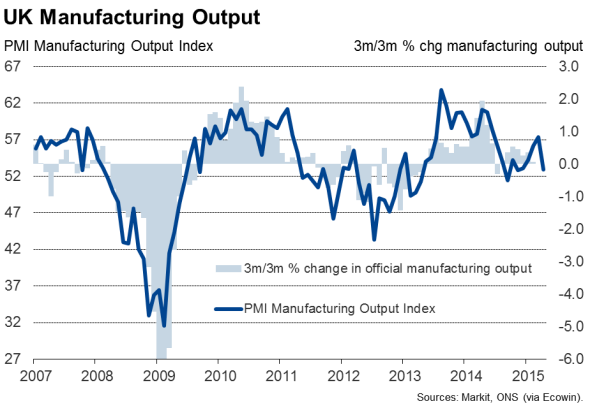

Hopes of the UK economy rebalancing towards manufacturing and exports were dealt another blow as the goods-producing sector reported its weakest growth for seven months in April, and the second-weakest in two years.

Not only did the PMI survey signal a disappointing start to the second quarter, linked to falling exports and business investment, but job creation also waned and output prices fell at the fastest rate since 2009, highlighting weak demand.

Coming on the heels of weaker-than-expected GDP in the first quarter, the data paint a disappointing picture of the economy in the lead up to the General Election, highlighting the fragility of recent growth.

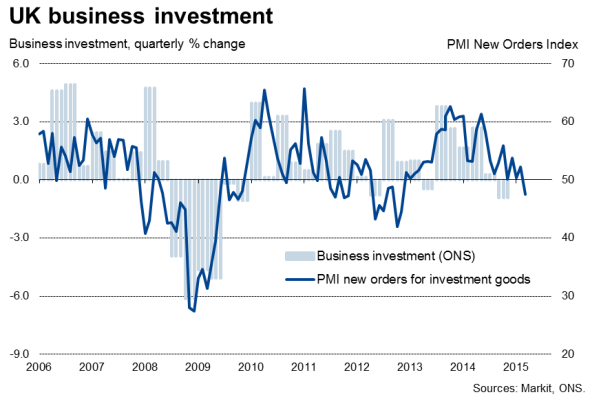

The details of the survey also suggest that rising uncertainty, linked in part to the election, is dampening business investment, leaving consumers as the main driving force behind the economy.

The weak headline growth numbers and downturn in output prices makes a strong argument for any talk of hiking interest rates to be put on ice. However, policymakers will also be concerned about the uneven nature of the consumer-led recovery.

PMI falls to lowest since last September

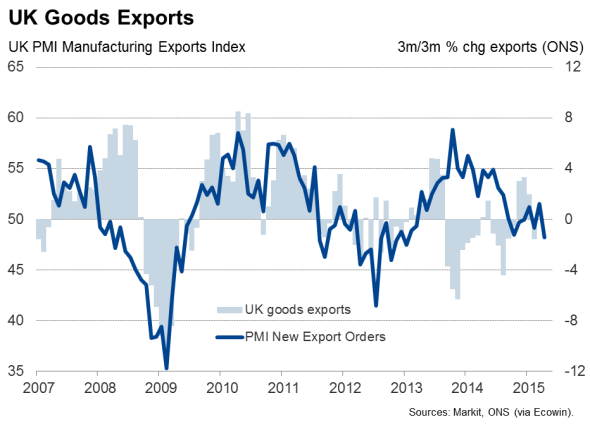

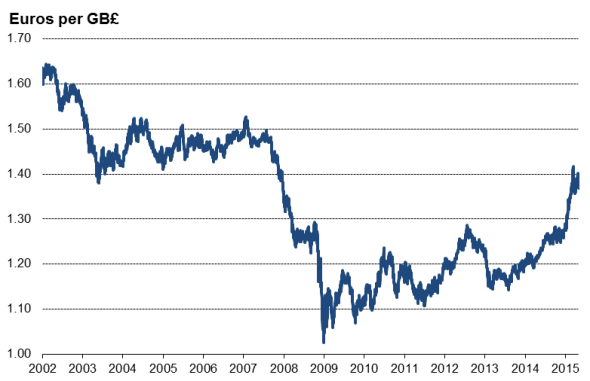

The Markit/CIPS Manufacturing PMI fell from 54.0 in March to 51.9 in April, its lowest since last September. The survey signalled the largest downturn in export orders since the start of 2013, and the fifth decline in the past seven months, highlighting how the appreciation of sterling - notably against the euro - is hitting competitiveness abroad.

Growth of overall new orders (including domestic orders) slowed sharply as a result of the drop in exports, and backlogs of work fell markedly, causing firms to reduce their rate of job creation. Employment rose only modestly, showing the smallest rise in headcounts for almost two years.

Consumer-led growth

Digging deeper into the survey results raises further cause for concern over the imbalanced nature of the current spell of economic growth.

Orders for investment goods such as plant and machinery showed the largest fall for almost two-and-a-half years, pointing to reduced business investment spending. Producers of intermediate goods - items used as inputs by other firms in the manufacturing process - also showed the steepest fall for over two years, suggesting that companies are preparing to reduce output in coming months.

That left producers of consumer goods as the driver of the expansion in April. New orders for consumer goods continued to show strong growth.

The details of the survey results therefore add to signs that the current upturn in the wider economy is being driven principally by consumer spending and lacks a key ingredient of rising business investment. Without an improvement in business investment, productivity looks set to remain disappointing and the longer-term sustainability of the upturn is called into question.

Charges fall at fastest rate since crisis

The latest survey also showed prices charged for manufactured goods falling at the fastest rate since September 2009. Factory gate prices have now decreased for four successive months. The decline was partly attributable to weak demand from customers in many markets and intense price competition, but also reflected falling input costs, which decreased for a eighth successive month, in turn linked to lower import prices arising from the strong exchange rate.

The drop in prices points to a gathering of deflationary pressures which, alongside the signs of renewed weakness in the economy, reduces the chance of any imminent tightening of policy by the Bank of England.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-UK-manufacturing-growth-slumps-as-exports-and-investment-goods-orders-fall.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-UK-manufacturing-growth-slumps-as-exports-and-investment-goods-orders-fall.html&text=UK+manufacturing+growth+slumps+as+exports+and+investment+goods+orders+fall","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-UK-manufacturing-growth-slumps-as-exports-and-investment-goods-orders-fall.html","enabled":true},{"name":"email","url":"?subject=UK manufacturing growth slumps as exports and investment goods orders fall&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-UK-manufacturing-growth-slumps-as-exports-and-investment-goods-orders-fall.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturing+growth+slumps+as+exports+and+investment+goods+orders+fall http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01052015-Economics-UK-manufacturing-growth-slumps-as-exports-and-investment-goods-orders-fall.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}