Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 04, 2023

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Central bank meetings in Canada and Australia will be highlights in the coming week, alongside services, composite and detailed sector PMI releases globally. Second quarter GDP readings from the eurozone, Australia, Japan and South Korea will also be in focus. Mainland China's trade and inflation updates are also eagerly awaited amid concerns over deflation.

Bad news morphed into good news for markets as disappointing data cooled concerns of further interest rate rises among investors. Weakness witnessed in flash PMI data across major developed economies in particular has provided support to key US and APAC equity indices. A fuller picture of developments on growth, employment and inflation trends will be sought with the services and composite PMI updates in the coming week. Furthermore, sector PMI data will offer more detailed clues on which parts of the economy fared better midway into the third quarter and provide insights into investment strategies into the rest of the year.

Central bank meetings meanwhile return to the spotlight. Expectations of the Bank of Canada lifting rates have been checked by an unexpected GDP decline in the second quarter. The consensus had been for the BOC to lift rates after Canada's July inflation figures climbed, but GDP fell an annualised 0.2% in the three months to June compared to the central bank's estimate of 1.5%.

Meanwhile GDP figures from the eurozone, Australia, Japan and South Korea are released through the week with Australia's figures to be especially closely watched given that the others are merely updated final numbers. Aussie growth had been sustained into the second quarter, according to PMI indications, though the latest August flash data suggest a slowdown into Q3, which has added to speculation that the Reserve Bank of Australia will likely keep rates on hold.

Mainland China meanwhile releases trade and inflation numbers for August, which follow Caixin Manufacturing and Services PMI releases this Friday and next Tuesday respectively. The inflation numbers will come under particular scrutiny amid concerns that China is facing a worrying bout of deflation, though PMI data will also provide valuable insights into price trends.

A paring-back of interest rate expectations following weaker than anticipated flash PMI numbers for the US and Europe gained further traction after the August US employment report. Although nonfarm payrolls rose in line with market expectations, up by 187k, prior months' data were revised lower. The past three months have consequently seen payroll growth come in consistently below the 200k mark, averaging 150k. While above the estimated 100k level needed to keep pace with growth in the working age population, the jobs numbers are clearly now trending lower.

Adding to the downbeat tone in the latest employment report was a surprising jump in unemployment from 3.5% to 3.8%, its highest since February 2022.

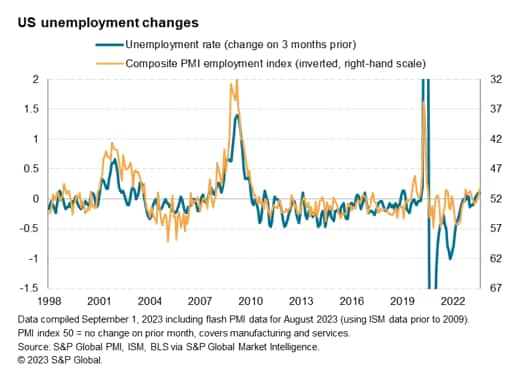

While some of the jobless rate increase reflecting a rising participation rate, the worsening picture from the official data tallies with recent PMI survey data. S&P Global's flash PMI for the US showed employment growth across both manufacturing and services rising only modestly, registering the weakest gain since the lockdowns of early 2020. This index is tracked below against the three-month change in unemployment, inverted to better illustrate how weaker PMI employment numbers result in higher unemployment.

Final US PMI data will be updated in the coming week, alongside comparable data for all other major economies, allowing fresh insights into how labour markets are trending and the likely impact on central bank policy.

Monday 4 Sep

United States, Canada Market Holiday

Germany Trade (Jul)

Switzerland GDP (Q2)

Turkey Inflation (Aug)

Tuesday 5 Sep

Worldwide Services, Composite PMIs, inc. global PMI* (Released across 5-6 Sep)

ASEAN S&P Global Manufacturing PMI* (Aug)

South Korea GDP (Q2, final)

South Korea CPI (Aug)

Australia RBA Interest Rate Decision

Australia Current Account (Q2)

Thailand Inflation (Aug)

Philippines Inflation (Aug)

Singapore Retail Sales (Jul)

Eurozone PPI (Jul)

South Africa GDP (Q2)

Brazil Industrial Production (Jul)

United States Factory Orders (Jul)

Wednesday 6 Sep

Australia GDP (Q2)

Germany Factory Orders (Jul)

Taiwan Inflation (Aug)

Eurozone HCOB Construction PMI* (Aug)

Eurozone Retail Sales (Jul)

Canada Trade (Jul)

Canada BOC Interest Rate Decision

United States Trade (Jul)

United States ISM Services PMI (Aug)

United States Fed Beige Book

US, Europe S&P Global Sector PMI* (Aug)

Thursday 7 Sep

Australia Judo Bank SME PMI Activity Report* (Aug)

Philippines Industrial Production (Jul)

Australia Balance of Trade (Jul)

Australia Trade (Jul)

China (Mainland) Trade (Aug)

Malaysia BNM Interest Rate Decision

Germany Industrial Production (Jul)

Eurozone Q2 GDP (final)

United Kingdom Halifax House Price Index* (Aug)

United Kingdom KPMG/REC Report on Jobs* (Aug)

United States Initial Jobless Claims

Worldwide and Asia S&P Global Sector PMI* (Aug)

Friday 8 Sep

Japan Q2 GDP (final)

Philippines Trade and Unemployment (Jul)

Germany Inflation (Aug, final)

Taiwan Trade (Aug)

Canada Employment (Aug)

United States Wholesale Inventories (Jul)

Worldwide Metal Users and Electronics PMI* (Aug)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Worldwide services, sector and electronics PMI

Following worldwide manufacturing PMI releases at the end of this week, services and composite figures will follow over September 5-6 and be studied for insights on service sector developments after flash PMI signalled that major developed economies' service sector expansion slowed for a third successive month on the back of higher interest rates.

Additionally, global detailed sector PMI, alongside US, Europe and Asia breakouts, will also be updated over the course of next week for insights not individual industry performances. Attention will steer towards the hospitality sectors as the spring travel surge appears to be fading. Meanwhile metal users and electronics PMI will round off the week with added attention on insights from the latter following indications of sustained deterioration in global electronics manufacturing sector's health earlier in July.

Americas: BOC meeting, Canada employment data, US services PMI and trade data

The Bank of Canada convenes next Wednesday with the expectations that interest rates may be raised by 25 basis points on the back of still-elevated inflation called into question by a surprise fall in GDP. Additionally, Canada's employment data will be anticipated on Friday. The US also releases ISM services PMI and trade numbers.

EMEA: Eurozone Q2 GDP, retail sales, Germany trade, industrial production, Turkey inflation, UK jobs report

Besides the services PMIs, a series of tier-2 data releases will be due across EMEA. Second quarter GDP from the eurozone will also be released on Thursday, though this will be the final estimate with little change expected. Worth also watching will be Germany's industrial production figures after flash PMI alluded to continued contraction in output. Also watch out for UK house price data and the latest REC/KPMG recruitment industry survey - the latter being keenly watched by the Bank of England for labour market dynamics.

Asia-Pacific: RBA meeting, Australia, Japan, South Korea GDP, China trade and inflation

The Reserve Bank of Australia convenes in the week ahead with no change to monetary policy expected. As far as APAC data are concerned, watch for second quarter GDP releases from Australia, Japan and South Korea plus a series of data releases from mainland China including trade numbers on Thursday and inflation at the end of week.

Special reports:

US Factory Gloom Deepens as Order Book Downturn Intensifies | Chris Williamson

Singapore Narrowly Averts Recession in First Half of 2023 | Rajiv Biswas

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location