Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 30, 2015

Week Ahead Economic Overview

A packed week includes major events that could destabilise markets. First, the most closely-fought UK general election in a generation raises the possibility of an inconclusive result. Second, Greece has to roll-over €1.4bn of debt on 8th May as well as paying €200m loan interest to the IMF.

Market watchers will also be eyeing the all-important US non-farm payroll numbers and worldwide manufacturing and service PMI releases as well as industrial production data across the eurozone.

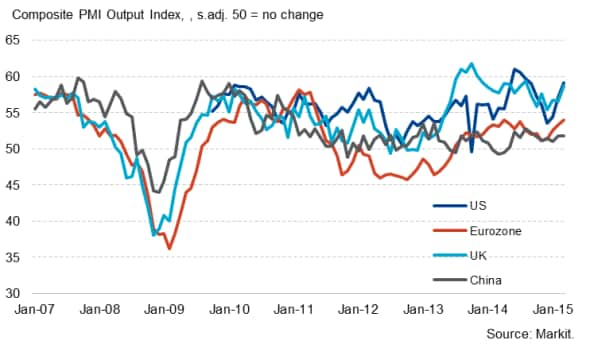

Composite PMI Output Index

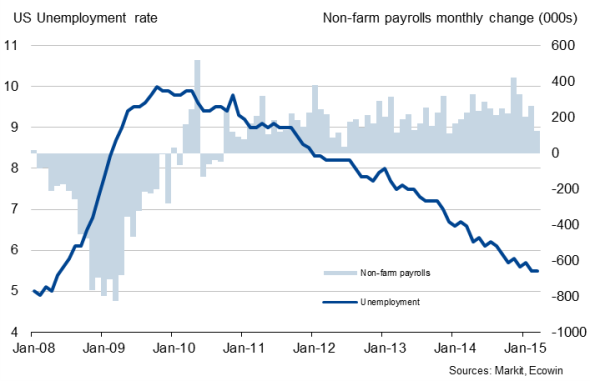

After US economic growth almost stalled in the first quarter, policymakers have indicated that they are in no rush to hike interest rates but will be scrutinising the data flow for signs that the current weakness of the US economy is only temporary. Friday's labour market report will provide important clues. In March, non-farm payrolls increased by 126,000, well below forecast and the smallest gain since December 2013. However, flash PMI data suggest that April saw a pick-up in jobs growth, with the rate of job creation the highest in ten months. The release of factory orders numbers and final PMI data for the US service sector will also be eagerly awaited for any signs of an improvement.

US labour market

Final PMI data will give further insight into the eurozone's performance at the start of the second quarter, and will include important national detail, especially in relation to the periphery's performance, which has been a key source of investor interest in recent months. The flash PMI data had signalled a slight slowing in economic activity amid weaker growth in Germany and near-stagnation in France.

Industrial production data for March are meanwhile released in France, Germany, Italy and Spain and will provide data watchers with more information on the region's performance ahead of the release of first quarter Eurozone GDP numbers the following week.

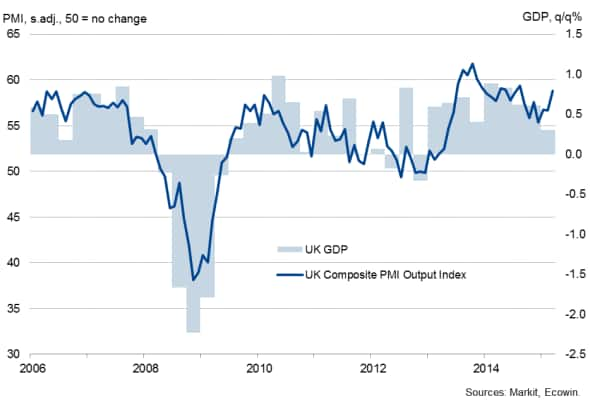

In the UK, all eyes will no doubt be on the general election. If the election outcome proves inconclusive, this could destabilise the economy through uncertainty among businesses and households. UK economic growth already slowed to a two-year low in the first quarter according to a first estimate by the Office for National Statistics. However, stronger survey data suggest that an upward revision to these growth figures is highly likely.

Construction and services PMI data for April will meanwhile give first insights into the UK's economic performance at the start of the second quarter, after the country's all-sector PMI hit a seven-month high in March. While the survey data support the view that the next move in interest rates will be upward, weak wage growth and the disappointing first quarter GDP data suggest that the first rate hike is still some way off. Trade data for March are also published in the UK. February's data showed a widening of the UK's trade deficit as exports fell to a four-and-a-half year low, largely attributed to the strengthening sterling.

UK GDP and the PMI

Final PMI data for April are also released in China. A preliminary flash reading for the country's manufacturing sector signalled the most marked deterioration in companies' operating conditions for a year, despite an upturn in new export orders. If confirmed by final data, this raises the possibility of further stimulus from the government.

Monday 4 May

A number of manufacturing PMI releases are published, including the HSBC China Manufacturing and Eurozone Manufacturing PMI.

Building permit data are out in Australia.

The Eurozone Sentix Index is meanwhile issued.

In Brazil, trade balance numbers are released.

The US sees the publication of factory orders data.

Tuesday 5 May

In Australia, new home sales numbers and trade data are out, while the Reserve Bank of Australia announces its latest interest rate decision.

In South Africa business confidence numbers and quarterly employment data are issued.

The UK Construction PMI is published by Markit.

Producer price figures are out for the eurozone while budget balance data are updated in France.

Trade data are out in Canada and the US, with the latter also seeing the release of the US Services PMI.

Wednesday 6 May

Services PMI data are released worldwide by Markit.

Retail sales figures are meanwhile issued in Australia and the eurozone.

Russia sees the publication of inflation numbers.

In Greece, unemployment data are updated, while France sees the release of investment data from INSEE.

The ECB Governing Council meets, but no interest rate decision is scheduled.

In Brazil, industrial output numbers are out.

ADP employment information are published for the US.

Thursday 7 May

A couple of services PMI reports and the Eurozone Retail PMI are released by Markit.

Australia sees the release of employment data and the AIG Construction Index.

Trade numbers are meanwhile issued in Russia.

Factory orders figures are out in Germany, while France sees the release of industrial production data and trade balance numbers.

Halifax issues house price data for the UK.

In Canada, building permits figures are updated, while the US sees initial jobless claims numbers.

Friday 8 May

The UK & English Regions Report on Jobs and global sector PMI data are released by Markit.

Trade balance numbers are updated in China and the UK.

Consumer price figures are out in Greece.

Industrial production numbers are published in Italy, Spain and Germany, with the latter also seeing the release of trade balance data.

Brazil sees the publication of inflation figures.

In Canada, housing start data and employment numbers are out.

A labour market update is released in the US, including non-farm payrolls and unemployment data.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f30042015-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}