Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 01, 2023

US manufacturers reported another tough month of trading in August. Output has fallen back into decline after a brief respite in July amid an increasingly steep deterioration in order books. Orders are in fact falling faster than factories are cutting output, suggesting firms will need to continue scaling back their production volumes into the near future.

An increasing sense of gloom about the near-term outlook has meanwhile hit hiring and led to a further major pull-back in purchasing activity.

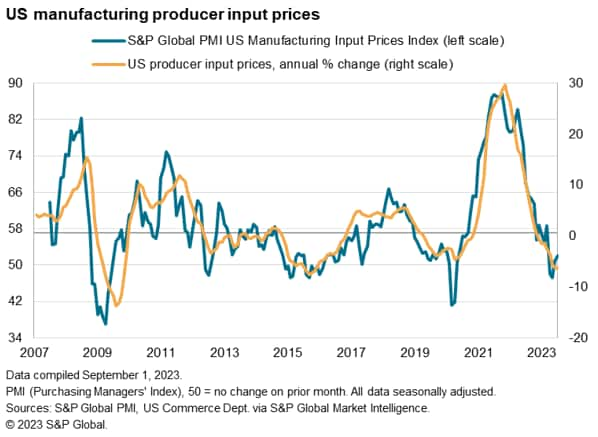

The survey meanwhile adds to evidence that the deflationary impact of improving supply chains has peaked, with prices starting to rise at an increased rate again in August. However, falling demand is clearly continuing to dampen pricing power and is keeping overall inflationary pressures in the manufacturing sector very subdued.

Policy initiatives such as the CHIPS and Science Act and IRA should start to help buoy production in the medium term as capacity in US manufacturing is expanded. A shifting of the inventory cycle toward restocking should also be evident by the end of the year, given improvements in some survey metrics such as the orders-inventory ratio. However, such rays of hope remain currently overshadowed by business confidence turning lower, which indicates that producers anticipate some further near-term headwinds to any manufacturing revival.

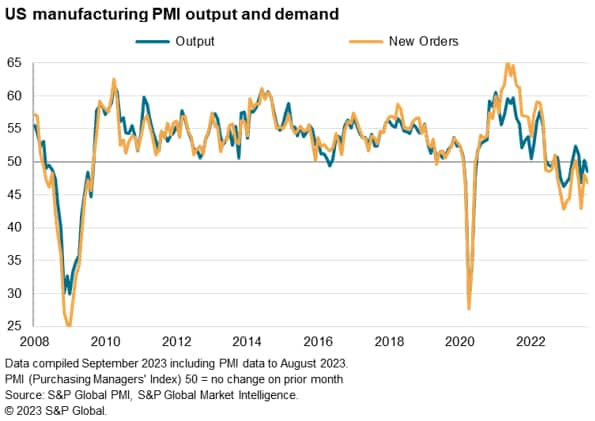

US manufacturing output fell in August, according to S&P Global's US PMI survey, dropping for the second time in the past six months after showing a marginal return to growth in July. As such the survey data hint at manufacturing acting as a drag on the economy midway through the third quarter after both the survey and official data pointed to a small boost to production in July.

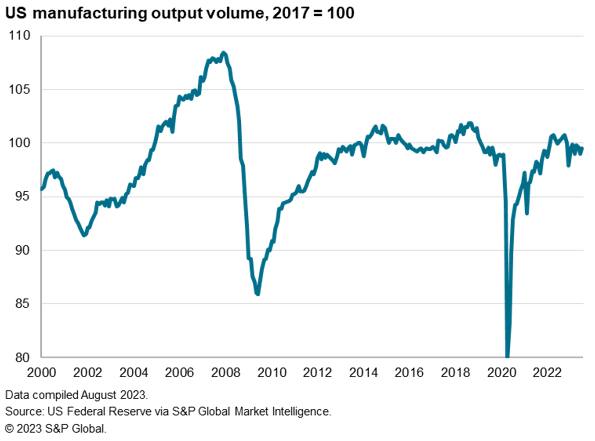

While the survey's output data remain less downbeat than seen late last year, companies have reported a broad weakening of the production trend for just over a year, which has been accompanied by disappointing official data. The Fed's production index was 0.7% lower than a year ago in July, and remains 2.3% lower than the pre-pandemic peak seen in 2018.

Falling output was again blamed on further order book losses. New order volumes fell for the thirteenth time in the past 15 months in August, with the rate of decline gathering momentum to one of the sharpest seen since the global financial crisis, albeit well off some of the especially steep rates seen over the past year. Importantly, however, the rate of loss of orders continued to outpace that of production, which hints at further downward pressure on production in the near term absent a revival of demand.

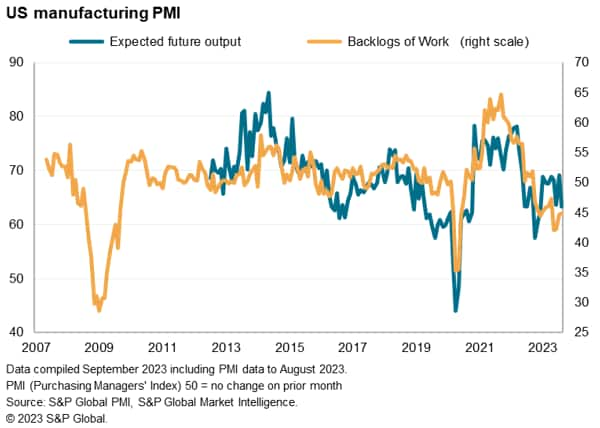

Such a demand revival is not being anticipated by producers. Expectations of output in the year ahead fell sharply in August, corresponding with a further depletion of overall backlogs of work - the latter being a key indicator of capacity utilization. The buildup of excess capacity signaled by the backlogs index from the survey in turn took pressure off hiring, leading to the smallest monthly rise in employment since January.

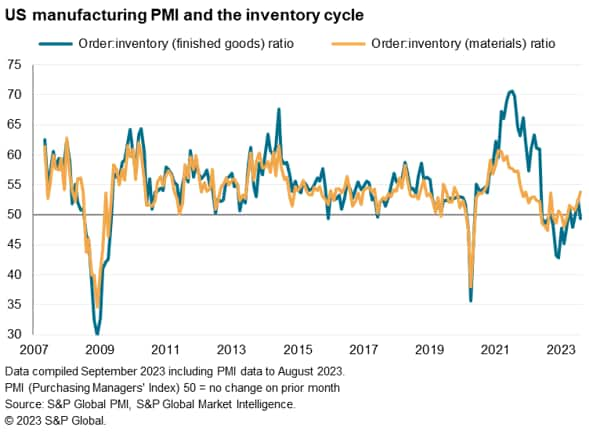

Somewhat more encouraging is the survey's orders-inventory ratio. The ratio of new orders to purchased inventory has risen to its highest since December 2021. This improvement hints at some support to production. Although the ratio of new orders to finished goods inventory dipped slightly, it likewise remains high by standards seen over the past year.

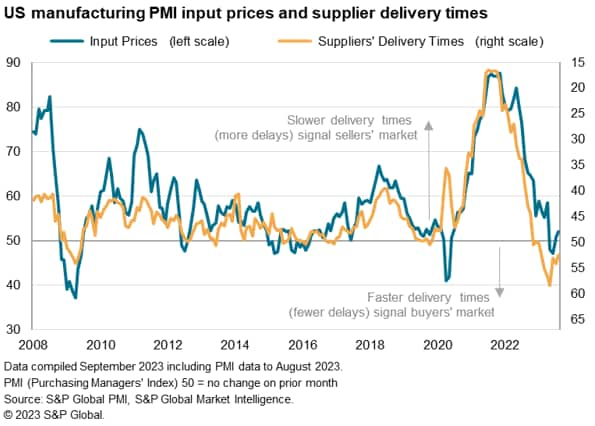

An ongoing advantage of the manufacturing downturn has been the alleviation of pressure on supply chains. The survey's supplier delivery times index continued to signal faster lead times in August, a development which is consistent with reduced pressure on prices and costs. Average input prices for raw materials rose, however, up for a second successive month and rising at the fastest rate since April amid rising fuel costs and upward wage pressures. The survey also picked up some mentions of lead times starting to lengthen for certain items. The rate of input cost increase nevertheless remains far weaker than seen earlier in the year.

Although price pressures remain subdued, the rise in costs hints that the peak deflationary impact from the post-pandemic easing of supply constraints has passed. The improvement in the survey's order-inventory ratio meanwhile suggests that production and pricing power should soon get some support from a shifting of the inventory cycle toward restocking in the near-future, barring a broader global economic downturn.

Policy initiatives such as the CHIPS and IRA should also start to buoy production in the medium term as capacity in US manufacturing is expanded. However, as yet, such rays of hope remain overshadowed by business confidence turning lower to hint at further near-term headwinds to any manufacturing revival.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location